Trade Alert: Fading The Rally In Meme Stocks

One of these we successfully bet against earlier this year.

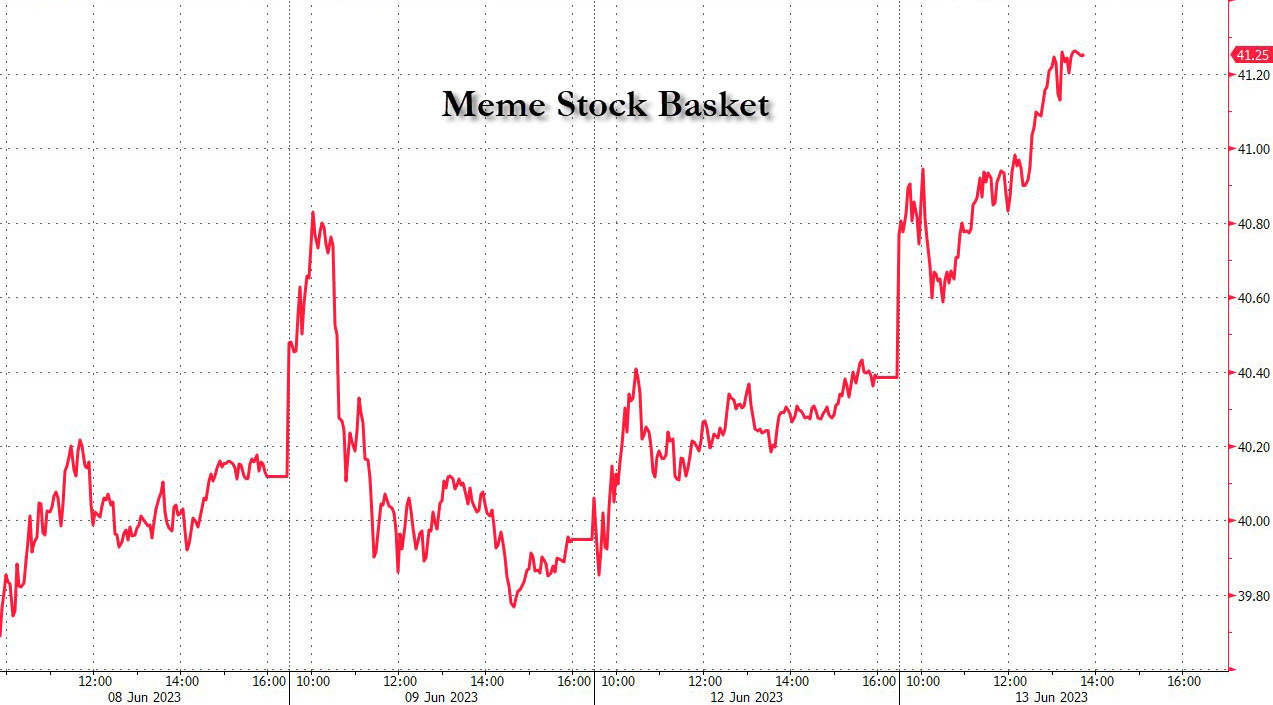

Mixed CPI Fails To Cool Meme Stock Rally

As ZeroHedge summarized it, today’s CPI report offered something for every narrative:

Something for every narrative in this morning's CPI:

Headline CPI tumbled (yay, Fed is done forever!);

Goods inflation rebounding (Fed can pause as Services prices slow);

Core CPI warmer than expected and still sticky high (Fed can't stop, but maybe a skip!);

SuperCore accelerating (Fed should keep hiking!).

Choose your own adventure.

The adventure two heavily-shorted meme stocks with weak fundamentals chose was to post double-digit gains today (both are up more than 30% over the past week). One of these is a stock we bet against earlier this year, by buying puts on after a similar rally. We were able to exit those puts for a 51% gain, but buying puts on it today was too expensive.

