Trading Note

Before we get to this week’s top ten, a brief trading note. We had a successful exit today from essentially a value investing options trade on Zoom Video Communications (ZM 0.00%↑).

I’ve found a stock in a different industry with a similar set-up, and plan on posting a trade alert on that one tomorrow, so keep an eye out for that.

Also, if you are concerned about market risk, remember, you can download our iPhone hedging app here, or by aiming your iPhone camera at the QR code below.

Now onto a recap of our core strategy and a performance update on our top names.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 15%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Top Names Performance Update

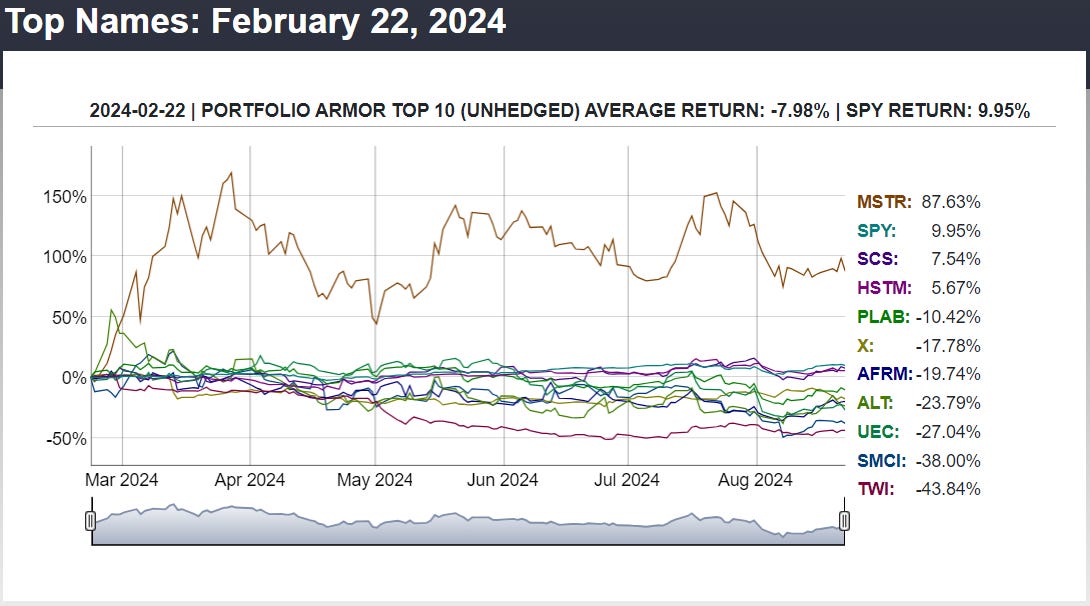

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from February 22nd.

Over the next six months, our top ten names from February 22nd were down 7.98%, on average, versus up 9.95% for the SPDR S&P 500 Trust (SPY 0.00%↑).

So far, we have 6-month returns for 61 weekly top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 21.22% over the next six months, versus SPY’s average of 12.83%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.