"You're thinking of this place all wrong, as if I had the money back in a safe. Your money's in Web3 innovations, it's in startups empowering women" —

, riffing on the bank run scene in “It’s a Wonderful Life”.Searching For Banks To Bet Against

In my last post (Banks: Eye of The Hurricane?), I mentioned four criteria I had looked for to identify a bank to bet against in the wake of the collapse of Silicon Valley Bank and Signature Bank:

Banks tend to be tough to analyze, so it seems best to not rely on any one metric. I settled on four different ones in my search:

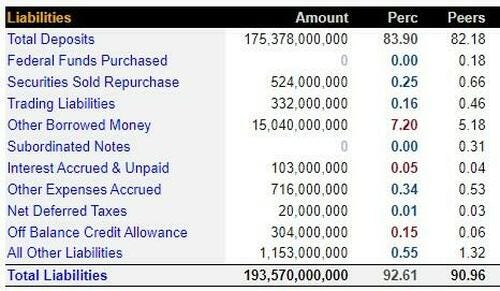

Deposits as a percentage of total liabilities. As ZeroHedge pointed out over the weekend, having a relatively high percentage of total liabilities as deposits can make a bank more vulnerable to a run. According to BankRegData.com, Silicon Valley Bank's deposits as a percentage of liabilities were 83.9% as of its most recent quarter

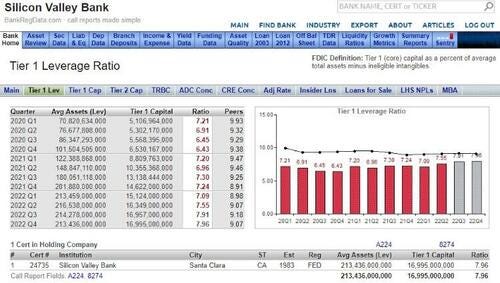

Tier One Leverage Ratio. That's the ratio of a bank's tier one capital (its core, most liquid capital) relative to its total assets. As an example of the difficulty of relying on any one metric in gauging bank risk, starting in 2018, federal regulators required a minimum tier one leverage ratio of 5% for larger banks in the U.S., and Silicon Valley Bank had a tier one leverage ratio of 7.96. That said, as the table below shows, that ratio was below that of its peers.

Piotroski F-Score. I've mentioned the Altman Z-Score in previous posts, which is a measure of financial health that NYU accounting professor Edward Altman came up with in the late 1960s. One limitation of the Altman Z-Score is it was designed for manufacturing companies. Altman subsequently invented another version for non-manufacturing companies (The Altman Z"-Score), but neither was intended for financial companies. Joseph Piotroski, an acccounting professor at Stanford, developed his method in 2000. Subsequent research (such as this Indian study), demonstrated its utility in analyzing banks. The Piotroski F-Score goes from 0 to 9, with scores of 8 and 9 indicating financial strength, and scores of 2 and below indicating financial weakness. Silicon Valley Bank had a Piotroski F-Score of 2 before its collapse (Signature Bank had an F-Score of 6 though, highlighting again how you don't want to rely on just one metric with banks).

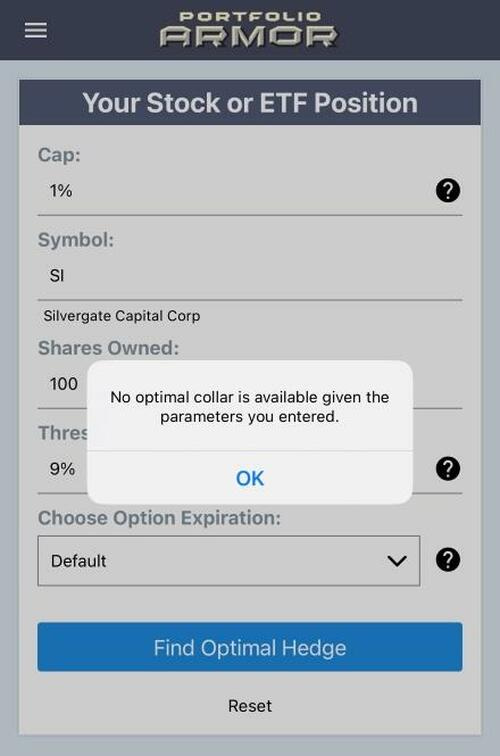

Options market sentiment. This is a screen we developed at Portfolio Armor several years ago. It's a test of whether it's possible to hedge a security against a greater-than-9% decline over the next several months with an optimal collar capped at 1%. Essentially, it gauges the relative demand for out-of-the-market (OTM) call options (bullish bets on a security) to OTM put options (bearish bets). If a stock fails this screen, this error message comes up when you try to collar it that way using our app (I've used Silvergate Capital Corporation (SI) here, because it was still trading on Friday, unlike Silicon Valley Bank's parent company).

We applied it to dozens of stock picks by prominent investors, and then looked at their performance six months later, and the ones that failed this test did significantly worse than the ones that passed. Again, like the other metrics, this one shouldn't be relied on alone. Signature Bank was expensive to hedge this way on Friday, but it did pass this screen.

The bank we found has these characteristics, all as bad or worse than Silicon Valley Bank did before its collapse:

Deposits comprise more than 87% of its liabilities (this was 83.9% for Silicon Valley Bank).

A Tier One Leverage Ratio below 7.5% (recall Silicon Valley Bank had 7.96%).

A Piotroski F-Score of 2 (same as Silicon Valley Bank).

It failed our test of options market sentiment (same as Silvergate Capital).

This stock is up fractionally in premarket trading in Frankfurt as I type this, so hopefully it will be green today when U.S. trading starts. I have a limit order to buy puts on it. I'll send a trade alert to Portfolio Armor Substack subscribers with the details later today if it gets filled.

That bank crashed on Monday, before recovering to a high-teens decline, and my limit order didn’t get filled. I spent some more time thinking about this on Monday though, and modified those criteria a bit to look for additional, less obvious banks to bet against. Specifically, I used these criteria:

Deposits comprise more than 80% of its liabilities.

Deposits less than $250k (the FDIC deposit insurance limit) as a % of total deposits. I replaced Tier One Leverage Ratio with this, because this seemed more relevant to the recent bank crashes. This figure was 39.7% for Silvergate Capital (SI), 19.8% for First Republic Bank (FRC), 6.2% for Signature Bank (SBNY), and 2.7% for Silicon Valley Bank (SIVB). All three names I ended up with (including my original name) had percentages less than Silvergate Capital on this metric.

A Piotroski F-Score of 2 or less. The two new names I found have Piotroski F-Scores of 1, even worse.

Failing Portfolio Armor’s test of options market sentiment. All three names failed this test.

I got filled on my limit orders for puts on all three of these names today. Details below.

The original bank stock I planned to bet against was Bank of Hawaii (BOH). I got the $45 strike, October expiration puts on it for $6.12.

The next bank stock was First Foundation, Inc. (FFWM). I got the $7.50 strike, October expiration puts on it for $1.

And the third bank stock was

Hilltop Holdings, Inc. (HTH). I got the $30 strike, August puts on it at $3.

A reminder about risk and position sizing with speculative options trades like these: use only an amount of money you are comfortable losing. Out-of-the-money options expire worthless.

These puts are all trading for less as I type this, but their prices have been jumping around today.

Out of the BOH puts today at $11, for a profit of ~80%.

This one is almost double, time to sell or are you holding?