A Quick Trading Update

Before we get to this week’s top names, a quick options trading update. In general, I usually wait until an options trade fills before posting about it, with two exceptions:

If the trade alert includes more than one trade, and one of those trades has filled, I post it as soon as the first one gets filled.

If the trade alert has one trade that hasn’t filled, but the price I entered is near the current midpoint of the spread, then I post it.

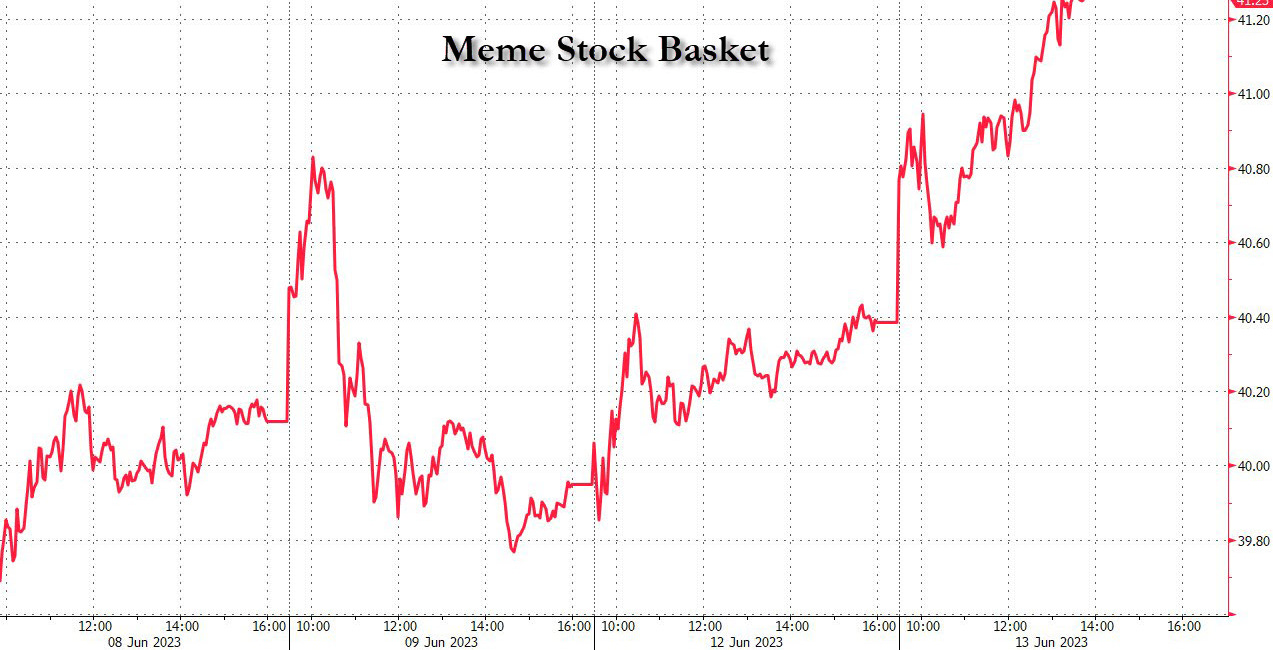

The second exception was the case when I posted this trade alert last week about betting against GameStop (GME 0.00%↑)

That trade finally filled on the 29th, as I noted in a comment on that post.

Now on to this week’s top names, where we have one stock I’d never heard of before.

This Week’s Top Names

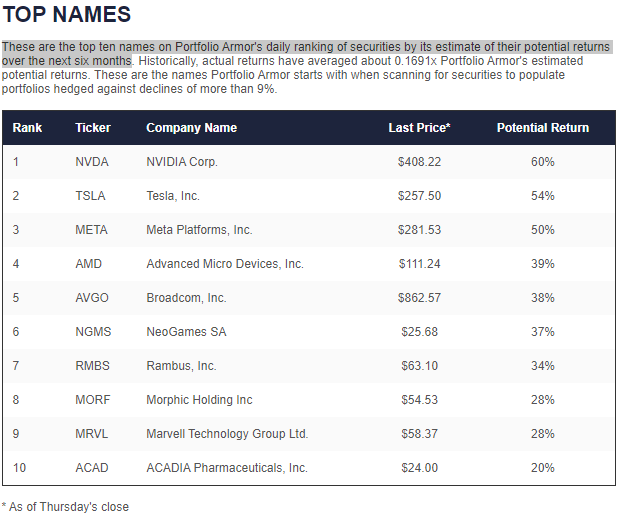

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Screen capture via Portfolio Armor on 6/29/2023.

The stock there I hadn’t heard of before is Morphic (MORF 0.00%↑), which apparently is a biotech company.

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter trailing stops on each of them. Initially, I was using 10% trailing stops on all positions, but I extended that to 15%. As you get stopped out of positions, you’ll add new ones from the current top ten names then.

In my case, I am already running this strategy, and didn’t get stopped out of any positions this week, so I won’t be adding any new names on Friday.

If you’re not buying round lots of each of these positions, it won’t be cost effective to hedge them individually, but you can hedge market risk by buying optimal puts on an index ETF such as the SPDR S&P 500 Trust (SPY 0.33%↑). As a reminder, you can use our website to scan for optimal puts (our iPhone app is currently closed to new users).

Alternatively, holding some of our bearish bets can work as a hedge against market risk too.

Below is a message from our sponsor, SpreadHunter.

For traders getting started with options and option spreads, SpreadHunter offers a comprehensive and reassuring environment – where asking questions is a plus. Run by ex-CBOE professionals with close to 50 years trading experience (each), we will train you how and why to enter and manage complex options strategies, and how to deal with today's changing and often unpredictable market environment.

To set up a one-on-one live demonstration during market hours, contact David A. Janello, PhD, CFA at david.janello@spreadhunter.com.

For more information:

https://spreadhunter.com

Interested in opening a TradingBlock brokerage account? Click here:

https://www.tradingblock.com/affiliates/public/spreadhunter.aspx