Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 10%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Top Names Performance Update

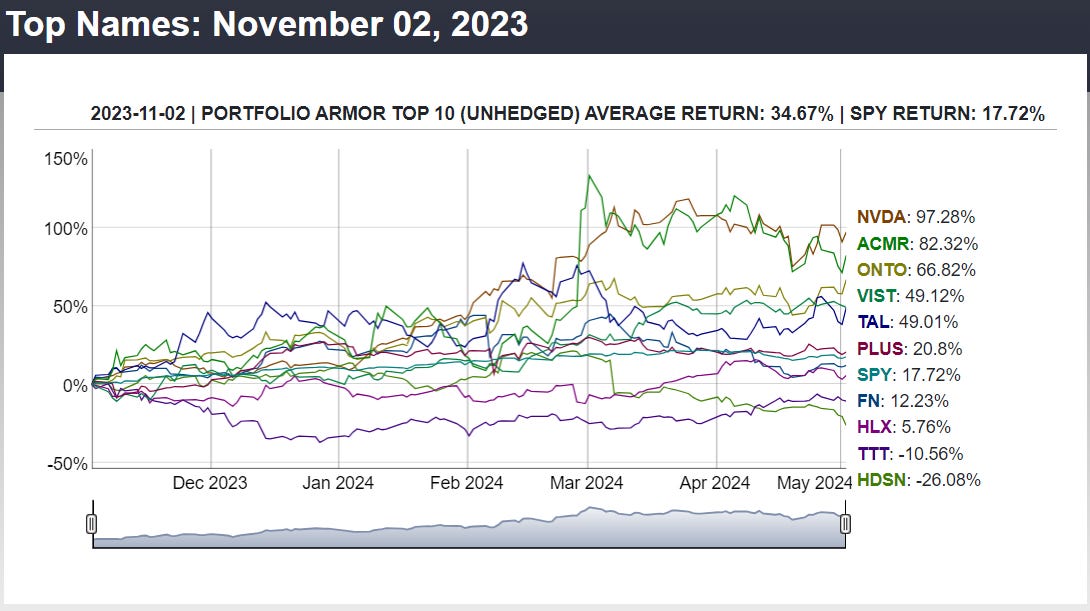

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from November 2nd, 2023.

Over the next six months, our top ten names from November 2nd were up 34.87%, on average, versus up 17.72% for the SPDR S&P 500 Trust (SPY 0.00%↑).

