Slyzyy/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week:

Stocks or Exchange Traded Products

None.

Options Trades

None.

Comments

Another week with no exits. On the options trading side, that means that none of our open trades came within 90% of their spreads (or, in the case of long put positions, 90% of the intrinsic value we’re targeting), and none were expiring this weekend. On the stock side, as I’ve mentioned before, every week without an exit is good news, because it means we didn’t get stopped out of any positions.

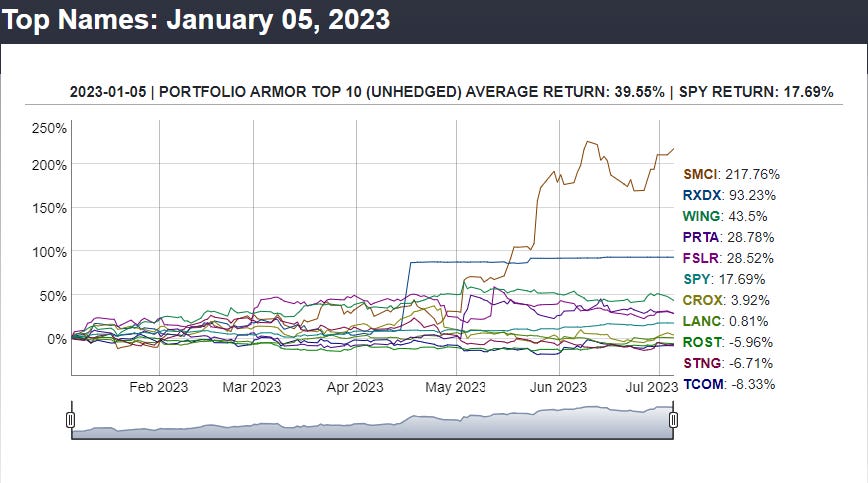

Top Names Performance

And that’s because the performance of our top names so far this year has been pretty good. For those who missed our top names post last night, on average, our top ten names from January 5th were up 39.55% over the next six months, versus up 17.69% for the SPDR S&P 500 Trust ETF (SPY -0.20%↓).

If you’re wondering why one of the lines on the chart above looks oddly straight, that’s Prometheus Biosciences (RXDX), which was acquired by Merck (MRK -2.56%↓) in April, and traded close to that acquisition price for the next few months.

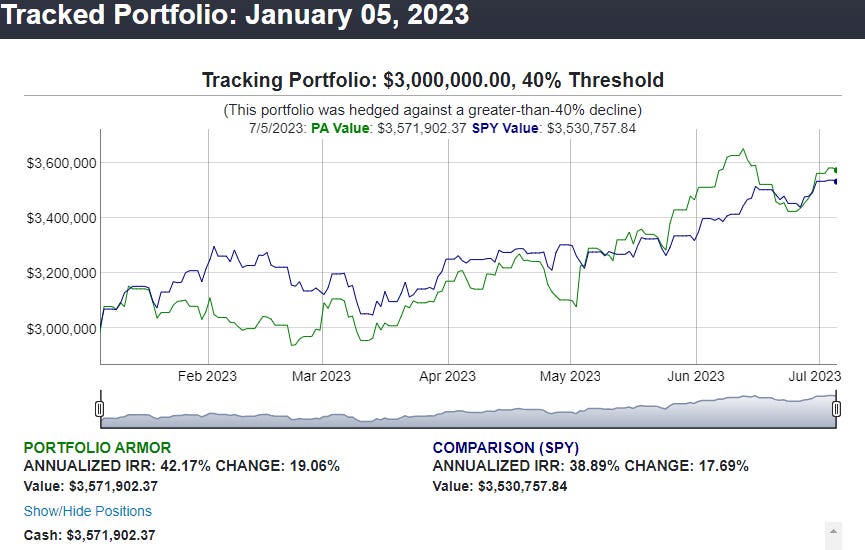

Hedged Portfolio Performance

On the Portfolio Armor website, this was the best performing hedged portfolio from the January 5th cohort. Not as spectacular as last week’s best hedged portfolio, but not bad.

You can find an interactive version of that chart here.