This woman is involved with the first company we’re betting on this week.

A Note About The Debt Ceiling

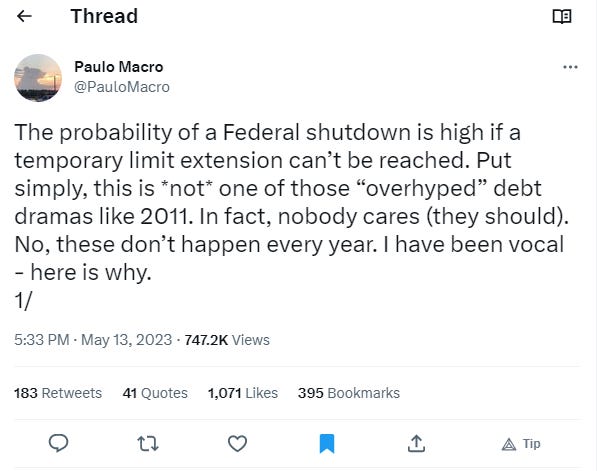

Before we get to today’s earnings trades, a quick note about the debt ceiling situation. If Substack hadn’t decided to take on Twitter, leading to Twitter cutting Substack off from its API, I would have embedded the Twitter thread below for you, but you can read it here. I’ll give you the gist though.

The gist is that there’s reason to be concerned this time, mainly because of the complacency this time, and game theory implications.

What To Do About It

We’ll be out of this week’s earnings trades before the “X date” for the debt ceiling, so we don’t have to do anything different with them. Our longer-dated bearish trades, such as our recent bets against regional banks should benefit from any market chaos. For your long equity positions, you could consider hedging. As a reminder, the Portfolio Armor website and iPhone app can help you with that.

Earnings Trades

One thing I’m doing differently this week is placing earnings trades no earlier than the day before earnings (if it’s before market open) or the day of earnings (if it’s after market close). That way, we’ll be able to take into account the price action immediately before earnings when structuring our trades. We’ve got one trade for today, on a company reporting before the open Tuesday.

Details below.

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.