Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 10%-15% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Personal Performance Update

Here’s how the current names in my version of our core strategy are doing since I bought them so far (these are ranked alphabetically by stock symbol, the order they appear in my account):

*Return as of Tuesday, when I got stopped out.

A Top Names Performance Update

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from August 3rd.

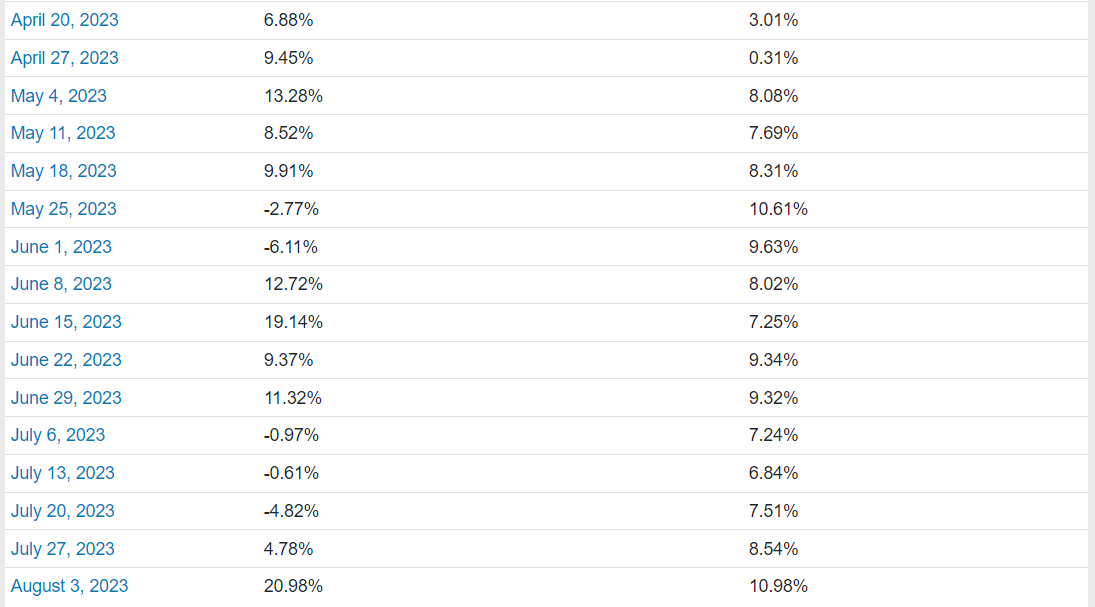

Over the next six months, our top ten names were up 20.98% on average, versus up 10.98% for SPY.

That was the 22nd top names cohort of 32 since we started this Substack that beat the market (PA top ten returns are on the left below; SPY returns on the right).

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.