Trade Alert: Betting Against Another Bank

The one with the highest risk of default, per Bloomberg Risk Monitor.

"You're thinking of this place all wrong, as if I had the money back in a safe. Your money's in Web3 innovations, it's in startups empowering women" —Delicious Tacos,riffing on the bank run scene in “It’s a Wonderful Life”.

Note: Unlocking this post too, as the trades have closed and FRC is circling the drain.

After The Acute Phase Of The Bank Crisis

The acute phase of the bank crisis appears to be over—we haven’t had any new banks fail since Silicon Valley Bank and Signature Bank last month—and we haven’t seen any footage of bank runs since, but the forces driving deposit flight continue (despite the recent slight uptick in deposits earlier this month). Savers can get much higher yields in money market funds or in Treasuries directly, and those with more than $250,000 in their accounts know their deposits over the FDIC limit aren’t insured. It’s also possible this is an interregnum between acute crises similar to the one between the fall of Bear Stearns in March of 2008 and the fall of Lehman about six months later. Time will tell.

Either way though, regional banks continue to be under pressure from deposit flight. As the FT notes below, analysts estimate depositors pulled out $100 billion from the big four banks, but the picture will almost certainly be worse for regional banks, because some of the regional deposits went to big four banks.

I used a screen capture of the tweet above since Twitter disabled embedding tweets within Substack, after Substack decided to launch a competing product.

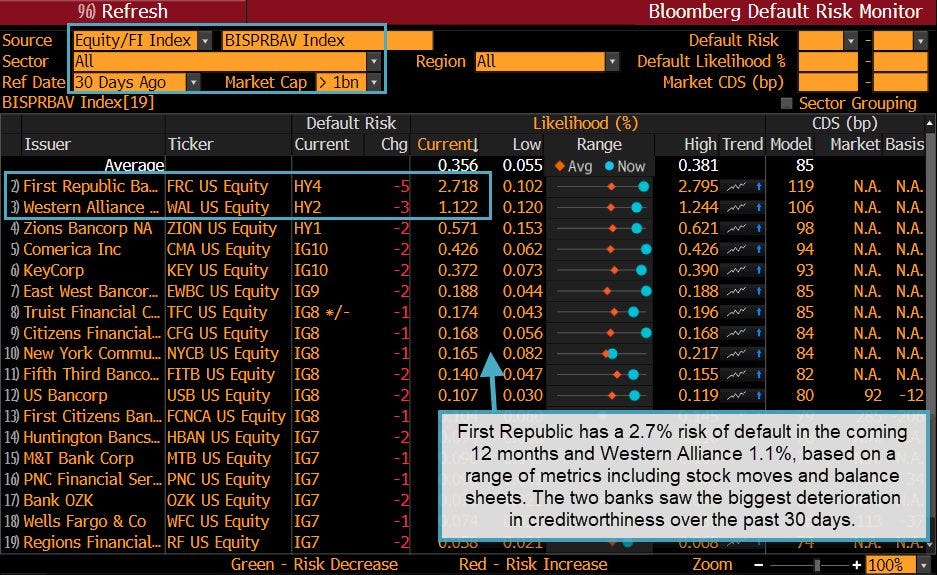

The regional bank we’re betting against this time has a high percentage of depositors above the $250k limit, and Bloomberg Risk Monitor sees a higher chance of it defaulting over the next 12 months than other regional banks. But we won’t need the bank to default for our trade to make money; we’ll just need it to drop slightly after earnings.

Essentially, this is a bet that the stock’s modest recovery since last month was overdone, and all the bad news hasn’t been priced into the stock yet.

Details below.

The stock is First Republic Bank (FRC), one I initially tried to buy puts on after Silicon Valley Bank collapsed, but my limit orders didn’t get filled.

This time, since puts on FRC remain pricey, we opened a put spread, buying the $14 strike puts on it expiring on April 28th and selling the $13 strike puts expiring on the same date for a net debit of $0.55 (FRC releases its earnings on April 24th). We’ll break even on this trade if FRC trades below $13.45 when we exit (it’s trading at $13.23 as I type this). The max gain on 10 contracts is $450 and the max loss is $550 (the same ratio applies if you did this with 1 contract or 100 contracts, just add or remove zeros).

I also placed a limit order on another put spread on FRC, buying the $13.50 strike puts and selling the $13 strike puts expiring on April 28th for a net debit of $0.25. The break even on that one is with FRC trading at $13.25, and the maximum upside on 15 contracts is a gain of $375 with a maximum downside of a loss of $375. I’ll let you know in a comment on this post if it gets filled.

Hi David, so the first on on the put spread you filled already?