Electic car company Lucid Motors is reporting after the close today.

Starting Our New Experiment

Recall that we’ve been looking at four metrics when placing these earnings trades:

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 1-10, this is a measure of technical consolidation. For bullish trades, I want a high setup rating; for bearish trades, a lower one.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

In a post yesterday, I mentioned a new approach I was going to try this week, using the Piotroski F-Score as an additional screen.

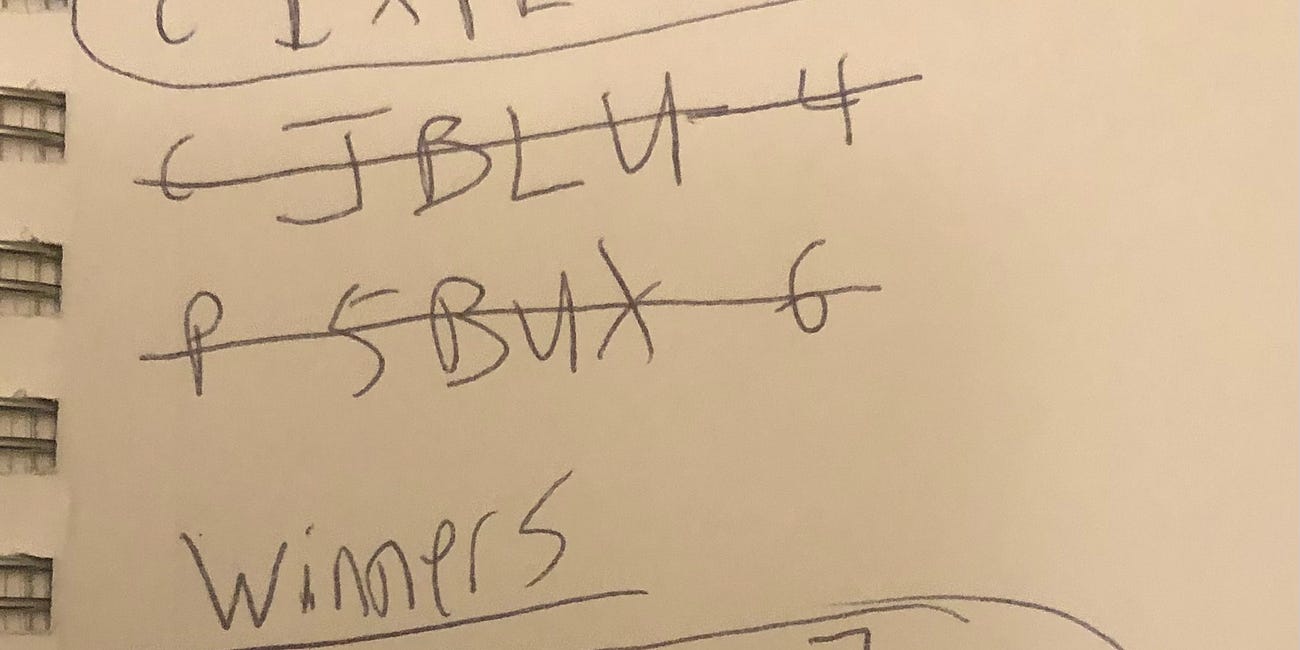

I didn’t see any names reporting after the close on Monday or before the market open on Tuesday with F-Scores of 2 or less, so I used F-Scores of 3 as the cutoff for bearish trades, and 7 for the cut off for bullish trades. That gave us four trades, two bullish:

Social +74, F-Score 7, PA Options Sentiment Neutral, Setup 8, Zacks ESP 1.63%.

Social +25, F-Score 7, PA Options Sentiment Bullish, Setup 8, Zacks ESP 20.89%

And two bearish:

Social -49, F-Score 3, PA Options Sentiment Bearish, Setup 3, Zacks ESP NA

Social -22, F-Score 3, PA Opions Sentiment Neutral, Setup 4, Zacks ESP 0% (neutral)

Details below.

The Bullish Trades

BellRing Brands (BRBR 0.00%↑). $37.50 calls expiring on August 11th for a limit price of $0.75. The max loss on 4 contracts is $300, and the break even is with BRBR at $38.25.

Chegg (CHGG 0.00%↑). A vertical spread expiring on August 18th buying the $10 strike calls and selling the $11 strike calls for a net debit of $0.44. The max gain on 7 contracts is $392, the max loss is $308, and the break even is with CHGG trading at $10.44.

This trade hasn’t filled yet. This trade filled at $0.44 on 8/7.

The Bearish Trades

Eastman Kodak (KODK 0.00%↑).

A vertical spread expiring on August 18th buying the $5 strike puts and selling the $2.50 strike puts for a net debit of $0.16. The max gain here requires a ~50% drop in the stock, which I don’t see happening, so it’s not worth mentioning; the max loss on 20 contracts is $320, and the break even is with KODK at $4.84.This trade hasn’t filled yet. Switched to just buying the $5 strike puts expiring on August 18th for $0.20. The max loss on 15 contracts is $300, and the break even is with KODK trading at $4.80.Lucid Group (LCID 0.00%↑). A vertical spread expiring on August 11th buying the $7 strike puts and selling the $5.50 puts for a net debit of $0.61. The max gain on 5 contracts is $445, the max loss is $305, and the break even is with LCID at $6.39.

Exiting These Trades

For KODK, since the spread is so wide, I’m going to set a GTC limit order to exit this trade at $0.55 or $0.60; for the other three trades, I’ll set the limit orders to exit at 90% of their respective spreads. So, for example with LCID, since the spread is $1.50 ($7 - $5.50), I’ll try to exit at $1.35. If those exit orders don’t fill after the companies release their earnings, I’ll lower my exit prices as necessary as we get closer to expiration.

Exited the KODK put spread today at $0.16, for a loss of 20%.

Exited the CHGG call spread today at $0.48 for a gain of 8%.