Trade Alert: Earnings, 12/4/2023

One bullish and one bearish trade using our signals, plus four experimental trades.

Something A Little Different This Week

We’ve got two trades today using our current approach that has done well over the last two weeks,

Exits, 12/1/2023

Dids/Pexels This Week’s Trade Exits As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week: Stocks or Exchange Traded Products

and then we’ve got four trades using an experimental approach that has never been done before. More on that below. Let’s start with a recap of our current approach.

Our Current Approach

Recall that we’re using these ten factors when evaluating earnings trades,

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

Zacks Ranking. This goes from 1 to 5, with #1 ranked stocks being their most bullish ones. They grade on a bell curve, so most stocks we see end up with their #3 (neutral) ranking.

The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

Recent insider transactions.

RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. We’re looking for RSI levels below 70 for bullish trades and above 30 for bearish ones.

Short Interest.

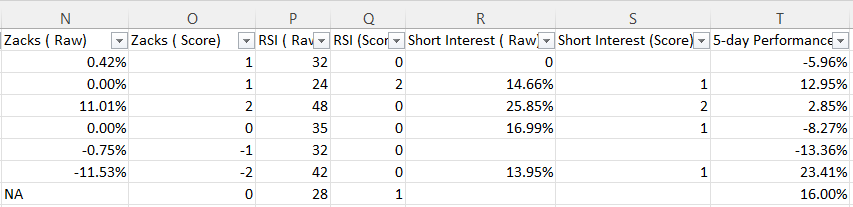

And we’re keeping track of each metric on a range from very bearish to very bullish, and tracking them and their performance in a spreadsheet, a snippet of which is below.

And we’re using their relative outperformance or underperformance versus all of the stocks that we’ve analyzed to adjust our weightings of each metric to determine which stocks we should be bullish or bearish on ahead of earnings.

The Stock We’re Bullish On

The number in parentheses represents our composite score for a stock, based on all the metrics: higher = more bullish, and lower (more negative) = more bearish.

Bullish Stock #1 (1.8)

Social data: +56.

PA Options sentiment: Very Bullish.

Setup rating: 8

Valuation rating: 4

F-Score: 6

Recent insider transaction(s): Net open market sales, as recently as October 30th.

Zacks ESP: -0.37%

Zacks Ranking: 3

RSI: 55

Short Interest: 2.96%

The Stock We’re Bearish On

Bearish Stock #1 (-2.2)

Social data: -9.

PA Options sentiment: Neutral.

Setup rating: 8

Valuation rating: 6

F-Score: 6

Recent insider transaction(s): Net open market sales, peaking last March.

Zacks ESP: -0.52%

Zacks Ranking: 3

RSI: 47

Short Interest: 4.4%

To be candid, I’m less confident on the two stocks above than last week’s, for two different reasons. In the case of the bullish stock, our composite score is lower than our bullish names from last week (though I haven’t determined what a minimum composite score for bullish trades should be). In the case of the bearish stock above, although the composite score is more negative than our successful bearish trade from last week, two of our strongest signals, social data and options sentiment, are neutral on it (Likefolio considers social data scores from -19 to +19 to be holds). So I’m going to place trades here that won’t require much movement in our direction to work.

Four Experimental Trades

A correspondent of mine on X (the site formerly known as Twitter) is the CEO of an Israeli technology company that developed an artificial intelligence to predict coronavirus waves. They’ve since applied their technology to other sorts of predictions, and are interested in applying it to stocks. So I shared the image at the top of this post with them, and they gave me two bullish and two bearish predictions for this week. I’ve filled in our other signals for them out of curiosity and for tracking purposes, but I placed these trades based on their signals, not mine.

Experimental Bullish Stock #1 (0.4)

Social data: NA

PA Options sentiment: Bullish.

Setup rating: 3

Valuation rating: 4

F-Score: 9

Recent insider transaction(s): Net open market sales for the year overall, peaking in March, but net open market purchases in September.

Zacks ESP: -0.06%

Zacks Ranking: 2

RSI: 51

Short Interest: 1.83%

Experimental Bullish Stock #2 (2.3)

Social data: NA

PA Options sentiment: Extremely Bullish.

Setup rating: 1

Valuation rating: 4

F-Score: 5

Recent insider transaction(s): Net open market sales peaking in September.

Zacks ESP: 0.22%

Zacks Ranking: 3

RSI: 70

Short Interest: 19.03%

Experimental Bearish Stock #1 (-1.4)

Social data: NA

PA Options sentiment: Bullish.

Setup rating: 9

Valuation rating: 4

F-Score: 5

Recent insider transaction(s): Net open market sales in March.

Zacks ESP: -1.47%

Zacks Ranking: 3

RSI: 61

Short Interest: 1.35%

Experimental Bearish Stock #2 (2.1)

Social data: NA

PA Options sentiment: Neutral.

Setup rating: 3

Valuation rating: 2

F-Score: 1

Recent insider transaction(s): Slight net open market purchases in September.

Zacks ESP: -10.8%

Zacks Ranking: 3

RSI: 54

Short Interest: 23.06%

Details below.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.