Don't Bet On The Fed Being Done

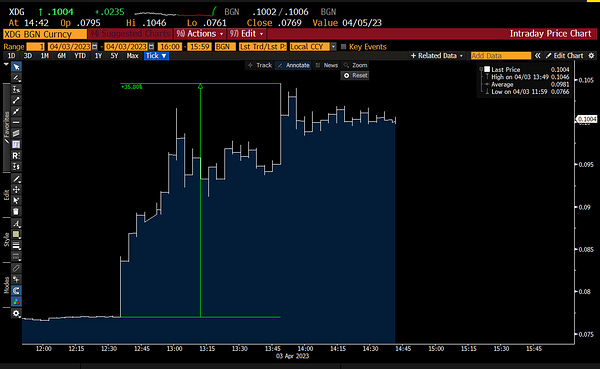

Twitter users logging in on the desktop version of the site on Monday saw a small surprise: the bird that normally appears on the top left of the Twitter website was replaced with the Shiba Inu face that's the symbol of the Dogecoin. Last month, Twitter owner Elon Musk said the Fed should cut rates by 50bps; Jim Bianco suggested that the Dogecoin spike Elon Musk engineered might have the opposite effect.

Recall that Credit Suisse strategist Zoltan Poszar has also pointed out that to lower inflation, the Fed ultimately needs to lower asset prices. This is because there is a wealth effect from higher asset prices that spurs consumer spending, which, all else equal, is inflationary. Conversely, a negative wealth effect from asset prices dropping has the opposite effect and can help to reduce inflation. A shitcoin spiking 25% in a day is obviously an example of inflationary froth.

Financial Stability Doesn't Mean Saving Every Incompetent Bank

Financial stability does not require lowering rates to boost banks that can't pay competitive returns on their deposits. Instead, banks that can't operate profitably in a non-zero interest rate environment should be bought by those that can. This natural market consolidation will help ensure a more stable financial system in the long run. It's understandable if a bank can't pay exactly what money market funds pay on deposits, since it has overhead the money market funds don't. But there's no reason to subsidize banks that are paying a fraction of a percent on deposits when money markets are paying 4%.

The 2024 Election Looms

Furthermore, the Fed is keen to avoid the appearance of interfering in the 2024 elections. As such, it would prefer to get most if not all of its interest rate increases done in 2024. This means that the Fed may need to continue hiking rates in the coming months in order to achieve its desired target.

The Fed Has A Credibility Deficit

In addition to the reasons above, it's worth noting that the Federal Reserve's credibility is increasingly at stake. Mohamed El-Erian, the chief economic advisor at Allianz, recently warned about the growing divergence between the Fed's stated 2023 interest-rate trajectory and market expectations:

Nor can I remember a time when markets have been so dismissive of the Fed’s forward guidance. The divergence between the Fed’s stated 2023 interest-rate trajectory and market expectations has been as wide as a full percentage point recently. That is a remarkably large gap for the central bank at the center of the global financial system. Markets continue to go against everything they have heard and read from the Fed by pricing in a rate cut as early as June.

This highlights the need for the Fed to take decisive action to restore market confidence in its ability to manage inflation and maintain financial stability. Continued rate hikes could be seen as a positive step towards achieving this goal, as it would demonstrate the Fed's commitment to its stated goals and its willingness to take bold action when necessary.

Investment Implications

Two ways we've been playing this on our trading site:

1) Betting against a crypto company that looks overextended this year.

2) Betting against a few regional banks that have weak financials and are particularly vulnerable to deposit flight.

We're also keeping an eye out for stocks that can do well in the current market environment.