Slyzyy/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week:

Stocks or Exchange Traded Products

None.

Options Trades

Puts on KeyCorp (KEY 0.00%↑). Entered on May 4th. Expiring today. Loss: 100%.

Put spread on First Financial Bankshares (FFIN 0.00%↑). Entered on May 5th. Expiring today. Loss: 100%.

Put spread on La-Z-Boy (LZB 0.00%↑). Entered at a net debit of $2.95 on June 20th. Exited at a net credit of $0.65 on July 17th. Loss: 78%.

Call spread on Morgan Stanley (MS 0.00%↑). Entered at a net debit of $0.72 on July 17th. Exited at a net credit of $1.35 on July 18th. Profit: 88%.

Put spread on Netflix (NFLX 0.00%↑). Entered at a net debit of $2.45 on July 19th. Exited at a net credit of $4.50 on July 20th. Profit: 84%

Put spread on Tesla (TSLA 0.00%↑). Entered at a net debit of $1.20 on July 18th. Exited at a net credit of $1.85 on July 20th. Profit: 54%.

Put spread on Discover Financial Services (DFS 0.00%↑). Entered at a net debit of $0.38 on July 18th. Exited at a net credit of $0.90 on July 20th. Profit: 136%.

Comments

On the stock side, this was another week where we didn’t get stopped out of anything, as our system’s top ten names continue their strong performance. For example, if you missed yesterday’s top names post, our top ten names from January 19th were up 47.63%, on average, over the next six months.

On the options side, to be honest, I forgot the first two trades (on KEY and FFIN) were expiring today. Had I remembered, I might have been able to exit for losses of slightly less than 100% on them earlier this week, but these were basically bets against banks that didn’t pan out. I’ll have to make a note to review my open positions ahead of big options expiration dates.

LZB was a leftover earnings trade from the end of Q1.

We made money on all four earnings trades we entered this week, and the three social data trades we passed on didn’t pan out. I left a bit of money on the table by exiting the Tesla put spread a little early, but considering that today was the expiration date for those puts, I decided to take profits sooner rather than later.

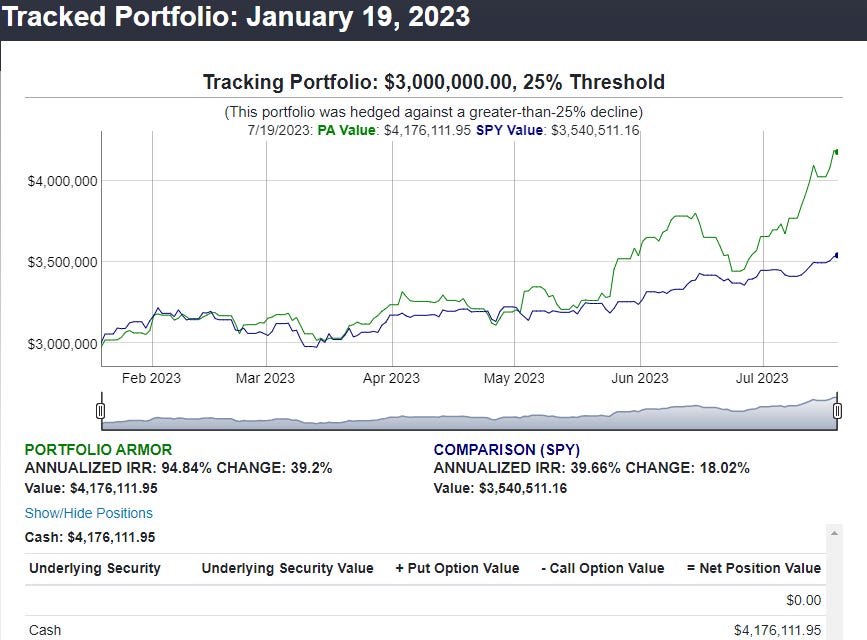

Hedged Portfolio Performance

On the Portfolio Armor website, this was the best performing hedged portfolio from the January 19th cohort.

You can find an interactive version of that chart here.