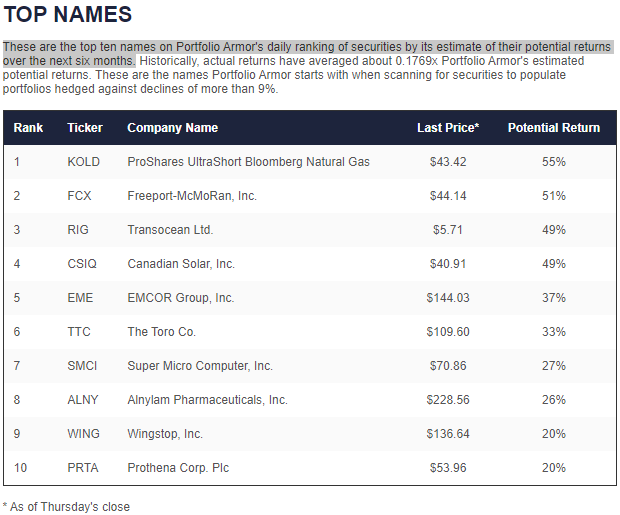

These were Portfolio Armor’s top ten names as of Thursday’s close:

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter 10% trailing stops on each of them. Note that our #1 name Thursday was leveraged ETF, so it’s going to be quite volatile. As you get stopped out of positions, you’ll add new ones from the current top ten names then.

In my case, since I am already running this strategy and got stopped out of one name this week (WING), I’m going to buy the top-ranked name from this list that I don’t currently own (KOLD) on Friday.

If you’re not buying round lots of each of these positions, it won’t be cost effective to hedge them individually, but you can hedge market risk by buying optimal puts on an index ETF such as the SPDR S&P 500 Trust (SPY). As a reminder, you can use our website or our iPhone app to scan for optimal puts.