A Top Names Performance Update

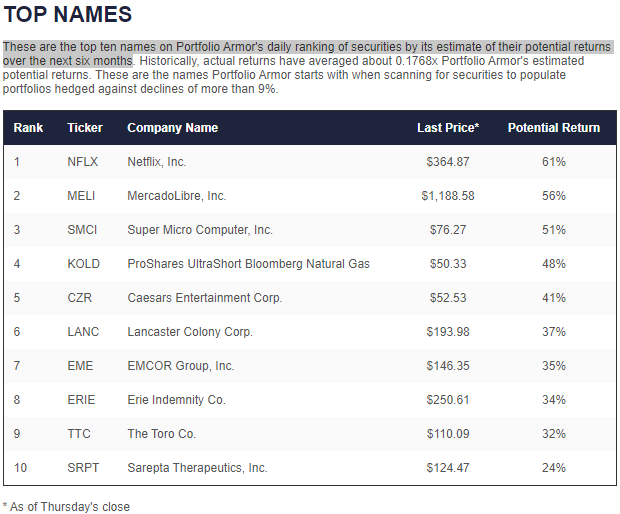

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top names from January 26th of this year.

Over the next six months, our top ten names from January 26th were up 34.96%, on average, while the SPDR S&P 500 Trust ETF (SPY 0.00) was up 13.4%.

Screen capture via Portfolio Armor on 7/27/2023.

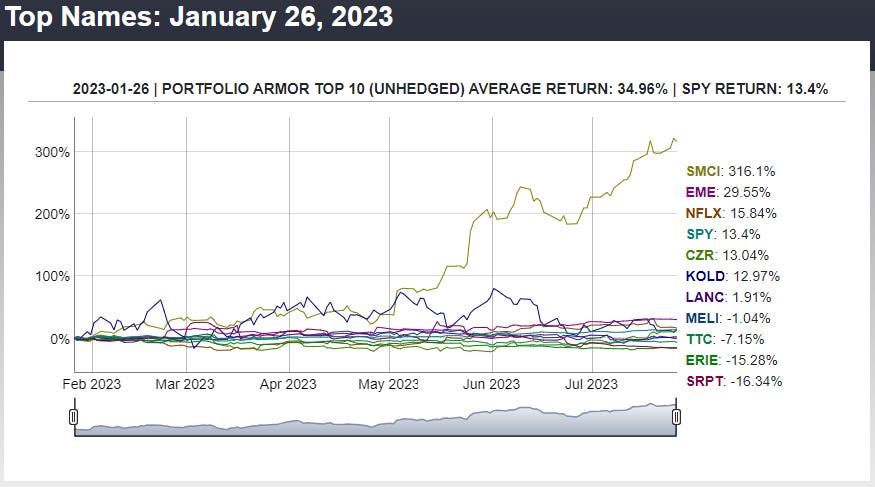

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Screen capture via Portfolio Armor on 7/27/2023.

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter trailing stops on each of them. Initially, I was using 10% trailing stops on all positions, but I extended that to 15%. As you get stopped out of positions, you’ll add new ones from the current top ten names then.

In my case, I am already running this strategy, and didn’t get stopped out of any positions this week, so I won’t be adding any new names on Friday.

If you’re not buying round lots of each of these positions, it won’t be cost effective to hedge them individually, but you can hedge market risk by buying optimal puts on an index ETF such as the SPDR S&P 500 Trust (SPY 0.33%↑). As a reminder, you can use our website to scan for optimal puts (our iPhone app is currently closed to new users).

Alternatively, holding some of our bearish bets can work as a hedge against market risk too.