The Starting Point: Our Top Names

Each day the market’s open, Portfolio Armor gauges stock and options market sentiment to rank securities by its estimate of their potential returns over the next six months. On June 24th of 2022, we added a new factor to our security selection process.

The new factor is based on historical data we’ve been tracking which shows that, all else equal, securities that underperformed over the last week and month relative to their historic averages, outperform ones that did well over the most recent week and month.

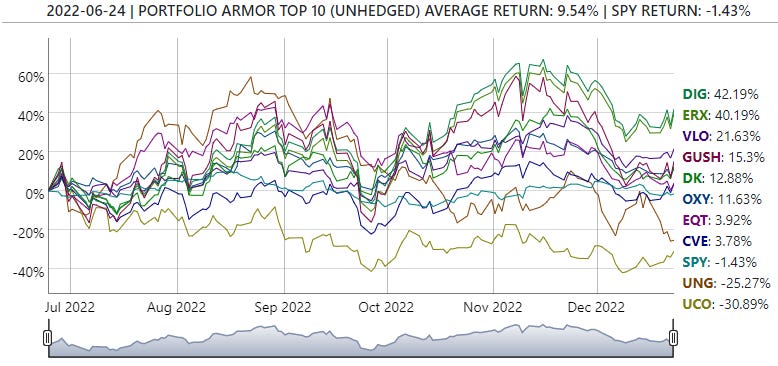

Here’s how that June 24th top names cohort performed versus the market-tracking SPDR S&P 500 Trust ETF (SPY):

On average, they were up 9.54%, while SPY was down 1.43% over the same period.

Six Months Is A Long Time In This Market

Although that six month performance was good, the interim performance of this top names cohort was a lot better. For example, here’s what it looked like at the end of August, 2022:

That inspired the strategy that’s going to make up the core of this Substack: Buying equal dollar amounts of Portfolio Armor’s current top names and holding them with a trailing stop, and then replacing each name with a new top name when we get stopped out. I’ll start with a 10% trailing stop, but may use a larger one if we have a leveraged ETF in our top names.

I’ll also place some short trades and hedging trades as opportunities present themselves. The point here won’t be to trade for trading’s sake, but to try to take advantage of what the market is offering.

This Substack And The Portfolio Armor Website

Subscribing to the Portfolio Armor website enables you to:

Scan for optimal put and optimal collar hedges on any security with options traded on it in the U.S.

See Portfolio Armor’s top ten names updated every trading day.

Construct hedged portfolios designed to maximize your expected return while strictly limiting your downside risk.

Get free access to this Substack (just contact me using the email you used to subscribe to Portfolio Armor).

This Substack will let you see trades I am making, and will also show you Portfolio Armor’s top ten names updated weekly. If you’re not a Portfolio Armor website subscriber, you can subscribe to this Substack separately.

last question for now, do I need to also subscribe to the app, in addition to the basic subscription here?

Appreciate the help, have not traded in years.

So when should I follow the top ten to start, do I wait for this Thursday or? Liquid and ready to start.

Thank you!