Don’t Mention The War

My last political post here cost me a few subscribers, so I have saved my politics for Zero Hedge (if you’re interested, you can read my take here). With respect to investing though, nothing obvious jumps out about this. Oil’s basically flat over the last 5 days, as is Lockheed Martin (LMT 0.00%↑)… the Russia-Ukraine War may be instructive here. When Russia invaded the Ukraine in late February of 2022, the seemingly obvious bet was to buy wheat, as both Russia and the Ukraine were among the world’s leading wheat exporters. But if you bought the Teucrium Wheat ETF (WEAT 0.00%↑) then, and held it until now, you’d be down about 26%. So caution his warranted when jumping to any macro conclusions here.

We’ll keep looking for opportunistic bets on the long and short side while keeping the macro picture in mind. And we’ll continue with our core strategy.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 10%-15% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Top Names Performance Update

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from April 6th.

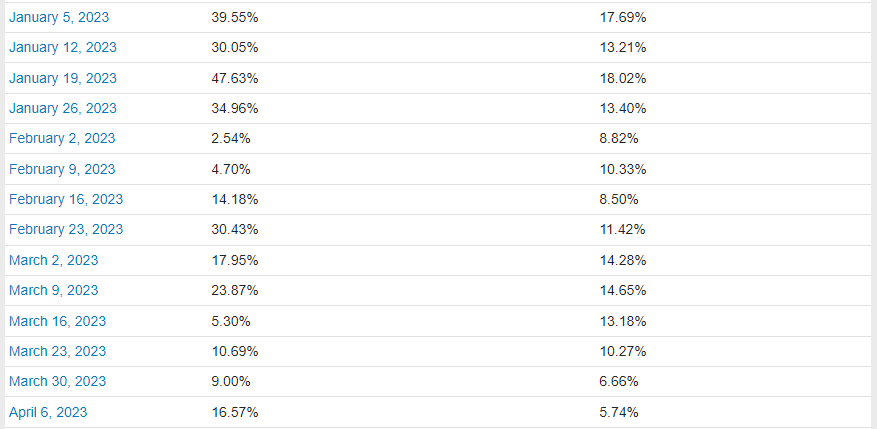

Over the next six months, our top ten names from April 6th were up 16.57%, on average, while the SPDR S&P 500 Trust ETF (SPY 0.00) was up 5.74%.

That was the 11th top names cohort of 14 so far this year that outperformed the market (PA top ten returns are on the left below; SPY returns on the right).

This Week’s Top Names

We’ve got a couple of unexpected names in this week’s top ten, including a REIT (Real Estate Investment Trust).

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.