Why subscribe?

Access To Free Posts

Subscribe to get full access to all free posts on our Substack.

Access To Our Top Names And Trades

Paid subscribers will get access to the same trades I place in real time, as well as Portfolio Armor’s current top ten names, which are the starting point for our core strategy.

Six months after we post our weekly top ten names on this Substack, you can find a chart of their performance, like the one above, in the table here.

Follow Our Core Strategy

Our core strategy is to buy equal dollar amounts of our current top ten names, place trailing stops of 15% to 20% on them, and then replace them with new top names when we get stopped out. You can track the 6-month performance of our top ten names versus the SPDR S&P 500 Trust (SPY 0.00%↑) here, but if you follow our core strategy, your returns will likely be higher than those, because you will be selling your losers early, and letting your winners run. You can examples of that in this Exits post.

Full Transparency

Every week in which I have exited a trade, I post an Exits post like the one above, detailing my entry price, my exit price, my profit or loss, plus some commentary on what went right or wrong. Starting on July 5th, 2024, I have been posting my trade exits to this spreadsheet as well.

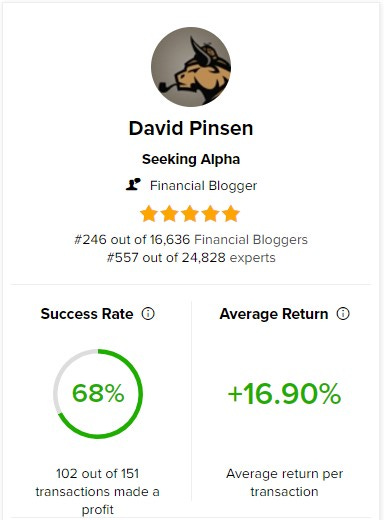

My Previous Track Record

Previous picks based on Portfolio Armor data during my time writing for Seeking Alpha did fairly well, on average.

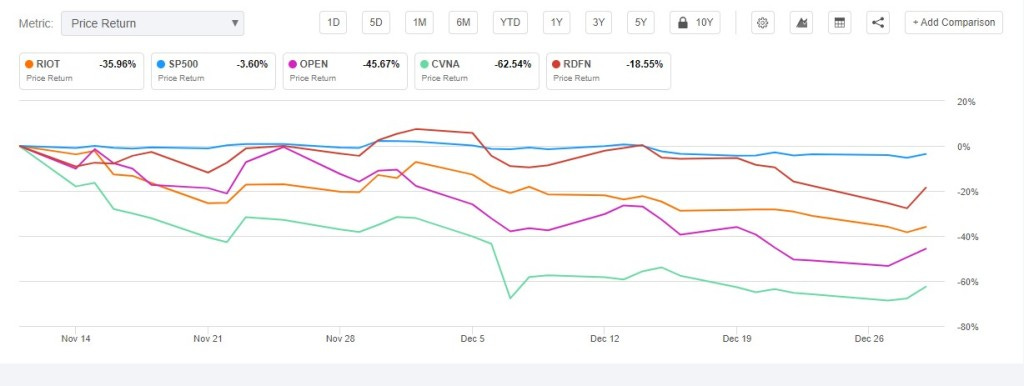

In 2022, I had some success on the short side as well, betting against names such as Redfin Corporation (RDFN), Riot Blockchain, Inc. (RIOT), Open Door Technologies, Inc. (OPEN), and Carvana Co. (CVNA).

I’ve also had some success with bets against AMC Entertainment Holdings, Inc. (AMC), Digital World Acquisition Corp. (DWAC), and Bed Bath & Beyond, Inc. (BBBY) in 2022.

Not Investment Advice

The content on this Substack won’t be investment advice—I’m not an investment advisor and I don’t know your personal situation. But you’ll see every trade I make, and you’ll be able to follow along as I make them. By using options instead of buying or shorting underlying securities in some cases, we may have opportunities for larger gains, while strictly limiting our downside risk.

Stay up-to-date

You won’t have to worry about missing anything. Every time I post about a new trade, it goes directly to your inbox.