Cash-Rich But Cutting Headcount

Earlier this week, we looked at a couple of TikTok videos from a former Google employee in Los Angeles, a day in her life at the company,

And the day she got laid off.

She was one of twelve thousand Googlers laid off last week, a number which apparently included 31 massage therapists.

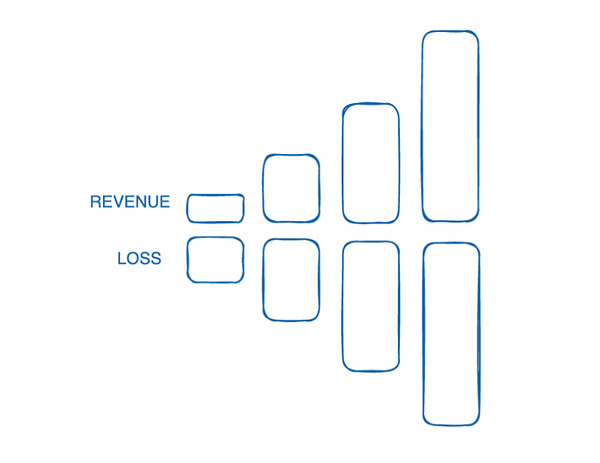

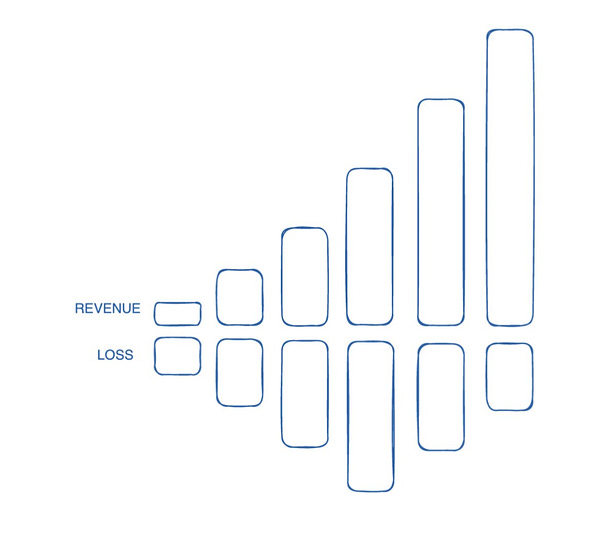

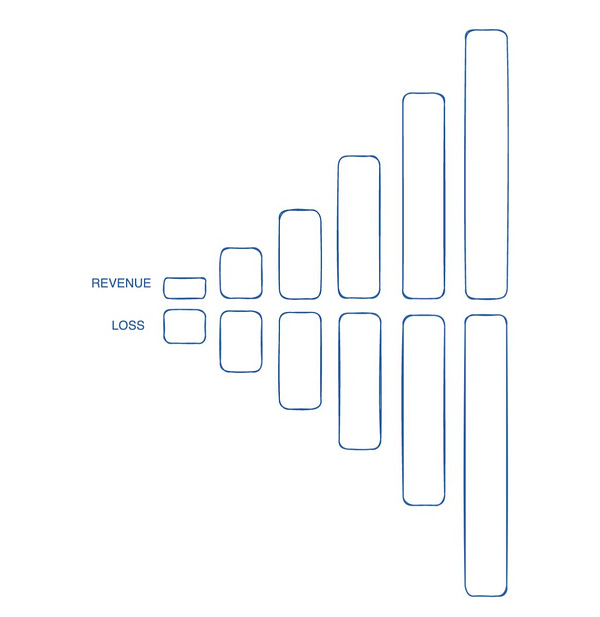

A question some investors have asked is why cash-rich, profitable companies like Google's parent Alphabet, Inc. (GOOG, GOOGL) would be cutting headcount. The short answer is that the market is repricing tech industry revenue, as this Leuthold Group chart illustrates.

The Repricing of Revenue

Matt Slotnick elaborated on this phenomenon in lucid Twitter thread this week:

A commenter reading this thread assumed this logic wouldn't apply to big cap tech companies such as Google and Microsoft, Inc. (MSFT), but Slotnick pointed out size offers no escape here:

Google And The Next Big Thing

Aside from the repricing of revenue, another caution flag for Google is that it no longer appears to be at the cutting edge of technology. Its dominance in search has led to an explosion in SEO (search engine optimization), which is why you can't Google a recipe without getting a keyword-stuffed essay as a preamble to it. Silicon Valley chatter suggests that enormous advances in artificial intelligence are happening now, and apparently Google is lobbying to shut it down.

Investing Implications

Occasionally, my personal view of securities and the Portfolio Armor system's take on them diverge, but on Google, we're both aligned. Portfolio Armor currently estimates Google will have a positive, but below-market return over the next several months. To me, it doesn't seem like a good long or short candidate; it seems to be in a grey zone where it has become less attractive to growth investors but not cheap enough to entice value investors. I prefer to bet against companies that aren't profitable and cash rich. Speaking of which, let's close with an update one: Bed Bath & Beyond (BBBY).

Blood Bath & Beyond

In a post a couple of weeks ago, I mentioned a that I had bet against BBBY when it rallied to $5.50 for no reason.

BBBY shares plummeted down to $2.52 on Thursday on news that the company had received a default notice from JPMorgan.

No need to bet against companies like Google when meme stock buyers were pumping companies like Bed Bath & Beyond for us.