Making More Money When We Get A Trade Right

The shares of Super Micro Computer (SMCI 0.00%↑) we bought yesterday are up about 30% today—imagine if those were call options instead?

I had thought about buying call options on Supermicro, but they were extremely expensive. Call options on today’s stock aren’t too expensive though.

This is a stock that has some crypto exposure, though that’s not its primary business. We placed an unsuccessful earnings trade on it over the summer, during Bitcoin’s pullback in July.

At the time, it was a beaten-down stock, with a Chartmill technical rating of 1 (on a scale from 0 to 1); now it has a technical rating of 10.

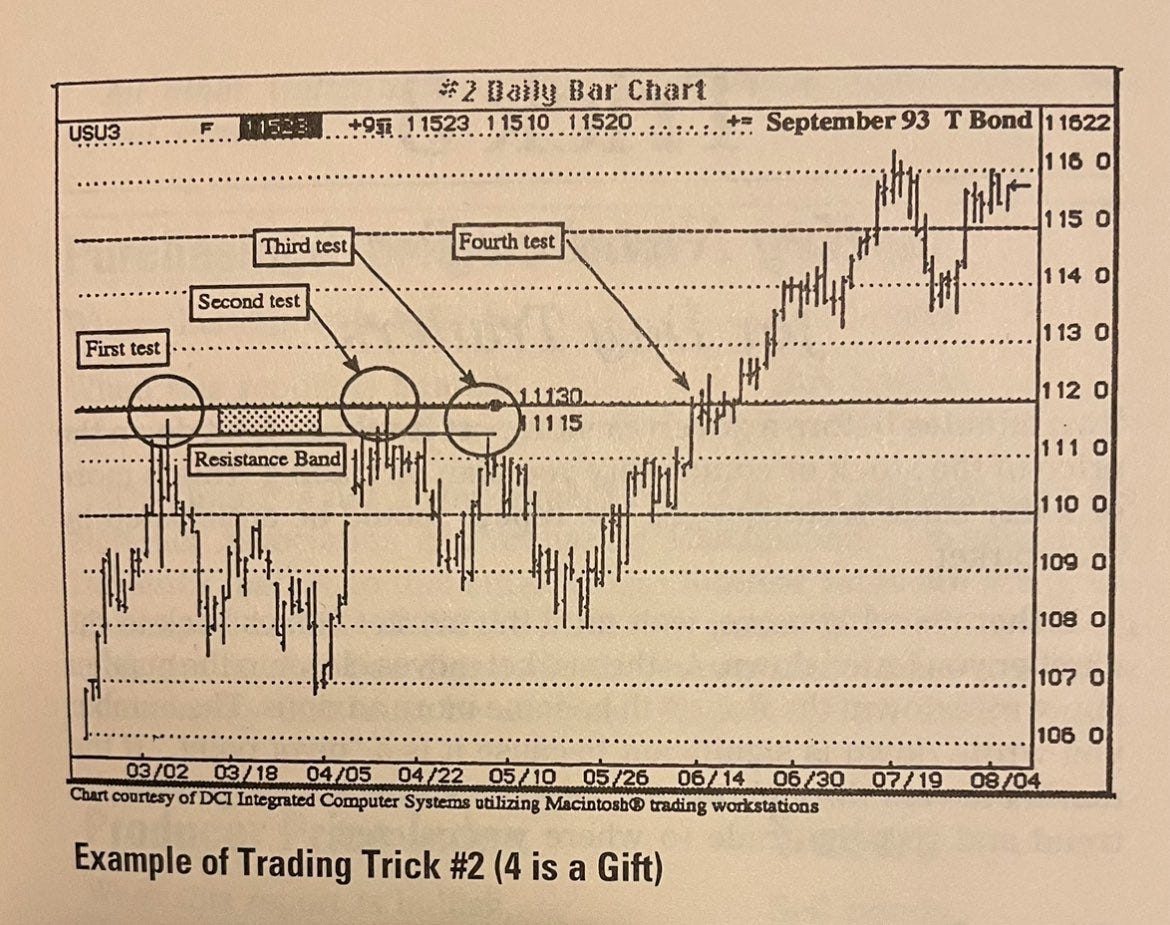

A veteran trader I follow on X has been bullish on for a few months, and is now more bullish on it based on the chart above, which he shared. That chart describes the movement of Treasury bonds in 1993, but the same technical phenomenon is at work here, a security testing its resistance level three times, before breaking through a fourth time. That trader expects this stock to run another 50 points from here, so we’re going to buy calls on it about 35 points out of the money. If he’s right, our gains could be 700% or more on these.

Of course, if he’s wrong, our losses could be 100%.

Details below.

Today’s Bullish Trade

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.