Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 10%-15% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Personal Performance Update

I haven’t done this before, because my returns on our core strategy are going to be different from yours, unless we started at the exact same time. But here’s how the current names in my version of our core strategy are doing since I bought them so far:

Typing that out, I realize there are 11 stocks there, for some reason, so I plan to sell MDB on Friday.

A Top Names Performance Update

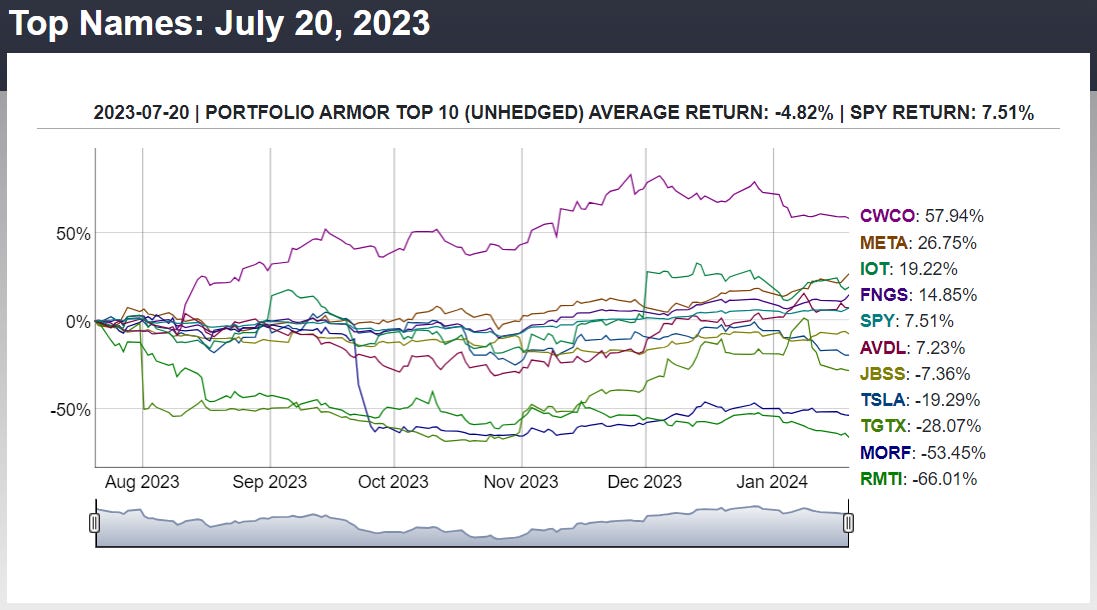

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from July 20th.

Over the next six months, our top ten names were down 4.82% on average, versus up 7.51% for SPY.

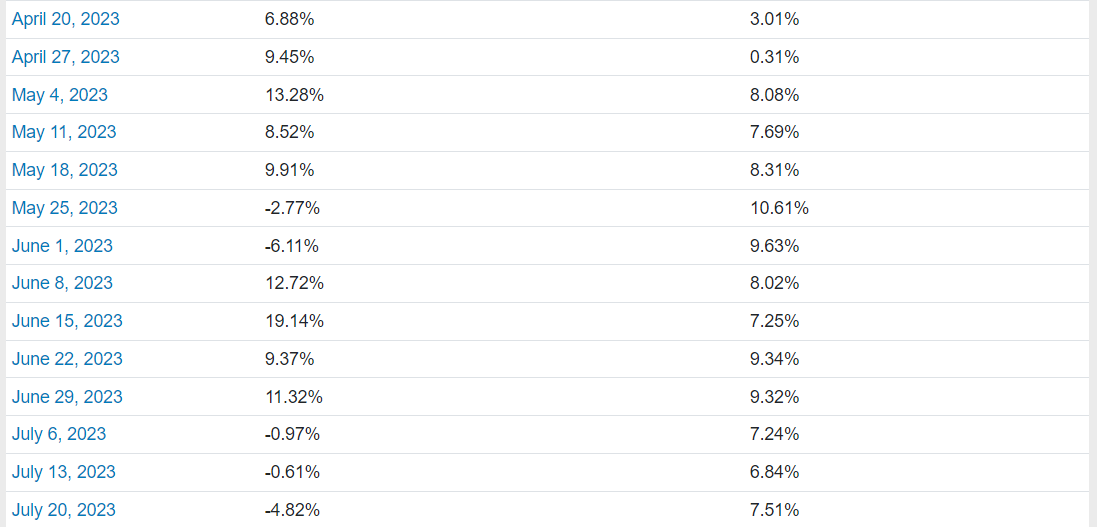

That was the 9th top names cohort of 30 since we started this Substack that underperformed the market (PA top ten returns are on the left below; SPY returns on the right).

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.