Top Names, 5/8/2025

A market comment, then revisiting our core strategy while updating our performance.

Is This Still A Bear Market Rally?

That was the question I asked in my post earlier today.

My answer was, “probably, yes”. I also talked about why that question matters for us:

We've got a source of alpha that works well during market rallies: our top ten names.

Since December of 2022, our top ten names have averaged returns of 17.03% over the next six months, versus 10.75% for the SPDR S&P 500 Trust (SPY). If this is a new bull market, it makes sense to start buying those top names again now, or placing bullish options trades on them. But if this is a bear market rally, it makes sense to wait.

Two things happened since I wrote that have prompted me to revise and extend my comment there. The first is that one of our top ten names from earlier this week, Groupon (GRPN 0.00%↑), spiked 42.3% today.

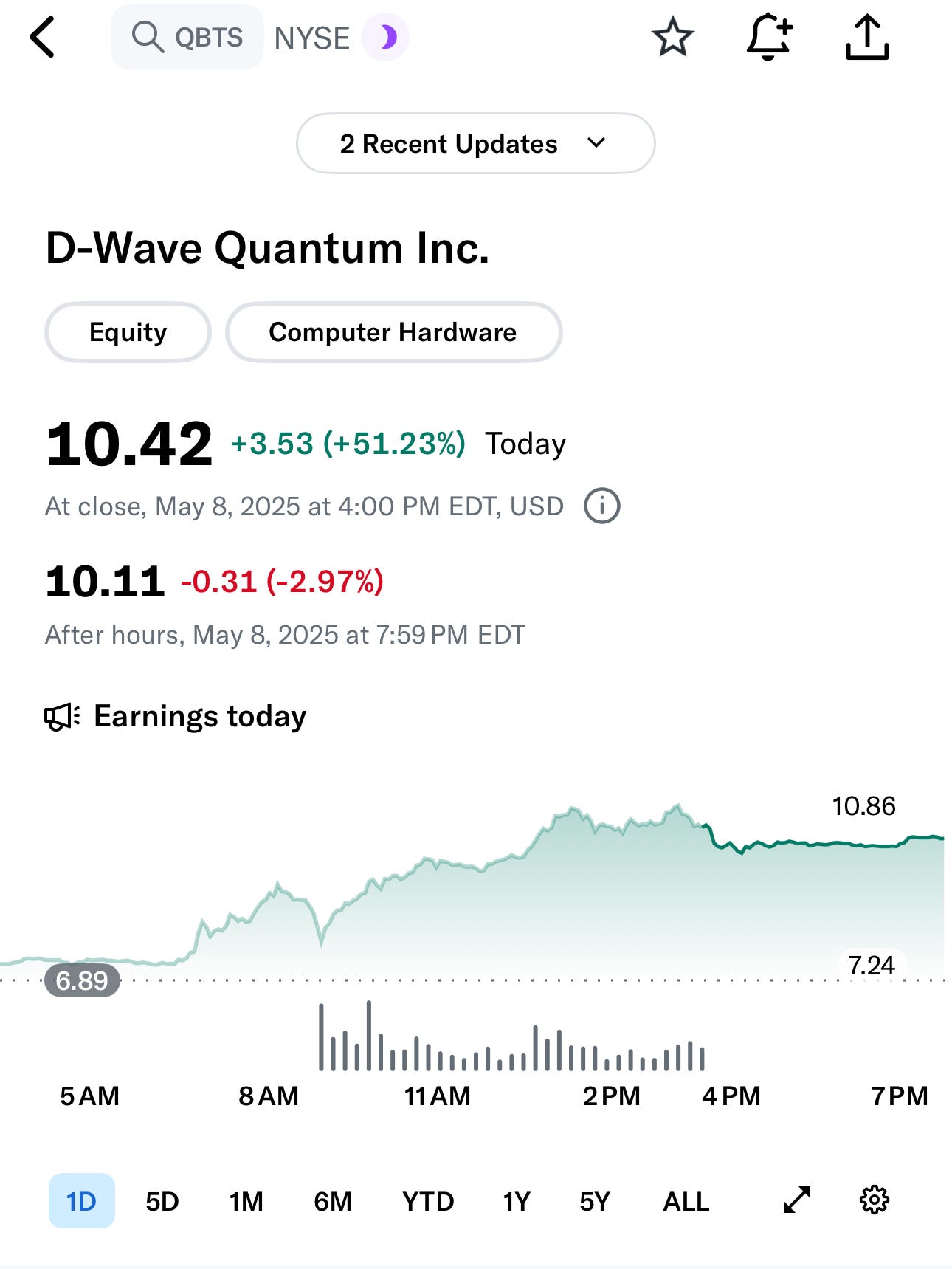

The second is that another top ten name of ours from earlier this week, D-Wave Quantum (QBTS 0.00%↑), was up 51.23% today.

So even though I still think this is a bear market rally, it might make sense to place short term trades on some of our top names with near term catalysts, even if we hold off on our core strategy for a bit.

And if you’re a conservative investor, you might consider taking advantage of the current rally to add some downside protection. As a reminder, you can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone). Our app can help you find the least expensive hedges given your risk tolerance and time frame.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 15%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

Another Use For Our Top Names

We also use our top ten names as a source of ideas for options trades, such as this one on Palantir (PLTR 0.00%↑) we exited last wee:

Options

Put spread on Palantir Technologies (PLTR -2.15%↓). Entered at a net credit of $2.80 on 3/7/2025; exited at a net debit of $0.30 on 5/1/2025. Profit: 114%.

Or the much bigger gains we could have gotten with options trades on GRPN 0.00%↑ and QBTS 0.00%↑ this week.

A Top Names Performance Update

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from November 7th, 2024.

Our top names from November 7th were up 2.34%, on average, over the next six months, versus down 2.48% for the SPDR S&P 500 Trust (SPY 0.00%↑).

So far, we have 6-month returns for 98 top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 17.03% over the next six months, versus SPY’s average of 10.75%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.