Tucker Talks Dollar Decline

The most-watched basic cable anchor in America opened his show last week with a 14-minute monologue about how American policy was destroying the value of the dollar, and the parade of horribles that could lead to. I’m going to talk about what I think he gets right and what he gets wrong in a moment, but first I think we should consider the significance of this kind of talk becoming mainstream. All else equal, I think it will put pressure on the Fed to keep rates higher for longer.

Below is Carlson’s monologue if you want to watch it first.

The Impact of U.S. Sanctions on Russia

As ZeroHedge notes here, Carlson cited Daily Caller article, in which the authors E.J. Antoni and Peter St. Onge wrote:

A second critical feature of a reserve currency is its apolitical nature. Which Biden is now gutting. After both parties in Washington destroyed the dollar’s stability with inflation, now the Biden administration has chosen to wield the dollar as a weapon. Together, the message to foreigners they should get out while they still can.

In response to Russia’s war with the Ukraine, the US froze the dollar reserves of Russia’s central bank. To be clear, these were not American assets, but were dollars owned by the Russian central bank and the Russian people. The seizure was intended to cause bank runs and collapse Russia’s credit system. It didn’t work.

Instead, it exposed the Biden administration’s willingness to violate the trillions of dollars foreigners rightfully own. The danger of this precedent is difficult to overstate.

This is true, for the most part, but freezing dollar assets itself isn’t unprecedented. For example, the U.S. froze Iran’s assets in 1979, after Iranians took the U.S. embassy staff in Teheran hostage.

What was unprecedented was trying to do it to an economy as large and important as Russia’s. This was a miscalculation on the part of America’s leadership, which underestimated the Russian economy’s size and importance, as I pointed out last year (Economic War Against A Real Economy; Sanctioning Ourselves):

Russia isn't an Iran or Libya. It's a continent-spanning country with a population of 145 million, and it is (or was) one of the world's top five exporters of oil, natural gas, nickel, wheat, coal, and other commodities.

But Carlson is right when he points out foreign countries have have more reason to fear having their dollar assets frozen now, after we did that to Russia:

So what if you have a border dispute with your neighbor that the State Department hadn't authorized? Or, what if you accidentally criticized transgender theology, and irritated the human rights campaign? Well, the US government might denounce you as immoral and then confiscate all your money. Because they just did that with Russia.

I made a similar point here last year:

Ultimately, our sanctions may lead to diminishing American power, and a weaker dollar, as non-Western countries diversify away from the dollar to avoid having their reserves frozen by us in a future conflict. This helps explain why the Saudis and others declined Biden's calls recently. What if a future American administration (or possibly the current one) decides the Saudis are worth of the same level of sanctions as Russia, due to the conduct of their war in Yemen?

(Fortunately, the war in Yemen appears to be coming to an end, thanks to China’s diplomacy. It’s remarkable that China is negotiating peace treaties while the U.S. has been doing the opposite in Ukraine and Taiwan.)

Is The Dollar Losing Its Reserve Status?

Tucker Carlson says so:

We should prepare to lose our position as holder of the world's reserve currency. That is happening in slow motion. It's unmistakable.

I think he overstates the case there. As Cullen Roche says below, we’re losing some currency dominance, but no other currency is in position to take the dollar’s place.

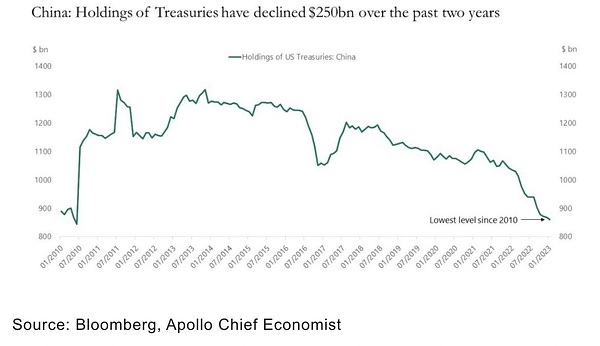

Nonwestern countries are moving to transact more trade in local currencies, including the yuan, but I suspect their goal is to avoid the threat of U.S. sanctions while engaging in mostly balanced trade with each other, not to stockpile yuan assets.

One reason no other currency is close to taking the dollar's place is that the most likely competitor, the yuan, can be arbitrarily devalued by China whenever it wants to make its exports more competitive.

In other words, China doesn’t want its currency to be the global reserve currency. That should be food for thought in the U.S.

War → Debt → Hyperinflation → Nazis?

