Dids/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week.

Stocks or Exchange Traded Products

None.

Options trades

Call spread on Nvidia (NVDA 0.00%↑). Entered at a net debit of $3 on 5/21/2024; exited at a net credit of $9.45 on 5/23/2024. Profit: 215%.

Comments

Stocks or Exchange Traded Products

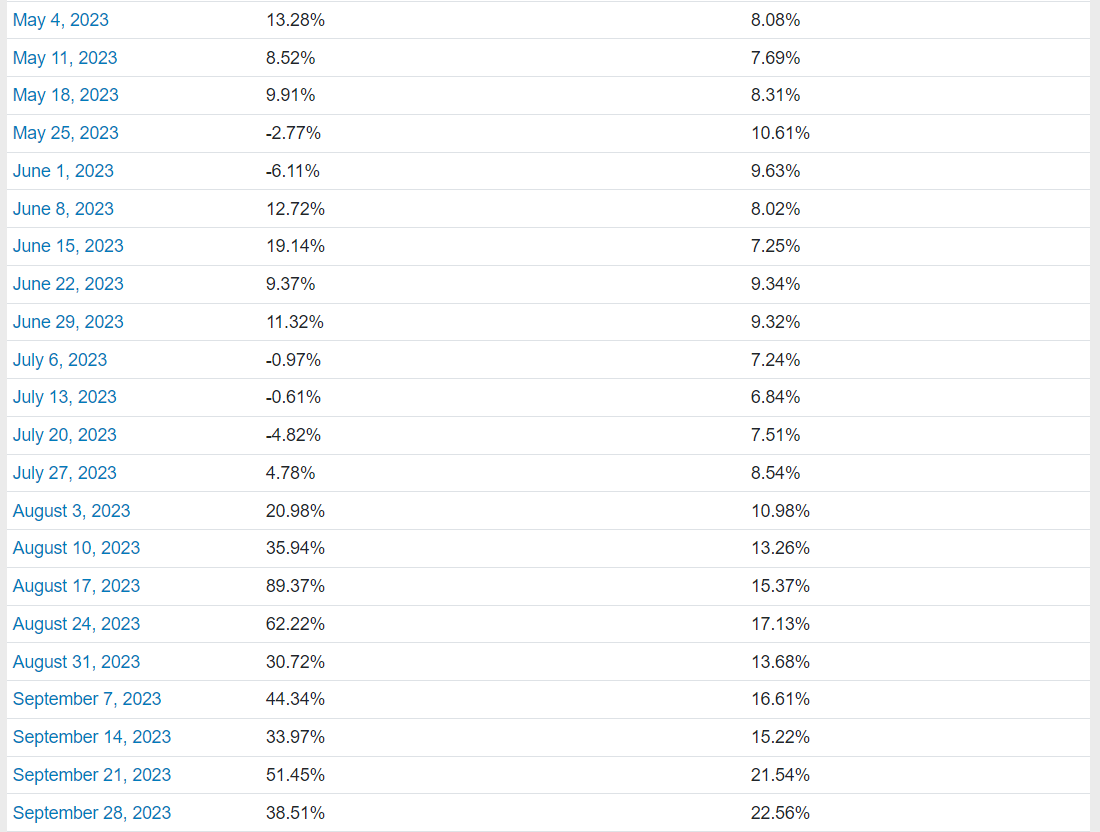

No exits this week, but our core strategy continues to do well, driven by the outperformance of our top names. Our most recent top names cohort to finish its six months posted a negative return, on average, but that was our first top names cohort in 17 weeks that failed to beat the market.

Screen capture via the Portfolio Armor web app.

Since we started this Substack, we now have 6-month returns for 48 weekly top names cohorts. On average, those 48 top names cohorts have returned 22.71% over the next six months, versus 12.58% for the SPDR S&P 500 Trust ETF (SPY 0.00%↑).

You can click here to see an interactive version of that table, where you can click on a date and see what are top names were then and how each of them did.

Options

In hindsight, we probably should have placed the Nvidia trade during the stock’s dip last month, which would have increased our chance of success, all else equal, but we can’t really complain about a 215% gain. Going forward, we’re going to be placing more earnings trades well before a company reports, as we did with another AI name this week.