A Bearish Bet Gone Wrong

Why we got it wrong suggests a way we can find more winners in the future.

That Didn't Work

A big difference between writing about options trading and, say, precious metals or value stocks is that options expire. That means you're either going to be right or wrong by that expiration date--you can't kick the can down the road and say you'll be right eventually (when the U.S. dollar collapses, or when the market decides to like value stocks again). In the case of our bearish options trade yesterday (Betting Against An Overbought Retailer), barring a reversal before next Friday (which we don't expect), we were wrong.

Why we were wrong is interesting though, because it suggests a way we can be right more often in the future. Basically, we developed a quantitative approach to earnings trades that had generated some success recently, and we tried to outsmart it yesterday and failed. Let's recap our approach and show where we went wrong.

Our Ten Signals For Evaluating Earnings Trades

We use these ten signals for evaluating earnings trades:

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

Zacks Ranking. A number from 1 to 5 with 1 representing their 5% most bullish stocks, 2 representing their next 20%, 3 the middle 50%, and so on.

The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

Recent insider transactions.

RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. We’re looking for RSI levels below 70 for bullish trades and above 30 for bearish ones.

Short Interest.

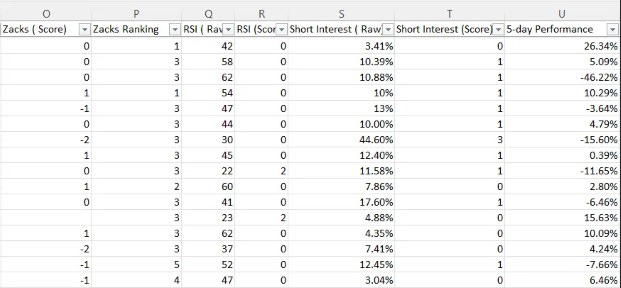

For most of those signals, we give a numerical rating from -2 (very bearish) to +2 (very bullish), and for each stock we evaluate each week (not just the ones we place trades on), we enter the data above in a spreadsheet, and at the end of the week, we record each stock’s 5-day return.

Torrid (CURV) (4.9)

Social data: -13.

PA Options sentiment: Very Bearish.

Setup rating: 5

Valuation rating: 3

F-Score: 6

Recent insider transaction(s): Net open market purchases in September, but at less than a third of the current share price.

Zacks ESP: 0%

Zacks Ranking: 3

RSI: 81

Short Interest: 18.99%

Let's pause here to point out that a 4.9 composite score is very bullish. By way of comparison, we made a 106% gain betting on a stock last week that had a composite score lower than that:

Ulta Beauty (ULTA) (4.4)

Social data: +44.

PA Options sentiment: Very Bullish.

Setup rating: 3

Valuation rating: 5

F-Score: 9

Recent insider transaction(s): Net open market sales, peaking last December.

Zacks ESP: -0.39%

Zacks Ranking: 3

RSI: 70

Short Interest: 2.54%

Why We Bet Against A Stock Our System Was Bullish On

We rationalized that in our post yesterday:

The recent insider transaction contributes 2.8 points to the 4.9 point composite score because, in our data, the average stock with net insider buying out performs the average stock without it by 2.8x during earnings week. But we have a relatively small sample of stocks with net insider buying, and in this case, the stock has climbed more than 200% since the insider bought his shares in September.

Also, we would consider an RSI of 81 to be very bearish (since it suggests the stock is extremely overbought), but it doesn’t impact our composite score here because we have never had a stock with an RSI that high before earnings. So based on all of that, we're betting against this retailer, despite its high composite score.

What Now?

Well, now we have more data that supports insider buying as a bullish signal, regardless of share appreciation since the transaction. And now we have data on a stock with an RSI that high before earnings, and that data says an RSI of 81 is bullish. That data will go into our spreadsheet this weekend, and next week we'll be armed with new weightings for the components of our composite score.

And we probably won't be betting against our composite score again any time soon. If you want a heads up when we place next week's trades, feel free to subscribe to our trading Substack/occasional email list below. Hopefully, our lessons from yesterday's losing trade will lead to more winners going forward.