The kinds of vertical put spreads we’ve been doing recently on earnings trades were too expensive as well, but our friend David Janello at SpreadHunter suggested a more cost-effective strategy to bet against both names. For one stock, this kind of trade overs potential gains of over 100%; for the other, over 200%; in both cases, your downside risk is strictly defined at the outset.

Details below.

Normally, I send these trade alerts out during market hours, but we didn’t get these trades structured until a few minutes before the end of today’s session, and then it took me some time to write this up. If you enter limit orders on them tonight, there’s a good chance you’ll get them filled before the FOMC news tomorrow afternoon.

Carvana (CVNA 0.00%↑). This is the name we exited for a 51% gain earlier this year. The trade: a skip-strike butterfly (or “betterfly” as the Spreadhunter folks call it) expiring on August 18th consisting of three legs: buying the $22.50 strike puts, selling twice as many of the $17.50 strike puts, and then buying the $15 strike puts, for a net debit of $1.61. The max gain opening this with 2 contracts on the outside legs and 4 contracts on the middle leg is $678, the max loss is $322, and the break even is with CVNA trading at $20.89.

This trade hasn’t filled yet.This trade filled at a net debit of $1.61 on 6/14.Beyond Meat (BYND 0.00%↑). The trade: a skip-strike butterfly expiring on August 18th consisting of three legs: buying the $15 strike puts, selling twice as many of the $10 strike puts, and then buying the $7.50 strike puts for a net debit of $2.22. The max gain opening this with 2 contracts on the outside legs and 4 contracts on the middle leg is $556, the max loss is $444, and the break even is with BYND trading at $12.78. This trade filled at $2.22 just before the close today.

GameStop (GME 0.00%↑). This one plummeted ~18% last week after missing on earnings and revenue, and firing its CEO, and as of Tuesday’s close, had gained it all back and more. Nothing fundamental has changed, beyond Ryan Cohen upping his stake in the company. The trade: another skip-strike butterfly, this one expiring on September 15th, consisting of these three legs: buying the $27 strike puts, selling the $25 strike puts, and buying the $24 strike puts for a net debit of

$0.40. The max gain with 8 contracts on the top and bottom legs and 16 contracts on the middle one is $1,280, the max loss is $320, and the break even is with GME at $26.60.Note: I just placed this order after hours, and the midpoint on the spread with this one is $0.57, so I may have to adjust it tomorrow to get a fill. I’ll update this post accordingly if I do.for a net debit of $0.70. The max gain with 5 contracts on the top and bottom legs and 10 contracts in the middle is $650, the max loss is $350, and the break even is with GME trading at $26.30. This trade didn’t get filled. I’ll send a separate trade alert if I place another bet against GME.

Exiting These Trades

For each trade, I’m opening a Good ‘till Canceled limit order to close it at a net credit of about 90% of the spread (the difference between the strike prices of the last two legs). In the case of CVNA, the spread is $5 ($22.50 - $17.50), and 90% of $5 is $4.5, so that’s where I’ll be placing my limit order to exit it. If that order doesn’t get filled over the next few weeks, I’ll lower the limit price as necessary as we get closer to expiration.

Below is a message from our sponsor, SpreadHunter.

For traders getting started with options and option spreads, SpreadHunter offers a comprehensive and reassuring environment – where asking questions is a plus. Run by ex-CBOE professionals with close to 50 years trading experience (each), we will train you how and why to enter and manage complex options strategies, and how to deal with today's changing and often unpredictable market environment.

To set up a one-on-one live demonstration during market hours, contact David A. Janello, PhD, CFA at david.janello@spreadhunter.com.

For more information:

Interested in opening a TradingBlock brokerage account? Click here:

https://www.tradingblock.com/affiliates/public/spreadhunter.aspx

Any inverse ETF’s of meme stocks?

Out our BYND butterfly at a net credit of $2.36 for profit of 6%.