Why We’re Placing Bets On PA Top Names

So far, we have 6-month track records for 75 weekly top ten names cohorts since we started this Substack, and, on average, our top ten names have returned 18.54% over the next 6 months, versus 12.76% for the SPDR S&P 500 Trust (SPY 0.00%↑).

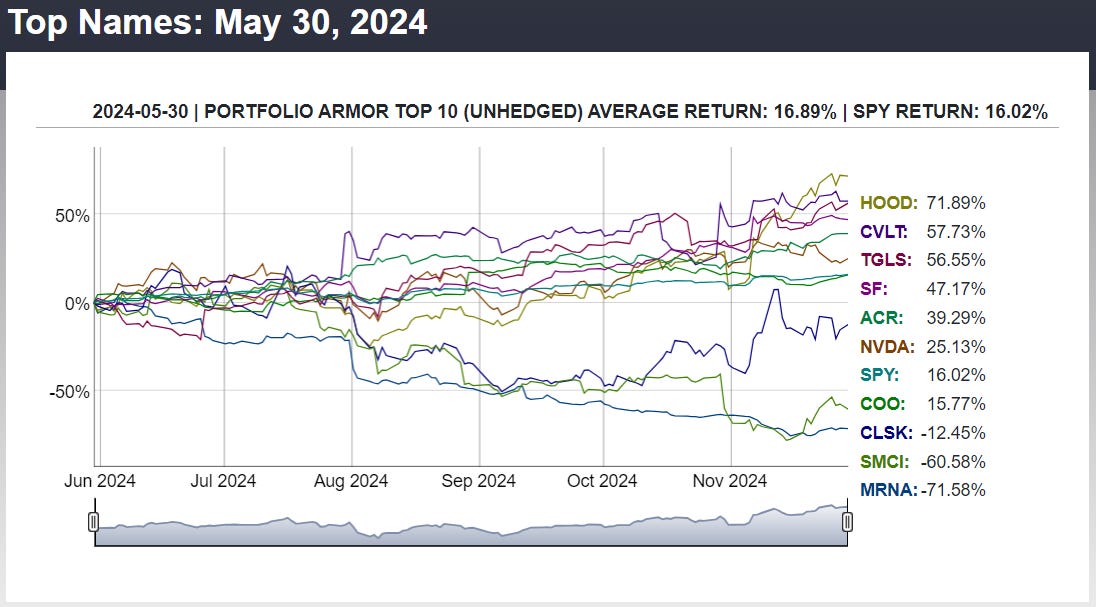

Our most recent top names cohort to finish its 6-month run, was this one, from May 30th. It only did fractionally better than SPY 0.00%↑, thanks to 2 names that were down more than 60%, SMCI 0.00%↑ and MRNA 0.00%↑. But if we placed the kinds of options bets we are placing now on any of the top five names below— HOOD 0.00%↑, CVLT 0.00%↑, TGLS 0.00%↑, SF 0.00%↑, or ACR 0.00%↑—we would likely have had gains of ~200% or more on all of them.

What Could Go Wrong

So, that’s what we’re aiming for here, with the understanding that some of our top names cohorts will be complete misses, or the market will go against them.

There will also be periods where the market rotates away from the sectors represented by our top names, but I don’t anticipate that happening over the next several months, as these are in sectors such as space and AI which appear to have a lot of runway ahead of them. If anything, a general correction seems more likely than that.

Hedging Against A Market Correction

We can of course use the Portfolio Armor iPhone app to hedge against a market correction. A simple way to do that would be to divide the dollar amount of your portfolio by the current price of a market-tracking ETF such as SPY 0.00%↑, and then scan for the optimal puts to hedge that number of shares of SPY 0.00%↑ against the largest drawdown that you are willing to risk. Then, you can buy those put options as a hedge against market risk.

You can download our hedging app by aiming your iPhone at the QR code below, or (if you are reading this on your phone) tapping on it.

Today’s Top Name Trades

Today’s top name trades are both bullish bets on stocks in the space industry. The max gains on these are about 300%.

Top Names Trade #1

The stock is Intuitive Machines (LUNR 0.00%↑), and our trade is a vertical spread expiring on June 20th, buying the $17 strike calls and selling the $18 strike calls, for a net debit of $0.25. The max gain on 12 contracts is $900, the max loss is $300, and the break even is with LUNR at $17.25. This trade filled at $0.20.

Top Names Trade #2

The stock is Rocket Lab (RKLB 0.00%↑), and our trade is a vertical spread expiring on April 17th, buying the $30 strike calls and selling the $31 strike calls, for a net debit of $0.25. The max gain on 14 contracts is $1,050, the max loss is $350, and the break even is with RKLB at $30.25. This trade filled at $0.23.

Exiting These Trades

I’m going to open GTC orders to exit the LUNR trade at about $0.95 and lower those prices, if necessary, as we approach expiration.