Slyzyy/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week:

Stocks or Exchange Traded Products

None

Options Trades

Put spread on Big Lots (BIG -4.65%↓). Entered at a net debit of $1.15 on 7/10; exited at $2.25 on 8/22. Profit: 96%.

Comments

On the stock side, we had no exits, as we didn’t get stopped out of any of our positions—which is unsurprising, given the performance of our top ten names from six months ago.

Screen capture via the Portfolio Armor website.

On the options side, we just had one exit, on a bearish bet against a struggling retailer that we entered last month.

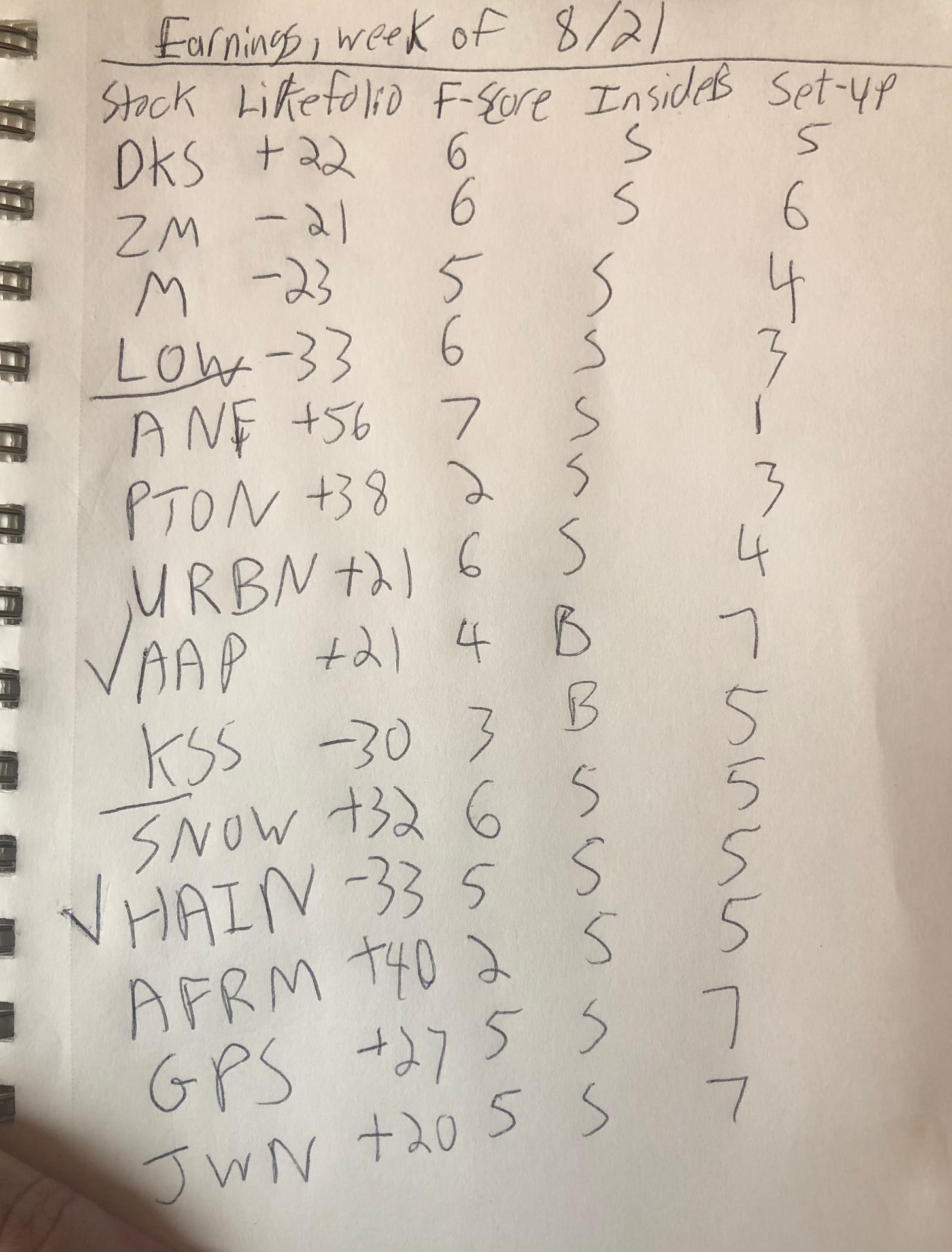

We were more selective on earnings trades this week, placing only two prior to earnings, a bullish one on Advance Auto Parts ( AAP 0.00%↑) which filled, and a bearish one on Hain Celestial (HAIN 0.00%↑), which didn’t. We also placed a couple of bullish trades on Peloton (PTON 0.00%↑) after it tanked post-earnings.

In hindsight, we may have been too selective on earnings trades this week, and put too much weight on recent insider buys and sells as metric. That kept us out of Abercrombie & Fitch (ANF 0.00%↑), which spiked after earnings, and it (along with the low Piotroski F-Score) kept us out of Affirm (AFRM 0.00%↑), which spiked as well. Portfolio Armor’s gauge of options market sentiment was bullish on AFRM. I’ll give that more weight next week.