Our Ten Signals For Evaluating Earnings Trades

We’ve been using these nine signals, or metrics, to evaluate potential earnings trades, but for one of them, Zacks Earnings ESP (Expected Surprise Prediction), I had been noting the stock’s Zacks ranking as well if it were other than 3 (neutral). I’ve now broken out Zacks rankings as a separate, tenth, signal.

LikeFolio’s earnings score based on social data. The higher the number, the more bullish, the lower (more negative) the number, the more bearish.

Portfolio Armor’s gauge of options market sentiment.

Chartmill’s Setup rating. On a scale of 0-10, this is a measure of technical consolidation. For bullish trades, we want a high setup rating; for bearish trades, a lower one.

Chartmill’s Valuation rating. On a scale of 0-10, this is a measure of fundamental valuation incorporating common rations like P/E, PEG, EBITDA/Enterprise Value, etc. For bullish trades, the higher the better the Valuation rating the better; for bearish trades, the reverse.

Zacks Earnings ESP (Expected Surprise Prediction). This is a ratio of the most accurate analyst’s earnings estimate versus the consensus estimate.

Zacks Ranking. A number from 1 to 5 with 1 representing their 5% most bullish stocks, 2 representing their next 20%, 3 the middle 50%, and so on.

The Piotroski F-Score. A measure of financial strength on a scale from 0-9, with 9 being best.

Recent insider transactions.

RSI (Relative Strength Index). A technical measure of whether a stock is overbought or oversold. We’re looking for RSI levels below 70 for bullish trades and above 30 for bearish ones.

Short Interest.

Quantifying Bullishness And Bearishness

The first step in figuring this out was to assign single digit, numerical scores to each of these metrics. For most of them:

Very Bullish = 2

Bullish =1

Neutral = 0

Bearish = -1

Very Bearish = -2

Social Data

For social data earnings scores, Likefolio considers +20 and higher to be bullish, and anything -20 or lower (more negative) to be bearish. For our purposes, I considered anything between +20 and +39 to be bullish (1), and anything from +40 to +59 to be very bullish (2). A rare score of 60 or higher I gave a 3 to.

Options Market Sentiment

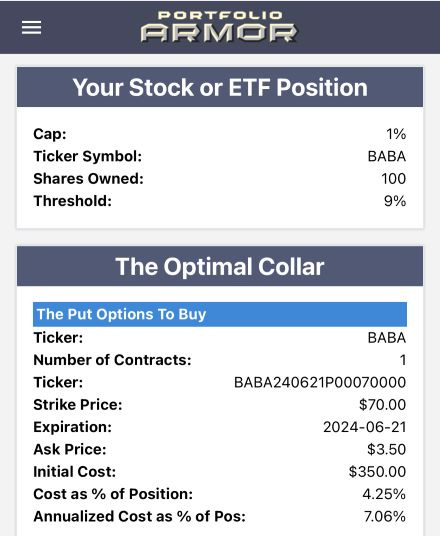

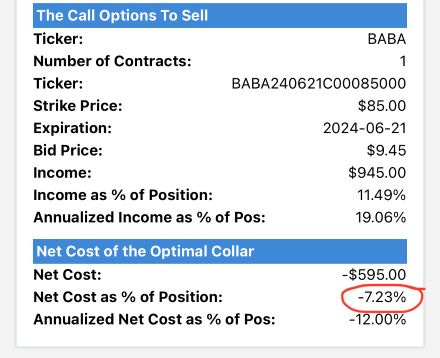

For options market sentiment, we’re looking at the cost of hedging a stock against a >9% decline over our default time to expiration (roughly six months) with an optimal collar capped at 1%.

Screen captures via Portfolio Armor.

We run a daily ranking of securities with positive price momentum sorted by the cost of hedging them as above; currently the hedging cost of the top ten names on that ranking goes from -7% to -5.8% of position value. Since BABA above has a hedging cost of -7.23%, we give it our highest bullish ranking for options sentiment, a 3. Stocks with hedging costs between -5.8% and -7% would get a 2; between -3% and -5.7% a 1; between 0% and -2.9% a 0 (neutral); between 0% and 8.9% a -1, and anything above 9% a -2, for very bearish.

Set-up and Valuation Ratings

These two Chartmill ratings are on a scale of 0-10. I give scores of 0-2 a -2 (very bearish), scores from 3-4 a -1, 5 a 0 (neutral), 6-7 a +1, and 8-10 a +2.

Piotroski F-Score

Scores from 0-2 get a -2, scores from 3-4 get a -1, 5 gets a 0, 6-7 gets a +1, and 8-9 gets a +2.

Zacks Earnings ESP

A single digit negative score, say -3.21%, gets a -1; a double digit negative score gets a -2, a 0% score gets a 0, and a single digit positive score gets a +1, and a double digit positive score gets a +2. Rare, extreme scores in either direction, get -3 or +3.

Zacks Ranking

For this one, the raw number (1 through 5) is the same number we use.

Recent Insider Transactions

Most of these get a 0, for neutral, as large companies in particular often have frequent insider selling, and if that’s part of regularly scheduled sales, it’s not clearly bearish. Notable net insider buying or selling shortly before earnings gets a +1 or a -1, respectively, with higher numbers for rare, extreme situations (like a stock where every open market insider transaction over the last year was a buy).

RSI

Anything between 30 and 70 gets a 0, for neutral. Between 29 and 25 (oversold) gets a 1, and under 25 gets a 2. I haven’t seen any over 70, but those would get a -1, and maybe a -2 if over 80 (over bought).

Short Interest

Short interest of less than 10% gets a 0, for neutral; between 10% and 19% gets a 1; between 20% and 29% a 2, and above 30% a 3.

Tracking Performance of All of These Metrics

For each stock I evaluate each week (not just the ones I place trades on), I enter the data above in a spreadsheet, and at the end of the week, I record each stock’s 5-day return.

Then I compare the average 5-day performance of all the stocks with the average 5-day performance of the ones that had social data scores of +2, +1, etc.

Preliminary Results

After two weeks, we have less than 100 stocks tracked so far, but these are the preliminary results.

Average 5-day stock return:

4.86%

Strongest bullish signals by average return:

Insider transactions +1: 16.3%.

Social data +2: 12.6%.

PA Options Sentiment +2: 10.6%.

Strongest bearish signals by average return:

Zacks #4 ranking: -11.2%

Short interest -3: -9.4%.

PA Options Sentiment -2: -6.1%.

Using This Data

The basic idea is to start with the average 5-day return as an expected return for a stock, and then adjust that up or down based on which bullish or bearish signals apply to the stock, but given that we’re dealing with relatively small sample sizes so far, I’d like to see at least two strong signals in the same direction to place a trade on a stock.

So far, for this week’s earnings trades, I haven’t seen that, but I have seen a potential opportunity in a stock that reported earnings last week. If that one looks like a trade, I’ll post an alert for it. And we’ll of course track the performance of the earnings trades we evaluated this week, and update our numbers at the end of the week to see which signals are the strongest.