Slyzyy/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week:

Stocks or Exchange Traded Products

None.

Options Trades

Call spread on G-III Apparel Group (GIII 10.28%↑). Entered at a net debit of $1.25, and exited at a net credit of $2.25 as noted here. Profit: 80%

Put spread on Smuckers (SJM -2.71%↓). Entered at a net debit of $2.05, and exited at a net credit of $3.18 as noted here. Profit: 55%

Put spread on DocuSign, Inc. (DOCU 2.49%↑). Entered at a net debit of $0.50, and exited at a net credit of $0.62, as noted here. Profit: 24%

Call spread on Academy Sports (ASO 1.81%↑). Entered at a net debit of $0.40, and exited at a net credit of $0.50, as noted here. Profit: 25%

Comments

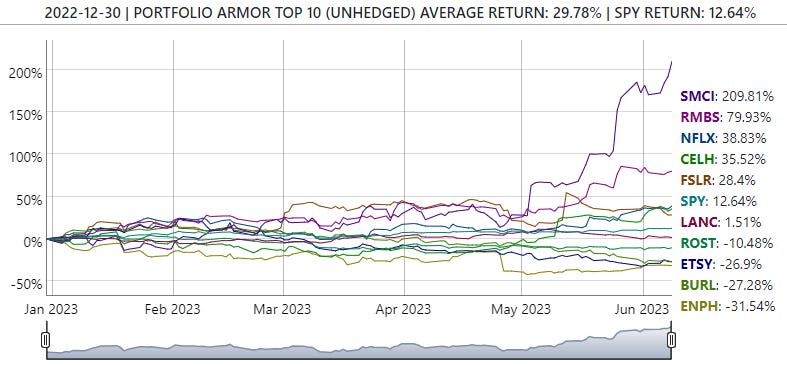

In our core strategy, we hold our top ten names until we get stopped out of them, so every week without an exit there is good news. As I mentioned in a couple of recent posts, our top names have had some winners this year related to the AI bubble, such as Super Micro Computer (SMCI 4.26%↑) and Rambus (RMBS 0.94%↑), as you can see in the performance of our top names from December 30th below (as of yesterday’s close).

On the options side, this was another tough week for social data, and we’re down on a number of trades expiring next week. We’ll see how that goes in next week’s Exits post. But if social data has a >50% success rate, then a reversion to that means we ought to have another winning streak with it at some point. So I’ll be sticking with it for now, but also keeping an eye out for other opportunities, including those sparked by recent short squeezes.