Trade Alert: Earnings, 2/6/2024

A bullish bet on a tech company reporting earnings after the close today.

Note: This one has been volatile in the past, dropping ~20% on earnings misses in the past. But we’ve got a few strong signals aligned on it now, as reflected in our composite score. I’m taking a flyer on it, and I invite you to join me.

Our Current Approach

Recall that we’re using these ten factors when evaluating earnings trades,

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

Zacks Ranking. This goes from 1 to 5, with #1 ranked stocks being their most bullish ones. They grade on a bell curve, so most stocks we see end up with their #3 (neutral) ranking.

The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

Recent insider transactions.

RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. We’re looking for RSI levels below 70 for bullish trades and above 30 for bearish ones.

Short Interest.

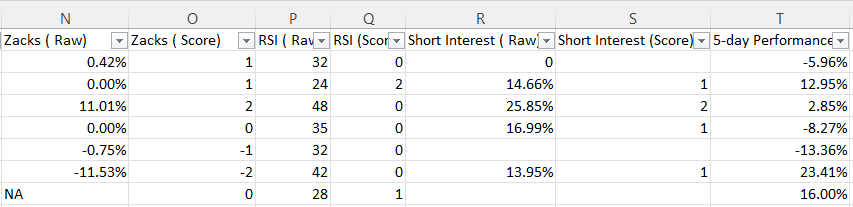

And we’re keeping track of each metric on a range from very bearish to very bullish, and tracking them and their performance in a spreadsheet, a snippet of which is below.

And we’re using their relative outperformance or underperformance versus all of the stocks that we’ve analyzed to adjust our weightings of each metric to determine which stocks we should be bullish or bearish on ahead of earnings.

The Stock We’re Bullish On

The number in parentheses represents our composite score for a stock, based on all the metrics: higher = more bullish, and lower (more negative) = more bearish.

Bullish Stock #1 (4.7)

Social data: +22

PA Options sentiment: Very Bullish.

Setup rating: 7

Valuation rating: 2

F-Score: 4

Recent insider transaction(s): Net open market sales, peaking last June.

Zacks ESP: 23.08%

Zacks Ranking: 3

RSI: 52

Short Interest: 9.12%

In addition to the signals above, the Estimize consensus is for an earnings beat as well. We’re aiming for a >100% gain on this one.

Details below.

Bullish Trade #1

The stock is Snap (SNAP 0.00%↑) and our trade is a vertical spread expiring on February 9th, buying the $17 strike calls and selling the $17.50 strike calls for a net debit of $0.22. The max gain on 18 contracts is $560, the max loss is $440, and the break even is with SNAP at $17.22. This trade hasn’t filled yet. This trade filled at $0.22.

Exiting This Trade

I’m going to set a GTC order to exit at about 90% to 95% of the spread and lower the price if necessary as we approach expiration.

SNAP managed to shit the bed again, despite the strong signals suggesting it wouldn't. Down 33% after hours.