That’s essentially how Tucker laid it out in his monologue:

Of course, you know, the famous pictures from Germany in the early twenties, banknotes in wheelbarrows. Want to buy a cup of coffee? That will be thirty pounds of currency. Kids playing with worthless stacks of deutschmarks. That was called Weimar, the Weimar Republic and that government collapsed because of hyperinflation and then economic collapse led to communist revolutions across Germany and ultimately to fill in the blank the Nazi regime. That's well known.

In fact, it's a cliche at this point, but here's the thing that nobody seems to remember What brought on the economic collapse that set the world on fire. Does anyone remember that? Why did the German government blow up its own currency? Well, simple. The German government took on too much debt in order to pay for a pointless war. Yes, a pointless war did that and if that sounds familiar, it's because exactly what we have done repeatedly for decades. We did it in Vietnam. We did it in Iraq. We did it in Afghanistan and every time we got away with it, because uniquely, we held the world's reserve currency, but this time could be very, very different. War against Russia will be the last war we can afford to fight.

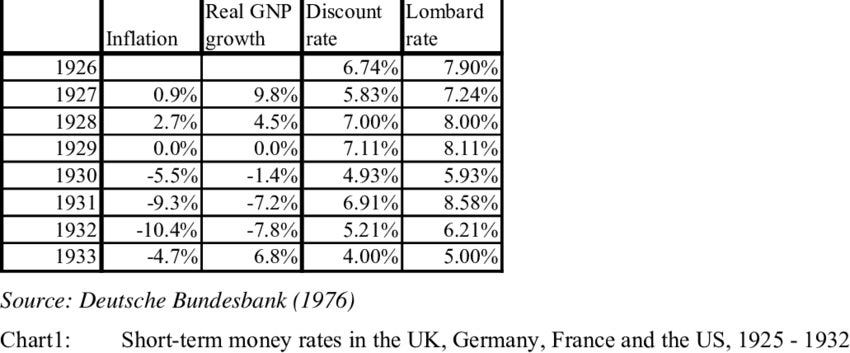

Tucker’s right that our proxy war with Russia has been destructive, and an actual war with Russia would be disastrous, but his German history is a bit muddled. For starters, communist revolutions in Germany happened in the immediate aftermath of World War I, before Weimar. And while war debt was a contributing factor, the proximate cause of the hyperinflation in Weimar was the French and Belgian occupation of Germany’s industrial heartland in the Ruhr valley (due to a dispute over Germany’s onerous war reparations), which, combined with German resistance to it, was a huge blow to the German economy.

But the hyperinflation was resolved by 1924, and by the time Hitler came to power in 1933, Germany was in its fourth year of deflation.

So, hyperinflation seems unlikely any time soon in the U.S., though we may be get stagflation if the Fed loses its nerve, but I suspect they won’t. I suspect they will keep rates higher for longer than the market currently expects, and that will keep pressure on regional banks, which is why I plan to open another bearish bet against them this week.

Weimar Germany Versus America Today

Some have noted similarities between the United States in recent years and Weimar Germany, such as transsexualism and political violence. But there are probably more differences than similarities. Mainly, the United States today is a lot more stable than Weimar Germany was. This may seem counterintuitive, if you think of the recent BLM and Antifa riots, or the more recent trans violent incidents, but the key difference is this: Weimar Germany had multiple paramilitary groups representing essentially the entire political spectrum, including Nazis on the right and Communists on the left.

In contrast, in the U.S., political violence has almost all been aligned with the reigning ideologies of our government. Hence, the spectacle of police officers and National Guard troops kneeling for BLM, or more recently, the White House press secretary reaffirming the government’s support for transsexualism days after an transsexual massacred six people at a Christian school. The only recent riot that comes to mind that doesn’t fit this pattern is the one at the Capitol on January 6th of 2021, but comparing that one to the others reinforces my point. One unarmed woman was shot dead during it by a Capitol police officer, who faced no charges for it; while a man in Texas was just convicted of murder for shooting an armed BLM rioter in 2020.