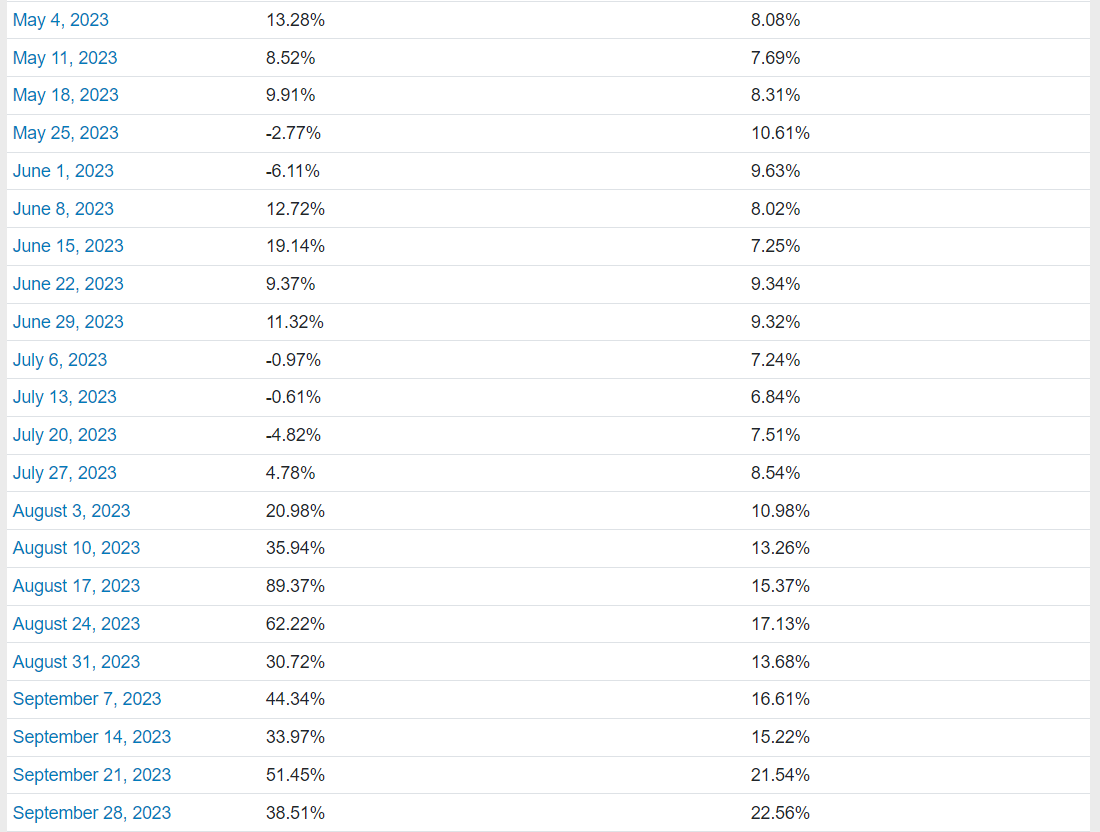

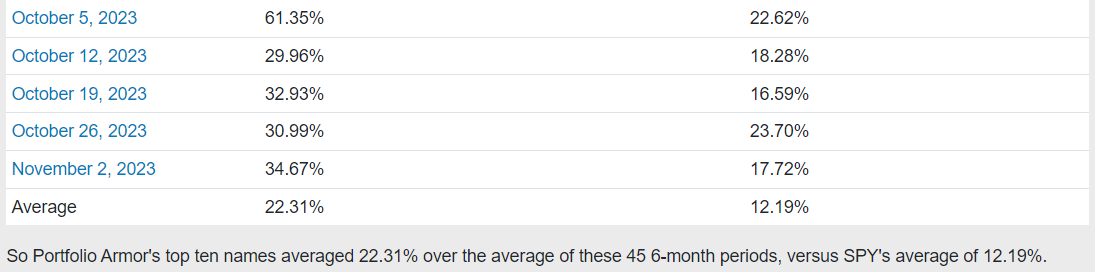

Here’s how all of our top ten names cohorts since we started this Substack have performed so far over the next six months.

You can click here to see an interactive version of that table, where you can click on a date and see what are top names were then and how each of them did.

This Week’s Top Names

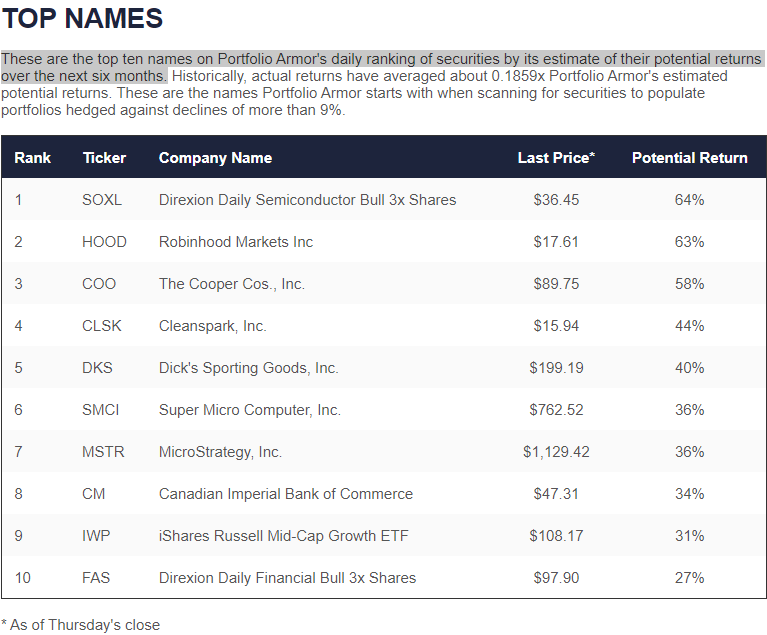

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Screen capture via Portfolio Armor on 5/2/2024.

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter trailing stops on each of them. Initially, I was using 10% trailing stops on all positions, but I extended that to 15% to 20%. As you get stopped out of positions, you’ll add new ones from the current top ten names then.

In my case, I got stopped out of one names this week, and I still have a top name to replace from last week, so I’m still in the market for two additions.

If you’re not buying round lots of each of these positions, it won’t be cost effective to hedge them individually, but you can hedge market risk by buying optimal puts on an index ETF such as the SPDR S&P 500 Trust (SPY 0.33%↑). As a reminder, you can use our website to scan for optimal puts (our iPhone app is currently closed to new users).

Alternatively, holding some of our bearish bets can work as a hedge against market risk too.

Bought COO at $91.10 today as part of our core strategy.

Bought SOXL at $39.10 today as part of our core strategy.