This Week’s Top Names

The big news in our top names this week was NVIDIA (NVDA -0.69%↓) crossing the $1 trillion market cap threshold . I am now up 85% on NVDA since buying it as part of our core strategy at the end of February.

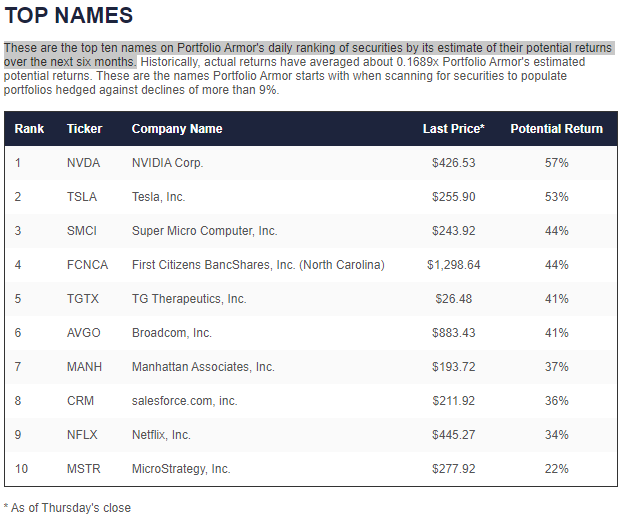

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Screen capture via Portfolio Armor on 6/15/2023.

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter trailing stops on each of them. Initially, I was using 10% trailing stops on all positions, but I extended that to 15%. As you get stopped out of positions, you’ll add new ones from the current top ten names then.

In my case, I am already running this strategy, and didn’t get stopped out of any positions this week, so I won’t be adding any new names on Friday.

If you’re not buying round lots of each of these positions, it won’t be cost effective to hedge them individually, but you can hedge market risk by buying optimal puts on an index ETF such as the SPDR S&P 500 Trust (SPY 0.33%↑). As a reminder, you can use our website to scan for optimal puts (our iPhone app is currently closed to new users).

Alternatively, holding some of our bearish bets can work as a hedge against market risk too.

Below is a message from our sponsor, SpreadHunter.

For traders getting started with options and option spreads, SpreadHunter offers a comprehensive and reassuring environment – where asking questions is a plus. Run by ex-CBOE professionals with close to 50 years trading experience (each), we will train you how and why to enter and manage complex options strategies, and how to deal with today's changing and often unpredictable market environment.

To set up a one-on-one live demonstration during market hours, contact David A. Janello, PhD, CFA at david.janello@spreadhunter.com.

For more information:

Interested in opening a TradingBlock brokerage account? Click here:

https://www.tradingblock.com/affiliates/public/spreadhunter.aspx