Pixabay/Pexels

KOLD Heats Up

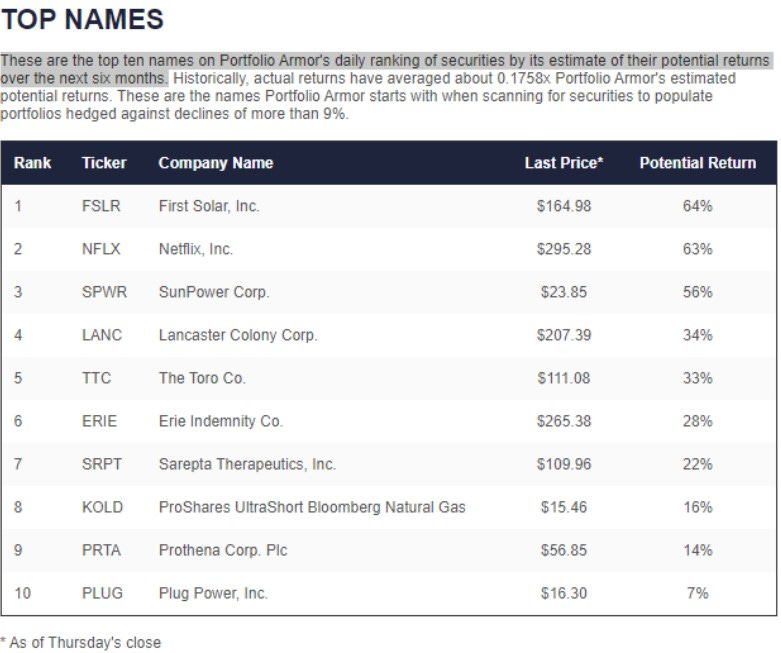

Back in November, when the ProShares UltraShort Bloomberg Natural Gas ETF (KOLD) appeared in our top ten names, I was skeptical. We were coming to the end of a year when energy names had been a tear, for the most part, with inflation near 40-year highs.

Screen capture via Portfolio Armor on 11/17/2022.

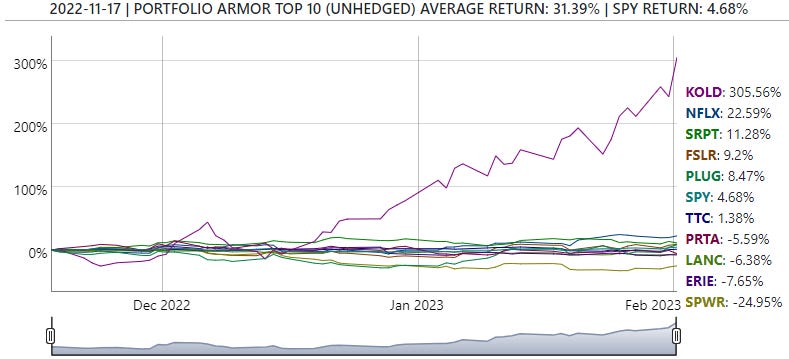

Since then, KOLD is up more than 305%.

It’s common to think of these leveraged ETFs as being strictly for day trading, but as the chart above shows, you can generate considerable gains by holding them for longer periods. The key is to have downside protection, so you don’t suffer steep losses when the trade goes against you.

If you’re holding KOLD now, and don’t have downside protection, here’s one way to add some. You’ll want to scan for an updated hedge, of course, but as of Wednesday’s close, this was the optimal collar to protect 100 shares of KOLD against a greater-than-25% drop over the next few months while not capping your possible upside by less than 25% over the same time frame.

Screen captures via the Portfolio Armor iPhone app on 2/1/2023

As you can see there, the net cost was negative, meaning you would have collected a net credit of $720, or 11.48% of position value when opening this collar. That cost assumes, to be conservative, that you placed both trades at the worst ends of their respective spreads, buying the puts at the ask and selling the calls at the bid. Since in practice you can often buy and sell options within the spread, you likely would have collected a larger net credit when opening this hedge on Wednesday. So your maximum possible upside with this hedge would be that net credit plus the 25% cap.