Here We Go Again

Warren Buffett's mentor Benjamin Graham famously described the stock market as a mentally ill man ("Mr. Market") who toggled between euphoria and despair. There's an additional twist today, with Wall Street leaning left. Investment professionals on our X Market Watchers list alternate between rage against Trump and contempt for him.

We saw that after hours yesterday (and continuing today), as markets ripped higher after hours on President Trump's comments. ZeroHedge led with the news that Trump said he wouldn't fire Fed Chairman Powell. But on our Market Watchers list, the focus was on tariffs. On Monday, they railed against Trump for wrecking the economy (as they saw it) with tariffs; on Tuesday, they mocked him for signaling some flexibility on them.

Tuesday's Contempt For Trump

Here's a small sample from our Market Watchers list:

"Trump capitulated" because he said the final tariffs on China are going to be somewhere below 145%? We'll see.

Maybe Trump's Critics Are Right

Let's concede the possibility that Trump is going to completely fold on tariffs. On the one hand, America's trade deficits have been one of Trump's two biggest political concerns since at least 1990 (his other concern: avoiding nuclear war).

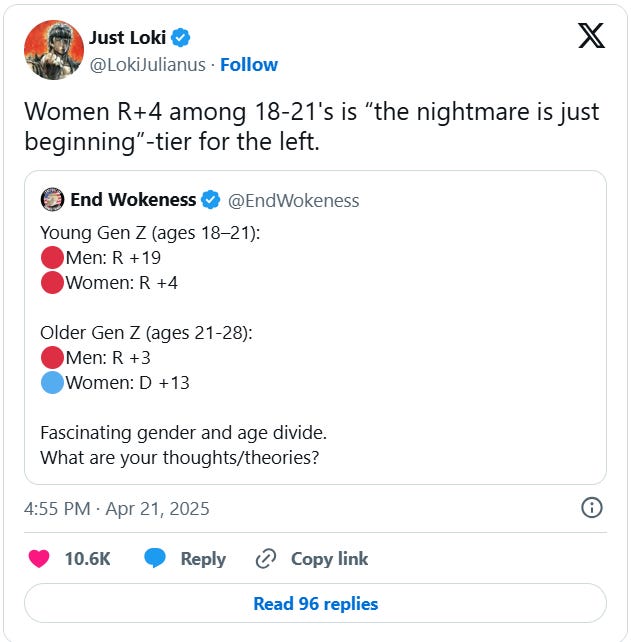

Also, Trump's strongest support today comes from groups that don't own a lot of stock, like young men (and very young women).

And, as we saw above, some Wall Streeters have contempt for him.

On the other hand...what? Trump is going to fold on his goal of reindustrializing America to please them? It's possible, but I wouldn't bet on that. Here's what we have been betting on.

How We're Playing The Market Roller Coaster

Our gameplan has basically been to buy the dips and fade the rallies. That's what we've done so far this week.

On Monday, when the market tanked, we took profits on a couple of our bearish big tech bets:

Options

Puts on Apple (AAPL 1.18%↑). Bought for $1.81 on 4//14/2025; sold for $2.71 on 4/21/2025. Profit: 50%.

Puts on Nvidia (NVDA -2.83%↓). Bought for $1.56 on 4/9/2025; sold for $4.02 on 4/21/2025. Profit: 158%.

And added a couple of bullish bets on Bitcoin-related names.

One of those bullish bets was on Semler Scientific, Inc. (SMLR), a profitable medical tech company that borrowed Michael Saylor's Bitcoin Balance Sheet strategy. SMLR closed up 11.57% on Tuesday.

On Tuesday, when the market rallied, we added bearish bets against two of the main vendors used by American small businesses that import from China.

And today, with the market up, we’re adding more short exposure. Specifically, we’re betting on another vendor to small businesses in the U.S. that import good from China. The de minimis exemption on imports from China goes into effect on May 2nd, so it should start impacting this company’s results in Q2. So our trade goes out to September, which is the first options expiration after the company will likely report those results in August.

Details below.

Today’s Bearish Trade

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.