Trade Alert: Copper

After the recent pullback, a copper miner appeared in our top names last night.

The Case For Copper

In an article last month (“Copper: Why A Multi-Year Bull Market Looms”), Zacks author Andrew Rocco quoted the legendary hedge fund manager Stanley Druckenmiller on the case for copper:

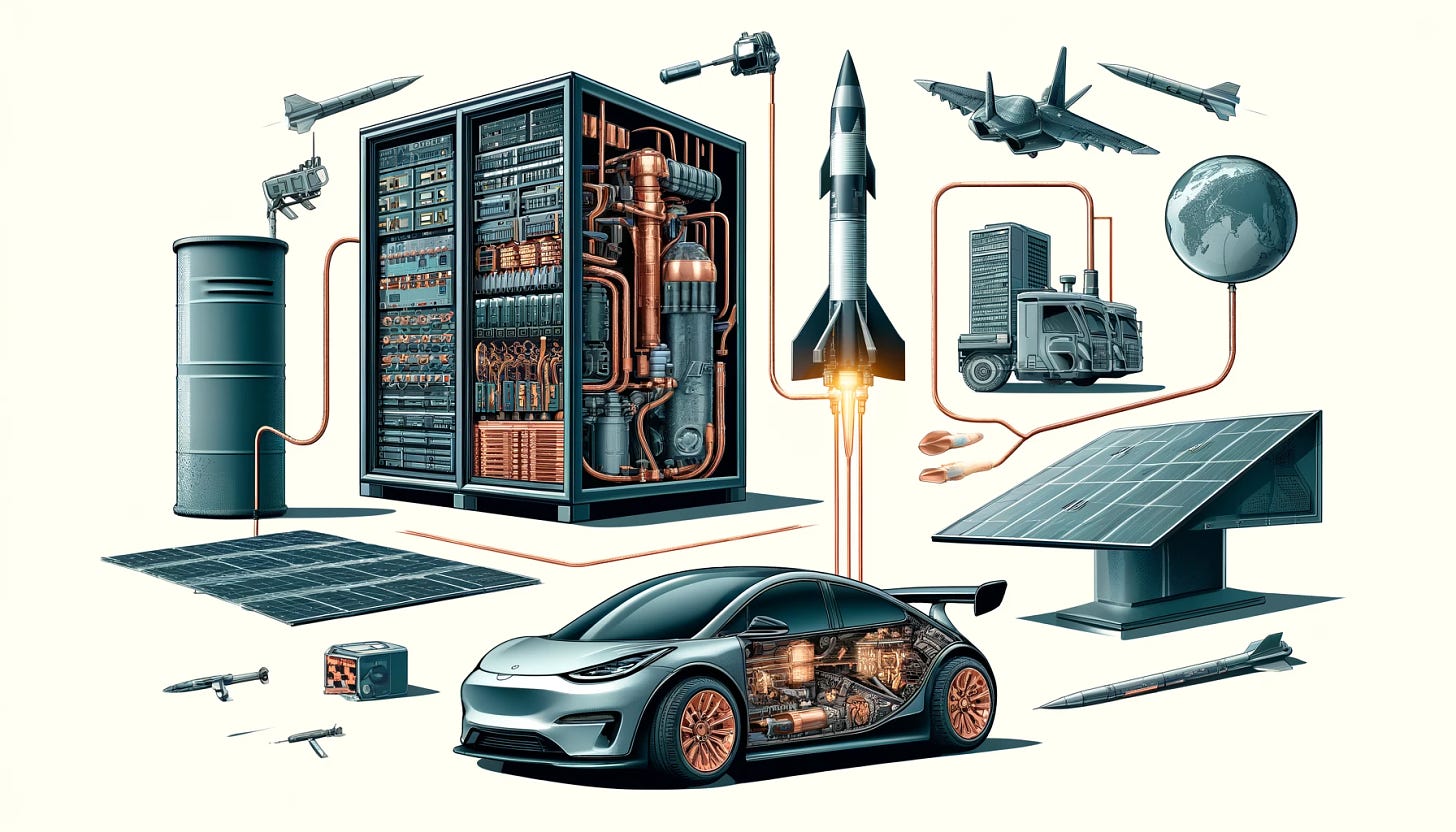

Copper is a pretty simply story. Takes about 12 years, greenfield to produce copper, and you got EVs, the grid, data centers, and believe it or not munitions. These missiles all got enough copper in them and the world’s getting hot that we just think the supply-demand situation is incredible for the next five or six years.

Rocco’s article could have been better timed: two days later, copper prices peaked, hitting a one-year high, and are down about 10% since.

But, all else equal, Portfolio Armor’s security selection system tends to like short term corrections, and yesterday it ranked a copper miner (not the one Rocco mentioned in his article) as its #4 name (the miner’s share price has corrected along with copper since late May).

Our options trade today is a bet on copper, and this copper miner, recovering somewhat by the time this miner releases earnings in late July. If we get it wrong, our worst case scenario is a 100% loss; if we get it right, our best case scenario is a gain of about 200%.

Details below.

Our Copper Miner Trade

The company is Southern Copper Corporation (SCCO 0.00%↑), and our trade is a vertical spread expiring on August 16th, buying the $115 strike calls and selling the $120 strike calls for a net debit of $1.62. The max gain on 2 contracts was $676, and the max loss was $324. This trade filled at $1.62. Note: I placed this trade overnight, and the stock dropped this morning, so you can get this same trade for less now, or you can be more conservative and go for a $110-$115 call spread instead.

Exiting This Trade

I’m going to open a GTC order to exit at a net credit of $4.95 and lower that price, as necessary, as we approach expiration.