Dr. Big Short Deletes His Account (Again)

Michael J. Bury, MD, the physician-turned-hedge fund manager who famously bet against the housing market before the 2008 crash (and also successfully bet on the meme stock GameStop in 2020), posted a one-word tweet on Tuesday: “Sell”.

In the wake of today’s melt-up after Powell’s dovish comments, Dr. Bury deleted his Twitter account. He’s done this before, so presumably, he’ll be back. But it illustrates that timing is a challenge for even the greatest investors. More often than not, you’d be better off listening to Bury than the Wall Street Bets folks cheering this.

The Financial Conditions Disconnect

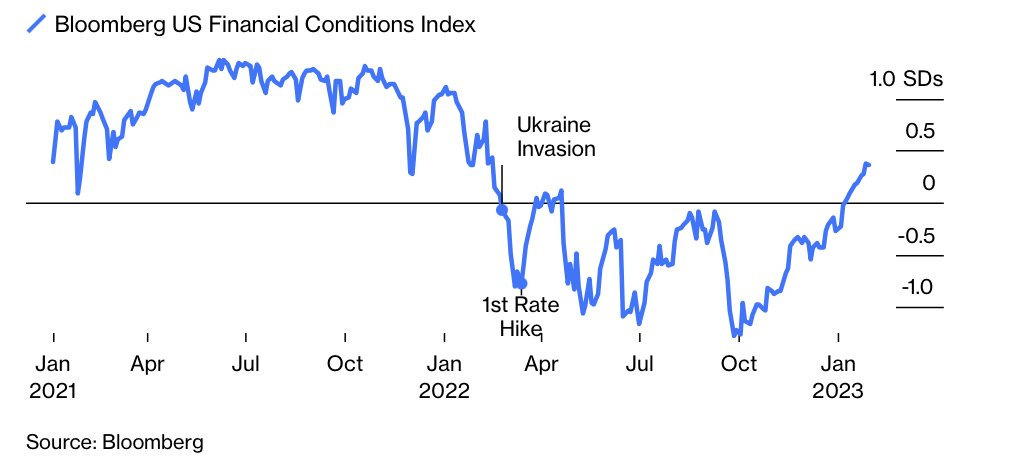

The comment by Fed Chairman Powell that seems to have been the biggest surprise today was about financial conditions tightening, as Sven Henrich notes below.

My view last year was that Powell would err on the side of hawkishness early this year, to avoid having to pump the breaks at all in 2024, and be accused of interfering in the Presidential election; now, I’m wondering if he’s being pressured to pump the gas ahead of 2024. In theory, the Fed is independent of politics, but as an insightful friend put it today, “Very ‘John Roberts upholds Obamacare’ vibe”.

The Market Reaction

As ZeroHedge summarized it, Bonds, Big-Tech, Bitcoin, and Bullion Blast Off. Some heavily shorted stocks soared as well, including Peloton Interactive, Inc. (PTON):

Peloton reported a revenue beat before the market opened, but it’s unlikely its shares would have spiked this high absent Powell’s dovish comments. A few months ago, I quipped that investors were “fleeing to the safety of Peloton”, and that seems to have worked out well for them.

I was short $5 puts on Peloton at the time, which of course didn’t get exercised, so I made a few dollars on Peloton’s rise. I would consider selling puts on it again after a pullback (I have no position in it currently, but remain bullish on the company’s long term prospects).

What To Do Now

One idea is to consider hedging, if you aren’t currently hedged. It tends to be cheaper to do so when the market is rallying. The NASDAQ-100 Index is now up nearly 14% year-to-date; buying optimal puts on it might make sense if you own some of the larger index components.

Screen capture via the Portfolio Armor iPhone app.

Another idea is to look at overvalued names to bet against. I have a couple of thoughts on that below for paid subscribers.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.