Trade Alert: Profiting From First Republic's Fall

Our bets against the bank pay off as the stock plummets post earnings.

Betting Against Another Bank

In a trade alert last week, we discussed the bank crisis and how regional banks were under pressure due to deposit flight.

We identified First Republic Bank ( FRC 0.00%↑ ) as a bank with a high percentage of depositors above the $250k limit, and we placed bets against it by opening two put spreads, anticipating a drop in stock price after earnings.

Our Bets Pay Off

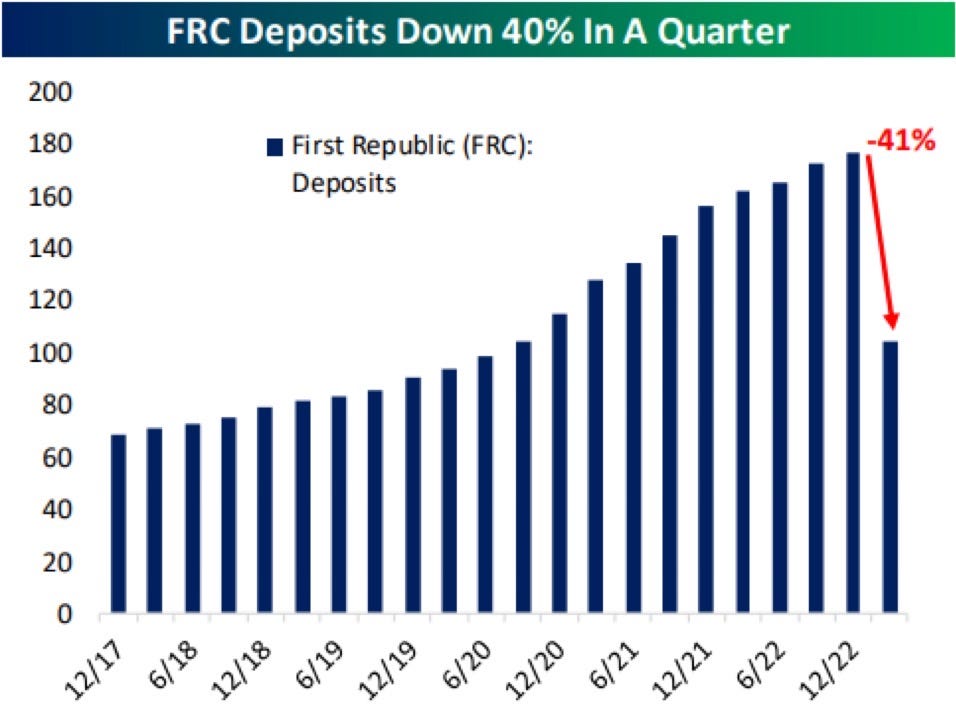

As it turns out, we were right. FRC announced during its earnings call after the close on Monday that its deposits had dropped by more than 40% in the first quarter. As expected, this news led to a sharp decline in FRC's share price (as I type this Tuesday afternoon, the stock is trading near $9, down more than 40% on the day.

Our first put spread, which involved buying the $14 strike puts and selling the $13 strike puts expiring on April 28th for a net debit of $0.55, will leave us with a net credit of $1 at expiration (assuming FRC shares stay below $13 by then), earning us an 82% gain. Our second put spread, which consisted of buying the $13.50 strike puts and selling the $13 strike puts expiring on April 28th for a net debit of $0.25, we leave us with a net credit of $0.50 at expiration, resulting in a 100% gain.

I have limit orders to exit both of those trades at their maximum gains now, one of which has been partially filled.

Our attention to the bank crisis, deposit flight, and FRC's potential vulnerability positioned us to profit from these trades. We'll continue to keep our eyes open for more opportunities like this.