Dids/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. Starting in July, 2024, I have also been tracking them in this spreadsheet. These are the trades I exited this week.

Stocks or Exchange Traded Products

None.

Options

Call on Netflix (NFLX 0.26%↑). Bought for $1.40 on 1/29/2025; expired worthless on 1/31/2025. Loss: 100%.

Call spread on Alphabet (GOOGL 0.52%↑). Entered at a net debit of $0.57 on 12/26/2024; exited at a net credit of $0.03 on 1/29/2025. Loss: 95%.

Calls on Coinbase Global ( COIN 0.67%↑). Bought for $3.70 on 1/24/2025; sold for $0.23 on 1/30/2025. Loss: 94%.

Call spread on Boeing (BA -0.04%↓). Entered at a net debit of $1.42 on 12/26/2024; exited at a net credit of $0.13 on 1/29/2025. Loss: 91%.

Calls on UnitedHealth Group (UNH 1.77%↑). Bought for $1.36 on 1/23/2025; sold for $4.35 on 1/27/2025. Profit: 220%.

Puts on Nvidia ( NVDA -5.78%↓ ). Bought for $0.75 on 1/24/2025; sold (half) for $20.80 on 1/27/25. Profit: 2,633%.

Comments

Stocks or Exchange Traded Products

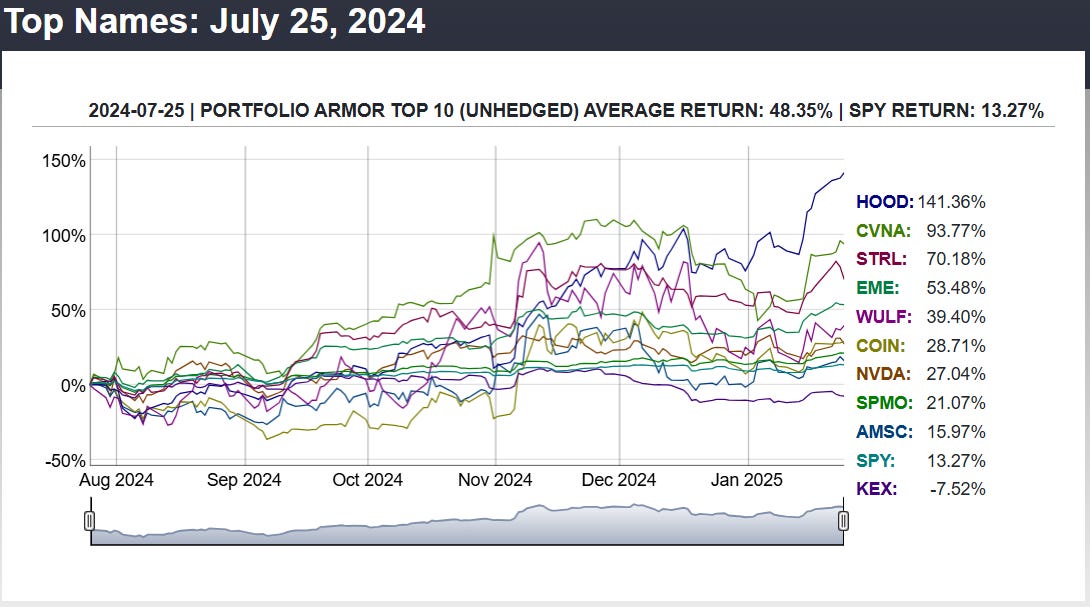

No exits this week, but our core strategy of buying our top ten names, putting trailing stops of 15% to 20% on them, and replacing them with current top names when we get stopped out, continues to perform well, driven by the performance of our top names.

You can see how all of the top 10 names cohorts have done since I launched this Substack at the end of 2022 here.

Options

A lesson I think I need to take from this week is to have more confidence in my own ideas, and Portfolio Armor’s top names. Trades 1, 3, and 5 on here were me tailing the momentum options trader on my X Market Watchers List whose pinned post includes this picture of his watch; trade 2 he liked as well at the time, but I also liked that one.

Trade 4 was a bit frustrating, for two reasons. One is that, had I exited earlier in the day, I might have gotten out for a modest profit. But more importantly because it looks like I correctly identified a bottom in Boeing in the $150s in November, but didn’t get a fill on the trade I placed on it then.

Trade 6 was my idea.

A Missed Opportunity To Buy The Dip

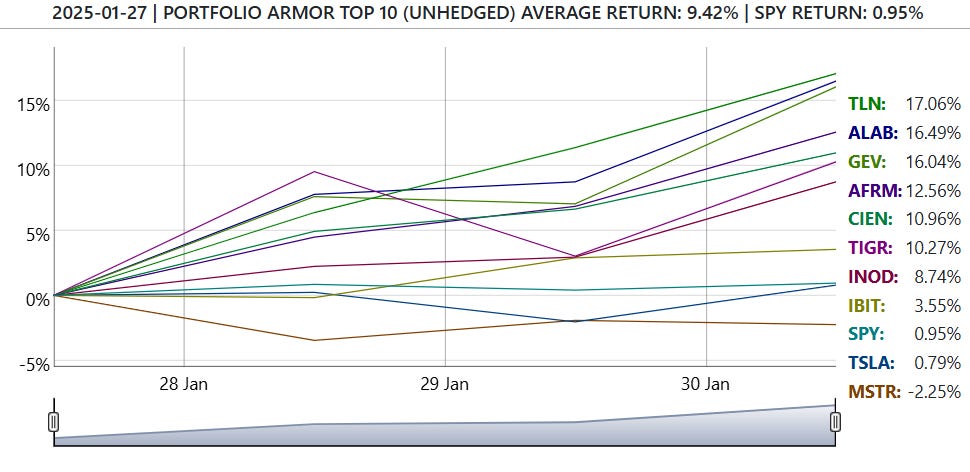

After Monday’s market meltdown, I should have placed bullish bets on Tuesday on one or two of Portfolio Armor’s top ten names from Monday night. Here’s how they did as of Thursday’s close (as I write this on Friday evening, Portfolio Armor is still crunching the numbers for Friday).

Weekly bullish options trades on 6 out of those 10 would probably have post some nice gains this week.

Next time.

Limiting Your Downside Risk

If you want to add some downside protection here, you can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

Our Top Names Every Day

Although I post Portfolio Armor’s once per week here, they’re available daily on the Portfolio Armor website and iPhone app (as an in-app subscription).