Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 10%-15% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Top Names Performance Update

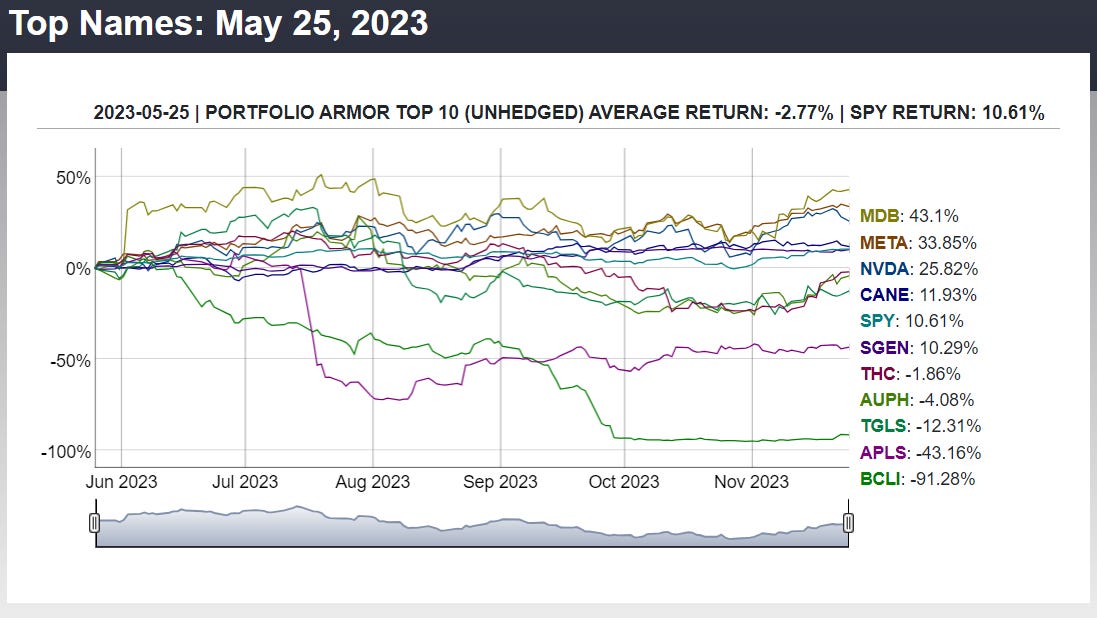

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from May 25th.

Over the next six months, our top ten names from May 25th were down 2.77%, on average, while the SPDR S&P 500 Trust ETF (SPY 0.00) was up 10.61%.

Of course, if you were following our core strategy, you would have exited BCLI after it dropped 10%-20%.

That was the 5th top names cohort of 21 so far this year that underperformed the market (PA top ten returns are on the left below; SPY returns on the right).

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.