Our Current Approach

Recall that we’re using these ten factors when evaluating earnings trades,

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

Zacks Ranking. This goes from 1 to 5, with #1 ranked stocks being their most bullish ones. They grade on a bell curve, so most stocks we see end up with their #3 (neutral) ranking.

The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

Recent insider transactions.

RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. We’re looking for RSI levels below 70 for bullish trades and above 30 for bearish ones.

Short Interest.

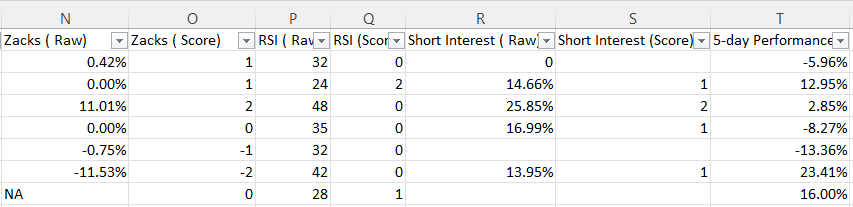

And we’re keeping track of each metric on a range from very bearish to very bullish, and tracking them and their performance in a spreadsheet, a snippet of which is below.

And we’re using their relative outperformance or underperformance versus all of the stocks that we’ve analyzed to adjust our weightings of each metric to determine which stocks we should be bullish or bearish on ahead of earnings.

The Stocks We’re Bullish On

The number in parentheses represents our composite score for a stock, based on all the metrics: higher = more bullish, and lower (more negative) = more bearish.

Bullish Stock #1 (2.1)

Social data: +31

PA Options sentiment: Very Bullish.

Setup rating: 8

Valuation rating: 5

F-Score: 6

Recent insider transaction(s): Net open market sales peaking in August.

Zacks ESP: 0.14%

Zacks Ranking: 3

RSI: 48

Short Interest: 17.29%

Bullish Stock #2 (1.2)

Social data: +31

PA Options sentiment: Neutral.

Setup rating: 8

Valuation rating: 3

F-Score: 6

Recent insider transaction(s): None in the last 12 months.

Zacks ESP: 4.35%

Zacks Ranking: 3

RSI: 58

Short Interest: 28.68%

Bullish Stock #3 (1.9)

Social data: +74

PA Options sentiment:

BearishBullish (this indicator flipped on Wednesday).Setup rating: 7

Valuation rating: 1

F-Score: 6

Recent insider transaction(s): Net open market sales.

Zacks ESP: 0%

Zacks Ranking: 3

RSI: 53

Short Interest: 4.21%

Details below.

Bullish Trade #1

The stock is Boot Barn Holdings (BOOT 0.00%↑), and the trade is a vertical spread expiring on February 16th, buying the $70 strike calls and selling the $75 strike calls for a net debit of $2.50. The max gain on 1 contracts is $250, the max loss is $250, and the break even is with BOOT at $72.50. This trade hasn’t filled yet. This trade filled at $2.50.

Bullish Trade #2

The stock is Canada Goose (GOOS 0.00%↑), and the trade is a vertical spread buying expiring on February 2nd, buying the $12 strike calls and selling the $12.50 strike calls for a net debit of $0.25. The max gain on 15 contracts is $375, the max loss is $375, and the break even is with GOOS at $12.25. This trade partially filled at $0.25 (8 contracts so far). This trade completely filled at $0.25.

Bullish Trade #3

The stock is Coursera (COUR 0.00%↑), and the trade is a vertical spread expiring on February 16th, buying the $20 strike calls and selling the $22.50 strike calls for a net debit of $0.75. The max gain on 4 contracts is $700, the max loss is $300, and the break even is with COUR at $20.75. This trade filled at $0.75.

Exiting These Trades

I’m going to set GTC orders to exit at 90% to 95% of the spreads and lower the prices if necessary as we approach expiration.

Exited the GOOS trade at a net credit of $0.30, for a gain of 20%.

You could have made more money on both of these trades than I did, if you watched them and were more patient than me. I put in limit orders on these a couple of hours ago and then had to get some dental work done while the stocks went up.

Exited the BOOT trade at a net credit of $3.59 today, for a gain of 44%.