Trade Alert: Earnings, 8/23/2023

Betting against a packaged foods company; plus, two post-earnings trades on a plummeting stock.

Who wants fake milk and meat?

Our Newfound Selectivity

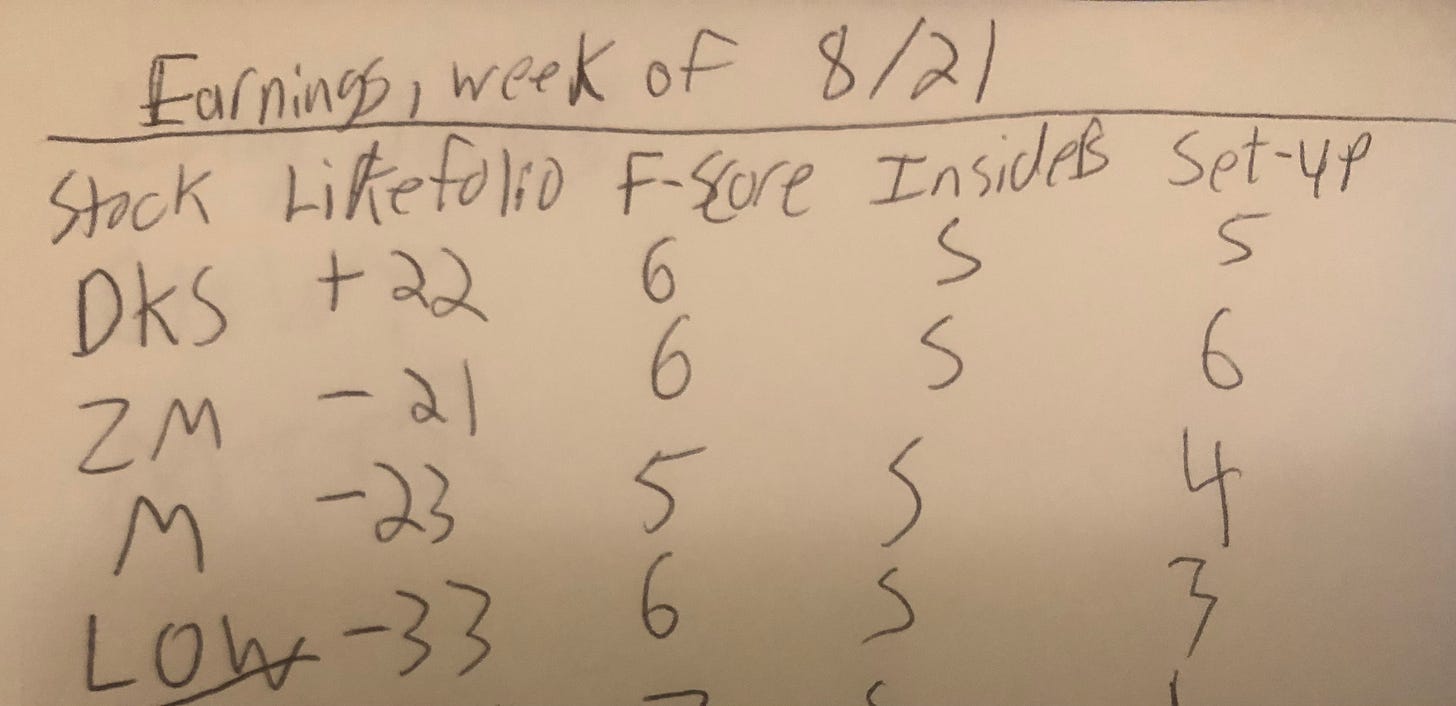

Starting last week, we’ve been more selective about placing earnings trades. This week, for example, we skipped the first four.

Overall, that turned out to be the right move: only one of those four, the bearish bet against Macy’s (M 0.00%↑), would have been a clear winner. Dick’s (DKS 0.00%↑) tanked, despite bullish social data; Zoom (ZM 0.00%↑) fell but recouped most of its losses; and so far Lowe’s (LOW 0.00%↑) has been positive despite bearish social data.

That’s also why we’ve been looking at five other metrics in addition to social data when placing earnings trades:

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 1-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

Recent insider transactions.

And, an additional change we made is to use longer dated options, covering more than one earnings release, where possible, to give the trade more time to play out. Here’s how the company we’re betting on today scores on the six metrics above:

Social data: -33

PA Options sentiment: very bearish

Setup rating: 7

Zacks ESP: 0% (neutral)

F-Score: 5

Recent insider transaction(s): open market sale in February.

A Post-Earnings Trade

One company social data was bullish on this week which we avoided betting on was Peloton (PTON 0.00%↑). Here’s how that stock looked on our six metrics prior to its earnings miss:

Social data: +38

PA Options sentiment: very bearish

Setup rating: 3

Zacks ESP: 0% (neutral)

F-Score: 2

Recent insider transaction(s): open market sales this month.

I have a post-earnings trade on PTON to go along with our pre-earnings trade on the company above.

Details below.

Our Bearish Trade

The company is Hain Celestial Group (HAIN 0.00%↑) and our trade is a vertical spread expiring on November 17th buying the $12 strike puts and selling the $11 strike puts for a net debit of $0.35. The max gain on 10 contracts is $650, the max loss is $350, and the break even is with HAIN at $11.65. This trade hasn’t filled yet. I may raise the limit as high as $0.40 if it doesn’t fill here. This trade never filled.

Exiting This Trade

I’m going to open a GTC order to exit this spread for a net credit of $0.80 or $0.85, and I’ll lower the price as necessary if the trade is still open as we get closer to expiration.

Our Peloton Trades

A vertical spread expiring on December 15th selling the $5 strike puts and buying the $3 strike puts for a net credit of $0.70. The max gain on 5 contracts is $350, the max loss is $650, and the break even is with PTON at $4.30. Basically, this is a bet that the bearishness on PTON is overdone. It still has millions of loyal customers (including me) paying $40-something per month, and at some point, I figure management can lower the burn rate. The best case scenario for us on this one is that PTON is trading over $5 per share on December 15th, the options expire worthless, and we keep that $350 credit.

This trade hasn’t filled yet. This trade filled at $0.88 on 8/23.Another vertical spread expiring December 15th buying the $6 strike calls and selling the $7 strike calls for a net debit of

$0.26. The max gain on 10 contracts is $740, the max loss is $260, and the break even is with PTON at $6.26. $0.29. The max gain on 10 contracts is $720, the max loss is $280, and the break even is with PTON at $6.28.This trade hasn’t filled yet. This trade filled at $0.28 on 9/8.

Exiting The Second Peloton Trade

If it fills, I’ll place a GTC limit order to exit it at a net credit of $0.85 or $0.90.

Exited the PTON debit spread at $0.16 yesterday for a loss of 43%. That was the result of an updated limit order I placed the night before, which proved unfortunate, because PTON ended up spiking 12% intraday on news that they hired a new chief marketing officer, and I could have made a profit exiting the spread yesterday had I not lowered my limit price the night before.

Just added another bet on PTON here.