A hotel lobby check-in kiosk. Not what most people think of when they see “AI”.

Artificial Intelligence Is Big, But This Isn’t It

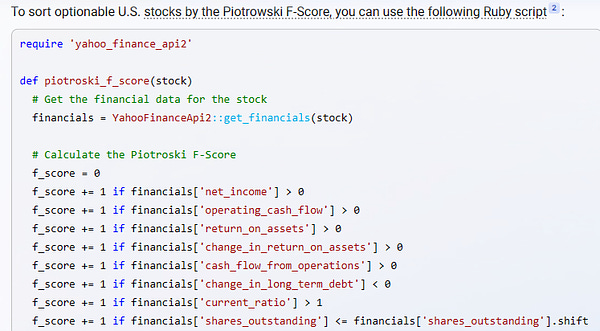

There’s some debate about whether ChatGPT and similar large language models constitute actual intelligence, but there seems to be little debate that they are going to have a transformative impact on the economy. One obvious example is on software development. I shared the example below with my software developers.

It seems clear that developers who don’t use this sort of AI as at least a starting point for their work are going to get left behind by those who do, because those who do will be able to get more work done in fewer billable hours.

Another area where it will likely have an impact is on medical diagnosis.

The company I tried shorting today isn’t engaged in that kind of work though, as far as I can tell. It appears to sell simple robots used to automate functions such as hotel check-ins, as pictured above. But its shares have rocketed hire due to the AI mania regardless, despite weak fundamentals including a Piotroski F-Score of 0 (recall scores of 2 and below are considered a sign of weakness) and an Altman-Z Score of 0.21 (recall scores below 1.81 indicate distress).

This one doesn’t have options traded on it, so I sold I tried to sell its shares short when it hit $16 per share today (it closed at $19.22, up more than 171% today). The company is Guardforce AI Co., Ltd (GFAI). Unfortunately, the brokerage I used (TD Ameritrade) had no shares available to short. But if yours does, shorting somewhere around the current price looks attractive, provided doing so is within your risk tolerance (theoretically, your downside shorting a stock is unlimited, of course, because a stock’s potential appreciation is unlimited, but I don’t see this one going to infinity).

GFAI closed at $12.99 today, down 32.41% from yesterday's close.