One of the companies in today’s earnings trades sells aftermarket auto products.

Continuing Our Experiment

Recall that we’ve been looking at four metrics when placing these earnings trades:

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 1-10, this is a measure of technical consolidation. For bullish trades, I want a high setup rating; for bearish trades, a lower one.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

In a post over the weekend, I mentioned a new approach I was going to try this week, using the Piotroski F-Score as an additional screen.

Adding F-Scores to our screens today gave us one bullish name:

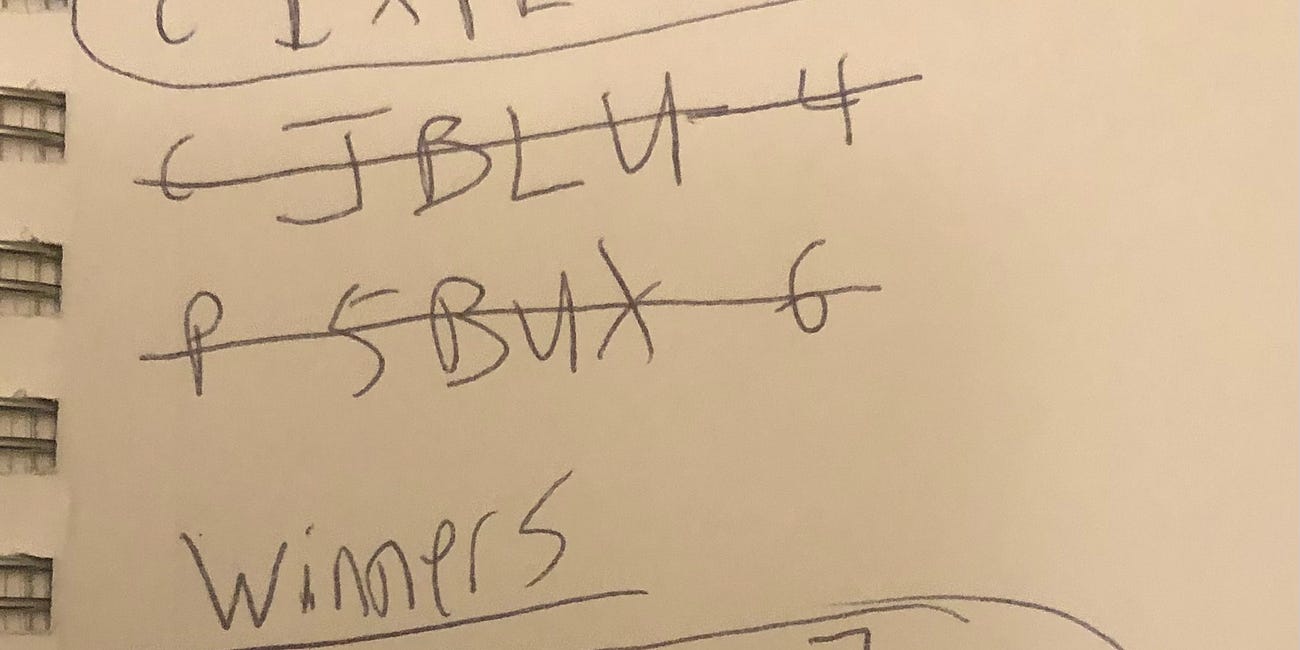

Social +65, F-Score 7, PA Options Sentiment Neutral, Setup 7, Zacks ESP 0%

And three bearish:

Social -31, F-Score 2, PA Options Sentiment Bearish, Setup 4, Zacks ESP 0%

Social -39, F-Score 3, PA Options Sentiment Bearish, Setup 5, Zacks ESP NA

Social -49, F-Score 3, PA Options Sentiment Bearish, Setup 5, Zacks ESP 0%

Details below.

The Bullish Trade

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.