Dids/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week.

Stocks or Exchange Traded Products

None.

Options trades

Skip-strike call butterfly on GameStop (GME 0.00%↑). Entered at a net debit of $0.50 on 6/4/2024; exited at a net credit of $0.60 on 6/12/2024. Profit: 20%.

Skip-strike put butterfly on GameStop (GME 0.00%↑). Entered at a net debit of $0.60 on 6/4/2024; exited at a net credit of $0.78 on 6/12/2024. Profit: 20%.

Comments

Stocks or Exchange Traded Products

No exits this week, but our core strategy continues to perform well, driven by the returns of our top names.

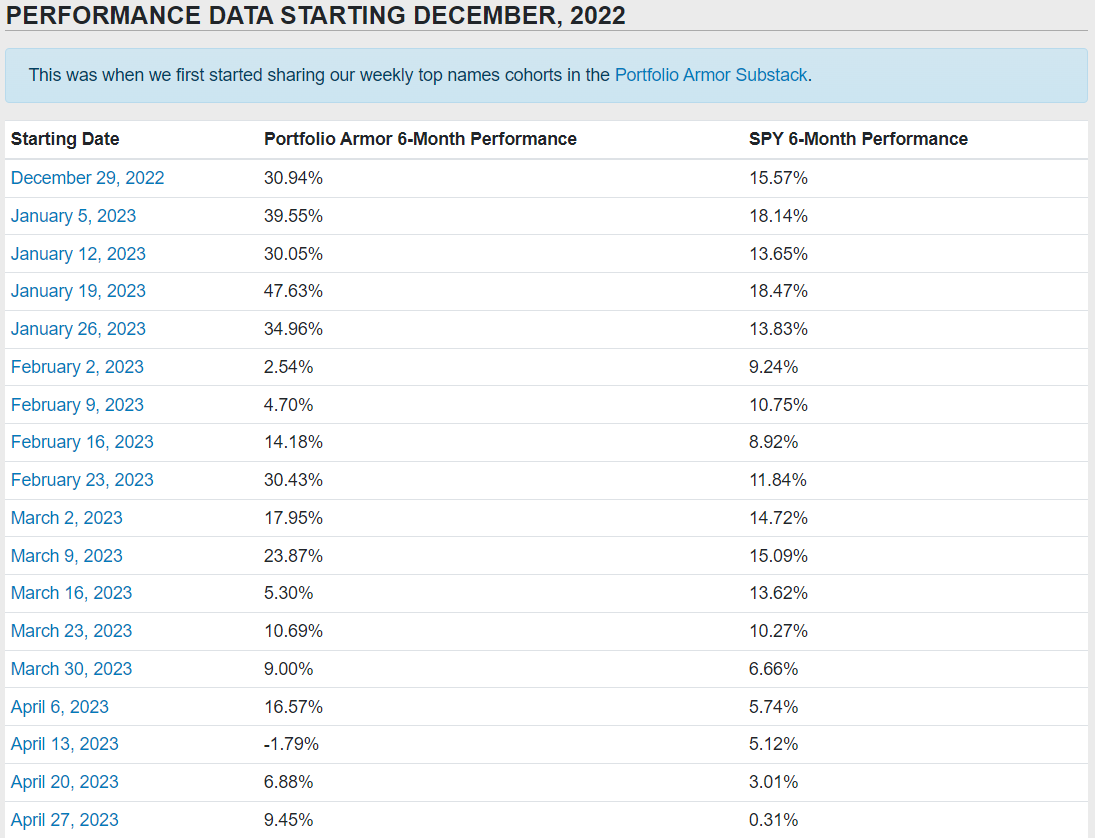

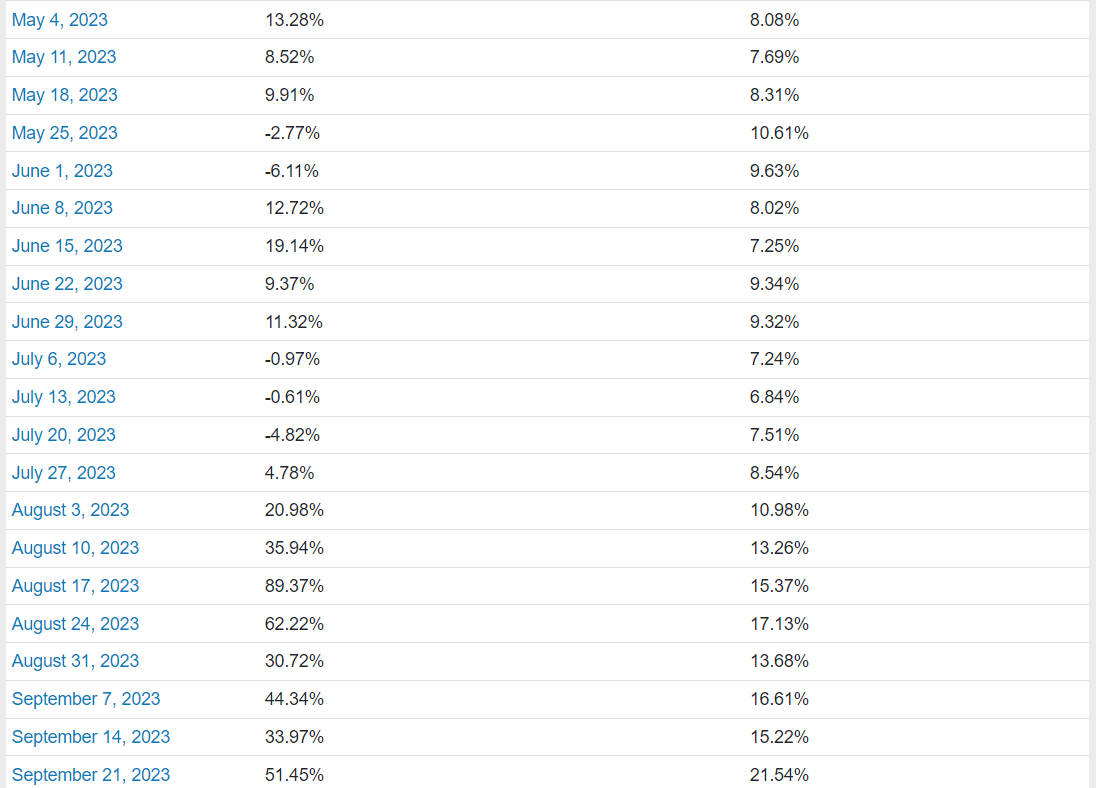

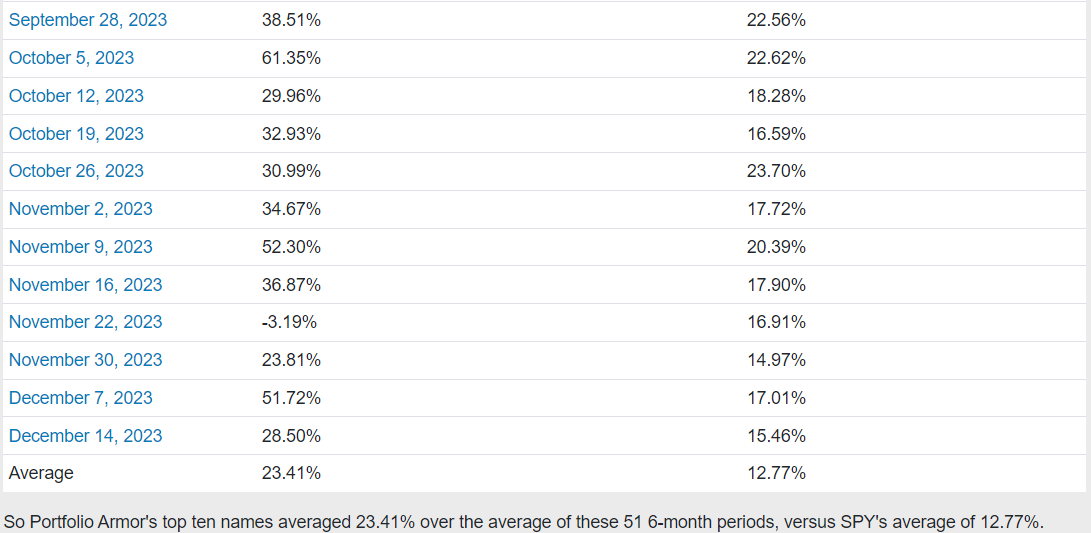

So far, we have 6-month returns for 50 weekly top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 23.41% over the next six months, versus SPY’s average of 12.77%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

Options

Our aim with the skip strike butterflies was to make ~200% on one and lose 100% on the other, but the stock was a bit too volatile for this strategy. We did make a modest profit on both bearish and bullish bets on the same day, so we’ll take that.