Our Current Approach

Recall that we’re using these ten factors when evaluating earnings trades,

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

Zacks Ranking. This goes from 1 to 5, with #1 ranked stocks being their most bullish ones. They grade on a bell curve, so most stocks we see end up with their #3 (neutral) ranking.

The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

Recent insider transactions.

RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. We’re looking for RSI levels below 70 for bullish trades and above 30 for bearish ones.

Short Interest.

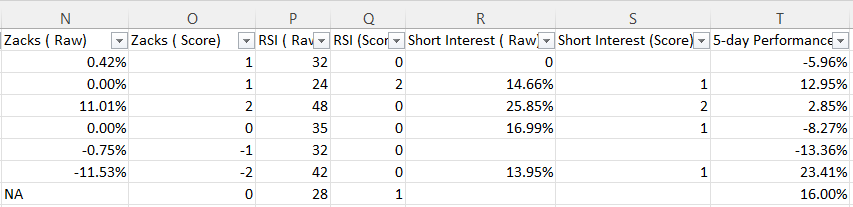

And we’re keeping track of each metric on a range from very bearish to very bullish, and tracking them and their performance in a spreadsheet, a snippet of which is below.

And we’re using their relative outperformance or underperformance versus all of the stocks that we’ve analyzed to adjust our weightings of each metric to determine which stocks we should be bullish or bearish on ahead of earnings.

The Stock We’re Bullish On

The number in parentheses represents our composite score for a stock, based on all the metrics: higher = more bullish, and lower (more negative) = more bearish.

Bullish Stock #1 (5.2)

Social data: +23.

PA Options sentiment: Bullish.

Setup rating: 7

Valuation rating: 3

F-Score: 7

Recent insider transaction(s): Net open market purchases, most recently in September.

Zacks ESP: 3.05%

Zacks Ranking: 3

RSI: 58

Short Interest: 3.11%

The Stock We’re Bearish On

The number in parentheses represents our composite score for a stock, based on all the metrics: higher = more bullish, and lower (more negative) = more bearish.

Bearish Stock #1 (-0.6)

Social data: -51.

PA Options sentiment: Very Bearish.

Setup rating: 6

Valuation rating: 0

F-Score: 2

Recent insider transaction(s): None over the last 12 months.

Zacks ESP: 0%

Zacks Ranking: 3

RSI: 50

Short Interest: 13.58%

Details below.

Bullish Trade #1

The stock is Dollar Tree (DLTR 0.00%↑), and the trade is a vertical spread expiring on December 1st buying the $116 strike calls and selling the $117 strike calls for a net debit of $0.45. The max gain on 7 contracts is $385, the max loss is $315, and the break even is with DLTR at $116.45. This one filled at $0.45.

Bearish Trade #1

The stock is Farfetch (FTCH 0.00%↑), and the trade is a vertical spread expiring on December 1st buying the $2 strike puts and selling the $1.50 strike puts for a net debit of $0.29. The max gain on 11 contracts is $231, the max loss is $319, and the break even is with FTCH at $1.71. I know we don’t ordinarily enter debit spreads where the potential upside is less than the potential downside, but looking at the alternatives here (just buying the $2 puts, or widening the spread to a $1), this looks like it offers the best realistic opportunity. This one filled at $0.29. Note: after I placed this trade, news broke intraday that the founder of Farfetch might take the company private, and the stock spiked about 25% on the news. I tried to add another spread, selling the $2.50 strike puts and buying the $1.50 ones for $0.45, but Fidelity’s site went down, so I don’t know if it filled or not. Update: that second trade never filled.

Exiting These Trades

I’m going to place GTC orders to exit at about 90% of the spread and lower the price as necessary as we approach expiration.

Out of the FTCH spread at $0.48, for gain of 66%.

Out of the DLTR spread at $0.80, for a gain of 78%. The stock's trading above our call spread, so if it stays there on Friday, you ought to be able to get out of this spread for closer to $1, but I exited today in case the stock pulls back before then.