A Good Day To Bet Against Stocks

We placed our most recent bearish bet during biggest short squeeze in eight years.

Taking Advantage Of Underwater Bears

You may recall that I took advantage of the post-Powell rally to share a bearish trade, a bet against a stock that had exploded higher on Thursday.

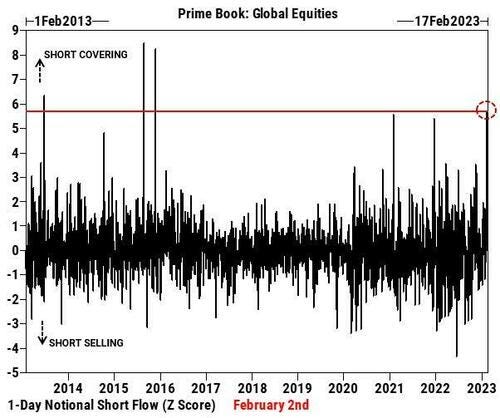

It turns out Thursday was an especially good time to place a bearish bet. As ZeroHedge detailed on Friday, Thursday’s rally was the biggest short squeeze in eight years:

[I]n notional terms, Goldman's Prime desk calculates that yesterday's short covering was the largest since Nov '15 (exceeding even Jan '21 during the meme frenzy) and ranks in the 99.8th percentile vs. the past 10 years. US and European equities made up ~61% and 38% of the notional short covering, respectively.

A Game Plan For Placing Bearish Bets

Obviously, no one knew how big that short squeeze would be ahead of time, but we (I and my subscribers who acted on my trade alert Thursday) had a few things working in our favor:

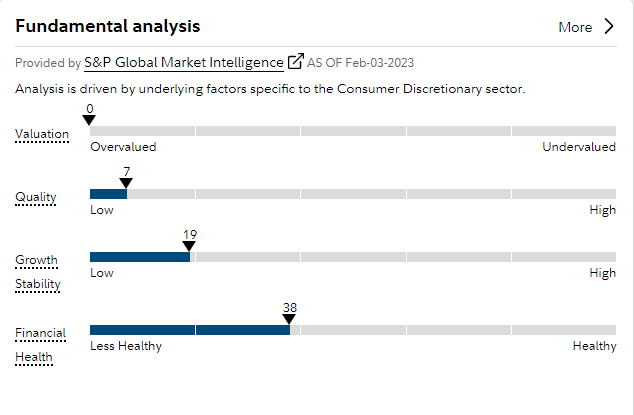

We had a target in mind, a stock with terrible fundamentals that had been rallying before Thursday.

We could see it had just shot up by +30% for no reason other than it was heavily shorted and risky names like it were leading the post-Powell rally.

That stock ended up giving up most of Thursday’s gains by the end of the day, and it was down about 18% from where we bet against it by Friday’s close.

Ready For The Next Crazy Rally

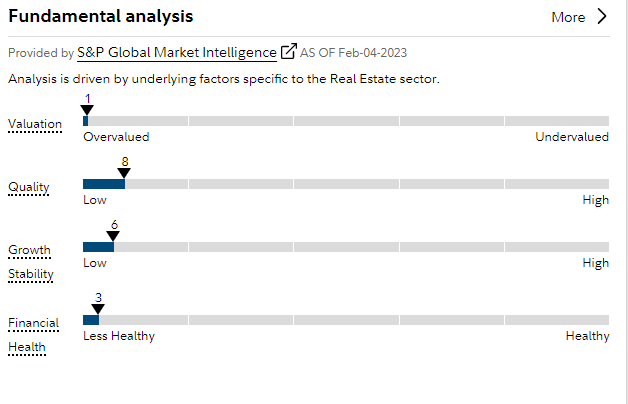

There’s a handful of names with similarly bad fundamentals I have my eye on that are likely to move during the next crazy rally, such as this one:

Similarly, every day we have a list of top ten names we can buy from in the event of a market crash. The key is to have targets in mind before a market event that makes for an auspicious time to enter the trade.