Trade Alert: Four Bearish Bets

Betting against an insurance company and a utility impacted by the Los Angeles fires.

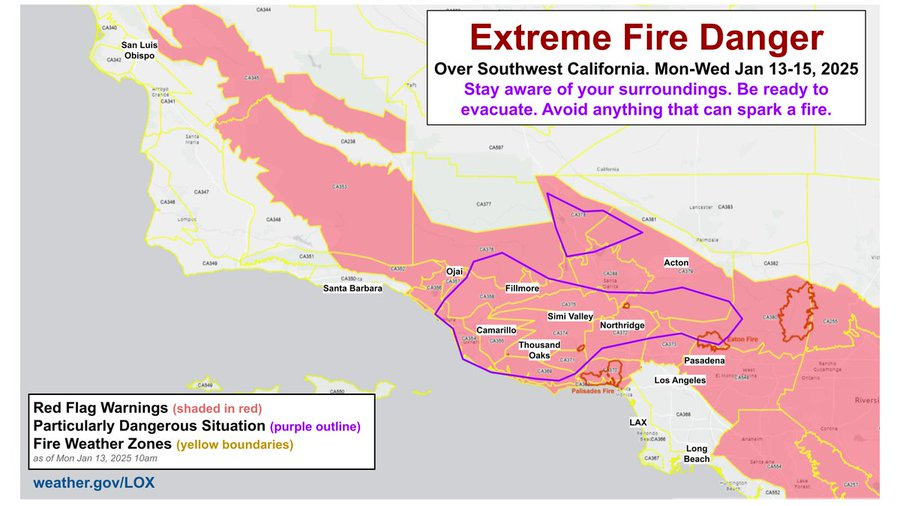

The Los Angeles Fires

The AP suggested recently that the Los Angeles fires could end up being the costliest natural disaster in American history. I’m not sure how “natural” the disaster is, given the vagrant arsonists who’ve been arrested, and the official incompetence which set the stage for it, but given the value of the real estate destroyed so far, the AP might be right.

And that’s not to mention the human cost (speaking of which, a business I’ve purchased from before, Passage Publishing, recommended this local charity, which I hadn’t heard of, if you’d like to donate to victims of the fires: The Dream Center.). Since our focus here is trading, let’s consider which publicly traded companies might incur a large share of the financial costs here.

A Utility And An Insurance Company

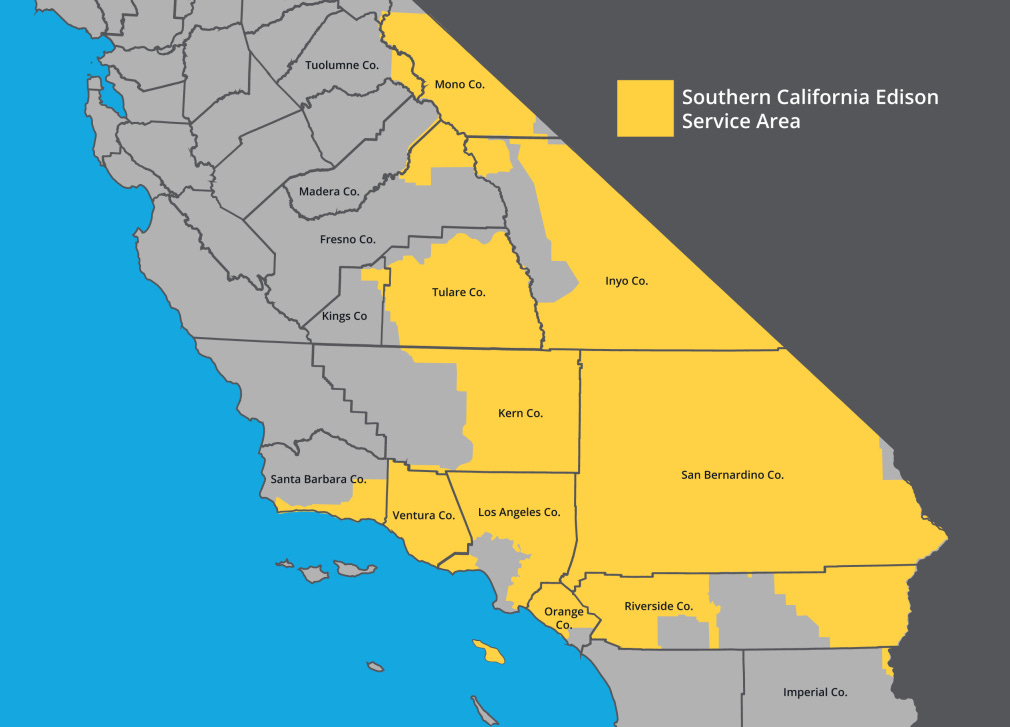

The first target here is the most obvious one, Edison International ( EIX 0.00%↑ ), the parent company of the local electric utility Southern California Edison. It was just sued by Los Angeles residents who say one of its utility poles started one of the fires.

The other company is an insurance company a member of my Market Watchers List highlighted as having the bulk of its insurance business in the area. Shares of both companies are down more than a quarter since the fires started, which raises another question.

Is It Too Late To Bet Against These Stocks?

Time will tell, of course, but I made a mistake last month not placing a bearish bet on another company when I missed its initial drop. The company was Quantum Computing (QUBT 0.00%↑), and my initial plan was to bet against it when it was at $23 or $24 per share. Then it dropped to the teens, and I didn’t short it there. On Monday it closed at $6.52. A different situation, of course, but a valid lesson there is you don’t need to capture the entire move to make money.

How Far Could These Stocks Fall?

With respect to Edison International specifically, I guess the closest analogue here is Hawaiian Electric Industries (HE 0.00%↑), which got similarly sued over its purported liability for the big fire in Maui in 2023. As of Monday’s close, HE traded at 0.89x its book value; EIX traded at about 1.8x book value. That suggests there could be considerable additional downside for EIX from here.

I don’t know of a similar analogue for the insurance company we’re betting against, as none of the insurance companies impacted by the Maui fire were as heavily exposed to Maui as this one is to the Los Angeles area, but our insurance company’s amount of reinsurance seems inadequate to the scope of the damages here.

Two of today’s three trades don’t require these stocks to fall that much to pay off: if they fall another 15% to 20% by late next month (after both each company reports earnings), we’ll hit our max gains, which would be 270% or more on each trade. If the stocks don’t fall further from here, we could lose a maximum of 100% on each trade.

Details below.

Bearish Bet #1

Keep reading with a 7-day free trial

Subscribe to The Portfolio Armor Substack to keep reading this post and get 7 days of free access to the full post archives.