Trade Alert: Earnings, 5/30/2023

A high risk, high potential reward trade for a company reporting after the close.

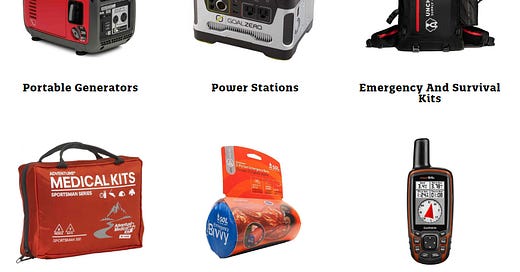

Some of the products this company sells.

Taking A Flyer On This One

Here’s another earnings trade based on social data, but in this case, social data is pretty much alone in its bullishness. The stock is trading near a 52-week low, and Chartmill gives it an overall technical rating of 0 and an overall fundamental rating of 3 (on a scale of 0-10 where 0 is the worst). Interestingly, Chartmill calculates a Piotroski F-Score of 6 for the stock, where scores between 0-2 indicate financial distress and ones between 7-9 indicate financial strength.

Last week, we had one particular miss with social data (Abercrombie & Fitch (ANF 0.00%↑)) where Zacks Research had an Earnings Surprise Prediction that went the other way, so I checked this stock with Zacks and Zacks has no Earnings Surprise Prediction either way. Estimize’s consensus estimate is above Wall Street’s consensus for earnings and revenue, which is consistent with social data.

Basically, what we’re aiming for here is a smaller loss than expected that will led to a bump in the price of a beaten-down stock, which ideally we can leverage via options to generate a solid return.

Details below.

The company is Sportsman’s Warehouse ( SPWH 0.00%↑) and this is the trade: buying the $5 strike calls expiring on June 16th for $0.60. The max gain on 5 contracts is unlimited, the max loss is $300, and the break even is with SPWH at $5.60. Note: this trade hasn’t filled yet, but I’m posting this now to give you time to place it yourself, if you like. Update: Filled at $0.60.

Exiting This Trade

Assuming this trade fills, I’ll see how this stock reacts after hours to determine where I’ll be placing my limit order to exit this trade. I’ll update this post accordingly when I do. If that order doesn’t as we get close to expiration, I’ll lower the limit price as necessary.

Update:

SPWH beat fractionally on revenue but posted a 2 cents larger than expected loss per share. The stock is down about 5% after hours as I type this. Based on that, I’m going to place a good ‘till canceled limit order to exit these calls at about $0.70 per share and see if the stock recovers enough for us to exit with a small gain. If that doesn’t work by the end of the week, I’ll probably lower my limit price next week. I’ll note what I do in the comments to this post either way.

Below is a message from our sponsor, SpreadHunter.

For traders getting started with options and option spreads, SpreadHunter offers a comprehensive and reassuring environment – where asking questions is a plus. Run by ex-CBOE professionals with close to 50 years trading experience (each), we will train you how and why to enter and manage complex options strategies, and how to deal with today's changing and often unpredictable market environment.

To set up a one-on-one live demonstration during market hours, contact David A. Janello, PhD, CFA at david.janello@spreadhunter.com.

For more information:

https://spreadhunter.com

Interested in opening a TradingBlock brokerage account? Click here:

https://www.tradingblock.com/affiliates/public/spreadhunter.aspx

We have totally missed the boat on a put spread on target, though its going to get worse with the VP of marketing works for the grooming company they pay $2M a year. https://www.zerohedge.com/political/groom-and-doom-target-shares-mark-longest-losing-streak-almost-5-years

Same with North face, you got anything coming up?

Greetings! With the midpoint @ $0.65, I placed a limit order @ $0.60, correct?