This Week’s Top Names

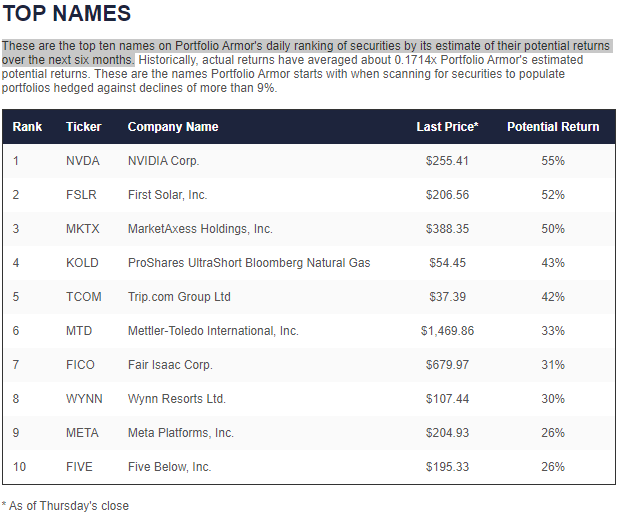

These were Portfolio Armor’s top ten names as of Thursday’s close:

Screen capture via Portfolio Armor on 3/16/2023.

As I’ve written before, one weakness I’ve noticed with Portfolio Armor’s automated security selection system when it comes to top names is that it sometimes remains bullish on leveraged ETFs for longer than it should. I think that’s the case now with #4 above, the ProShares UltraShort Bloomberg Natural Gas ETF (KOLD). Readers may recall I bought calls on its opposite number, BOIL month. So you may want to replace KOLD with what would have been the #11 name in our ranking on Thursday: Applied Materials, Inc. (AMAT).

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter trailing stops on each of them. Up until now, I’ve been using 10% trailing stops on all positions, but I may extend that to 12% going forward. As you get stopped out of positions, you’ll add new ones from the current top ten names then.

In my case, I am already running this strategy, and have four names to replace this week, so tomorrow I plan to buy MKTX, MTD, META, and AMAT.

If you’re not buying round lots of each of these positions, it won’t be cost effective to hedge them individually, but you can hedge market risk by buying optimal puts on an index ETF such as the SPDR S&P 500 Trust (SPY). As a reminder, you can use our website or our iPhone app to scan for optimal puts.

Sold a leftover fractional share of META yesterday at $248.56, for a gain of 151%.

Sold META today at $277.32 for a 0% gain.