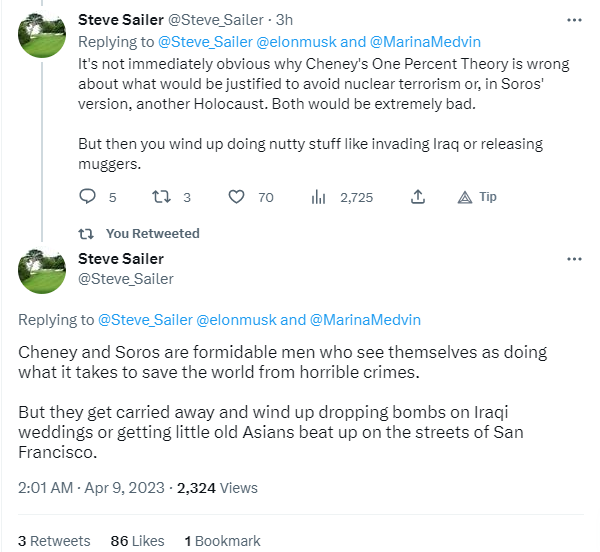

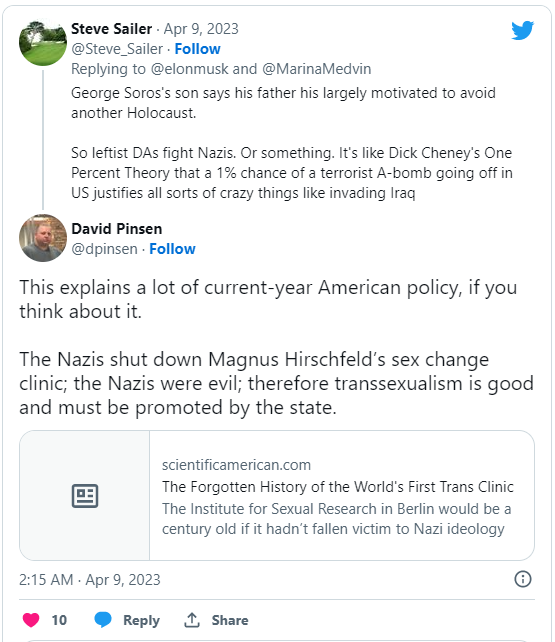

The One Percent Doctrine

As unlikely as it may seem, there’s actually a link between Weimar and that case in Texas. The Weimar Republic preceded Nazi Germany, which perpetrated the Holocaust, which had a lasting impact on George Soros, who financed the election of the district attorney who prosecuted the man for shooting a BLM rioter who pointed an AK-47 at him. The journalist Steve Sailer connected those dots for Elon Musk, when he wondered why Soros had helped elect prosecutors across the country who are soft on criminals, but tough on those who fight back against them.

As I noted in reply, this explains more than Soros’s current philanthropy.

If you’re wondering why I used screen captures above, instead of embedding those tweets, it’s because I couldn’t embed them:

More collateral damage from Substack’s decision to take on Twitter.

Let me add to your great recap of post ww1 germany. I would say all the hyper, de-inflation was a symptom of policy blunder upon policy blunder that slowly (almost two decades) decredited ALL the "main-stream" institutions in Germany from 1914 to 1933. Deflation, depression were just the "straw that broke the camel's back". WW1 useless war lead to inflation. A weak, divided politcal system after the revolution assured hyperinflation. Hyperinflation lead retenmark(sp?), austerity which lead to politics of scarcity. Eventually, economic contraction, which led to a false messiah. It all because the politcal/economic elite failed.....and eventually the masses said f you and flocked (ish) to that messiah. To me, that is the enternal lesson.....failure(s) ussually don't led to institional collapse like Germany, Russia but repeated failure can led to cathrophic results. In a small way, the repeated policy failures since the GFC (eg QE 1-3, QT 1-2, rate supression etc) are sympthomatic to the failure of our own elites to actually do the "right" thing. Add in foreign policy, Afghan w/d, enless "War on X". We may not be the Wiemar but we have started down that path of discrediting our institutions. Instead of reforming/adjusting, the state/institutions has just doubled down, and declared war on the people.

David, while Weimar was experiencing its fourth year of deflation when the Browns were elected/negotiated into office in early 1933, the hyperinflation of a decade earlier had helped their cause - or had given them a hook on which they could hang their campaign.

The hyperinflation had inflated away to nothing the value of many Germans' savings, causing destitution. However those who had access to foreign money - the purchasing power of which grew ever higher the longer the hyperinflation continued - were in a much stronger position. Assets need to be owned by someone, and many Germans found, at the end of the hyperinflation, that most of the country's assets had been sold to one social group for not much more than a song, because that social group had access, through family and business networks, to US and British money.

Adolf made hay from this outcome, appealing to the resentment of ordinary Germans regarding the wealth and influence this group had been able to acquire while the rest of the country slid into destitution.