Nothing Goes Straight Up

In my last post (Playing With The House’s Money), I mentioned that our February 21st natural gas trade was up 118% as of Friday’s close. As I type this Sunday evening, natural gas futures are down about 9%; if that decline holds, the options we bought on February 21st may only be up 70% or 80% tomorrow. In either case, there’s probably still plenty of upside from here, as market technician Tim Knight pointed out yesterday:

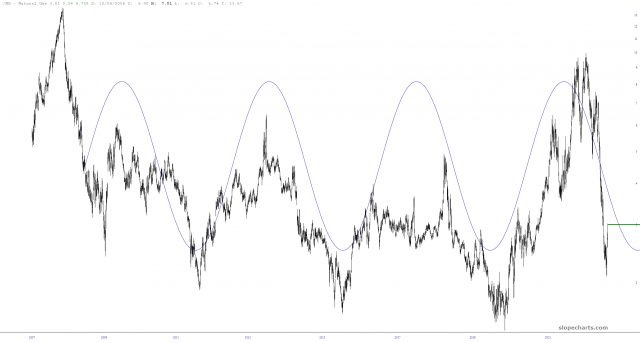

Early last year, I noticed something which I have never seen on any other chart before, which is a really magnificent application of the sine wave tool. In this instance, it seemed to follow the long-term path of natural gas beautifully, and it strongly suggested the commodity was in for a fall. Well, it did fall, and with a speed never seen before.

Recent lows seem to approximate a bottom, since they roughly match the lows seen over the long-term. We’ve bounced recently, but I’d suggest that if we encounter any other bout of weakness this quarter, it might be a good buying opportunity.

With that in mind, you might consider placing a limit order to buy the call options we bought on February 21st tomorrow at a price about 30% below the current bid.

As I wrote on the 21st, if you decide to place this trade, use only an amount you’d be willing to lose. If we’re wrong, these calls will expire worthless, and if we’re right, you won’t need to own a lot to have a decent gain.

Looks like a downtrend is forming, with warmer weather etc forecasted for the rest of winter. I would guess the bet really becomes all about cooling needs in the summer? (I'm no expert in energy so feel free to correct that assumption). Are you expecting this downtrend to continue? What lows would you re-enter the position.