Trade Alert: Earnings, 2/21/2024

Two bullish bets and two bearish bets on companies releasing earnings on Thursday and Friday.

Note: I showed an example of our composite score in action in this post yesterday, in case you missed it:

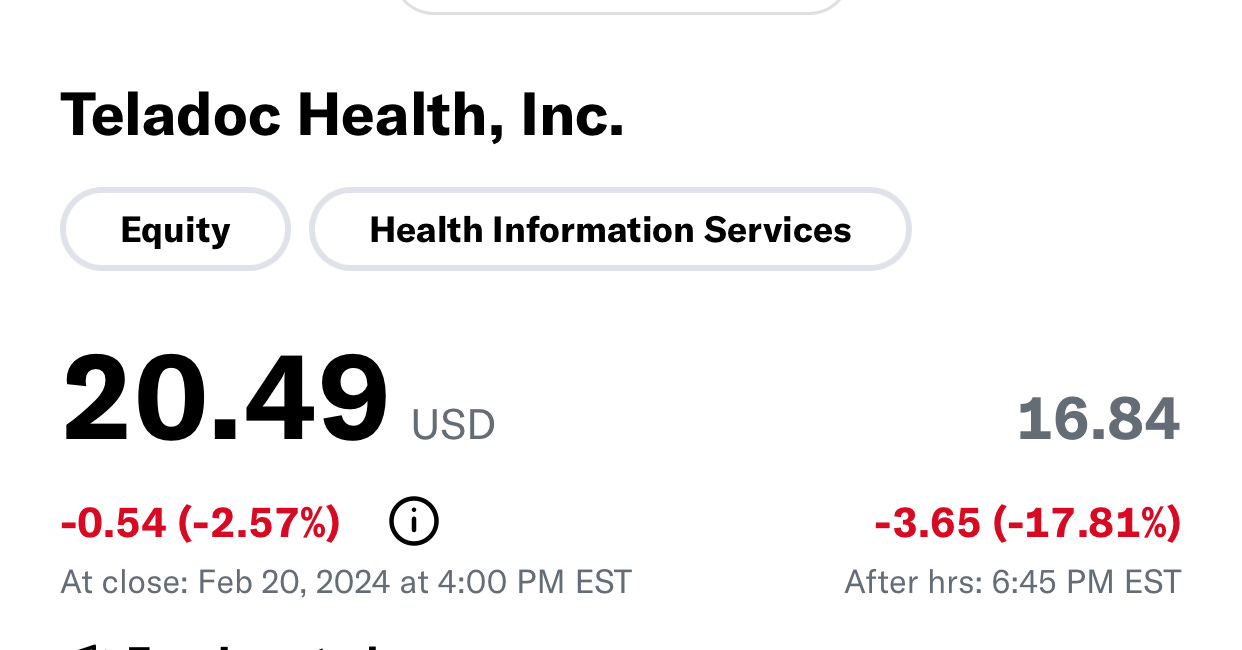

Teledoc Health

Our Composite Score In Action In a post over the weekend, I wrote about our composite score and the ten metrics that go into it. In a nutshell, we look at these ten metrics: LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Our Current Approach

Recall that we’re using these ten factors when evaluating earnings trades,

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

Zacks Ranking. This goes from 1 to 5, with #1 ranked stocks being their most bullish ones. They grade on a bell curve, so most stocks we see end up with their #3 (neutral) ranking.

The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

Recent insider transactions.

RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. RSI levels above 70 suggest a stock is overbought and and RSI levels below 30 suggest it’s over sold.

Short Interest.

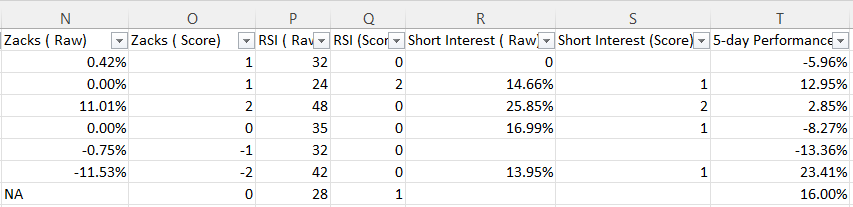

And we’re keeping track of each metric on a range from very bearish to very bullish, and tracking them and their performance in a spreadsheet, a snippet of which is below.

And we’re using their relative outperformance or underperformance versus all of the stocks that we’ve analyzed to adjust our weightings of each metric to determine which stocks we should be bullish or bearish on ahead of earnings.

The Stocks We’re Bullish On

The number in parentheses represents our composite score for a stock, based on all the metrics: higher = more bullish, and lower (more negative) = more bearish.

Bullish Stock #1 (3.4)

Social data: +26

PA Options sentiment: Neutral.

Setup rating: 8

Valuation rating: 0

F-Score: 2

Recent insider transaction(s): Net open market purchases.

Zacks ESP: NA

Zacks Ranking: NA

RSI: 45

Short Interest: 8.79%

Bullish Stock #2 (5.4)

Social data: -62

PA Options sentiment: Very Bullish.

Setup rating: 3

Valuation rating: 1

F-Score: 5

Recent insider transaction(s): A couple of small net open market sales in September and December.

Zacks ESP: -18.37%

Zacks Ranking: 3

RSI: 57

Short Interest: 32.98%

The Stock We’re Bearish On

The number in parentheses represents our composite score for a stock, based on all the metrics: higher = more bullish, and lower (more negative) = more bearish.

Bearish Stock #1 (-1.4)

Social data: +35

PA Options sentiment: Neutral.

Setup rating: 9

Valuation rating: 8

F-Score: 8

Recent insider transaction(s): No net open market transactions in the last 12 months.

Zacks ESP: 1.72%

Zacks Ranking: 4

RSI: 53

Short Interest: 10.43%

Details below.

Bullish Trade #1

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.